The current market conditions for cryptocurrencies appear bleak, with Bitcoin  $91,081 dropping below $58,000. This decline, although disappointing, is not surprising, especially with the opening of U.S. markets. Investors now question how to rectify their misconceptions and return to an upward trend. Let us revisit our dual-scenario targets for Floki Coin, XRP, and AVAX.

$91,081 dropping below $58,000. This decline, although disappointing, is not surprising, especially with the opening of U.S. markets. Investors now question how to rectify their misconceptions and return to an upward trend. Let us revisit our dual-scenario targets for Floki Coin, XRP, and AVAX.

Floki Coin Insights

Floki Coin remains one of the largest meme coins by market capitalization, surviving last year’s surge alongside PEPE Coin. It is one of the few assets with a strong community amidst a chaotic meme coin landscape. Maintaining support at $0.00011285 is crucial; a close below this level could push Floki Coin to test $0.00009762, with potential lower dips reaching $0.00006125. The safe return level for investors is set at $0.000130, while resistance for a rally lies at $0.000199.

XRP Coin Analysis

With significant developments in the SEC lawsuit, investors cannot relax just yet. The SEC may appeal the ruling that deemed secondary market sales not to be securities or investment contracts. Despite the market pricing in potential negatives, this could be seen as good news.

For XRP Coin, a critical support level remains at $0.577. If the price stays above this point, there is potential for a rally toward targets of $0.7485 and $0.9378. If it drops, the previously identified levels between $0.54 and $0.50-$0.48 may come back into play.

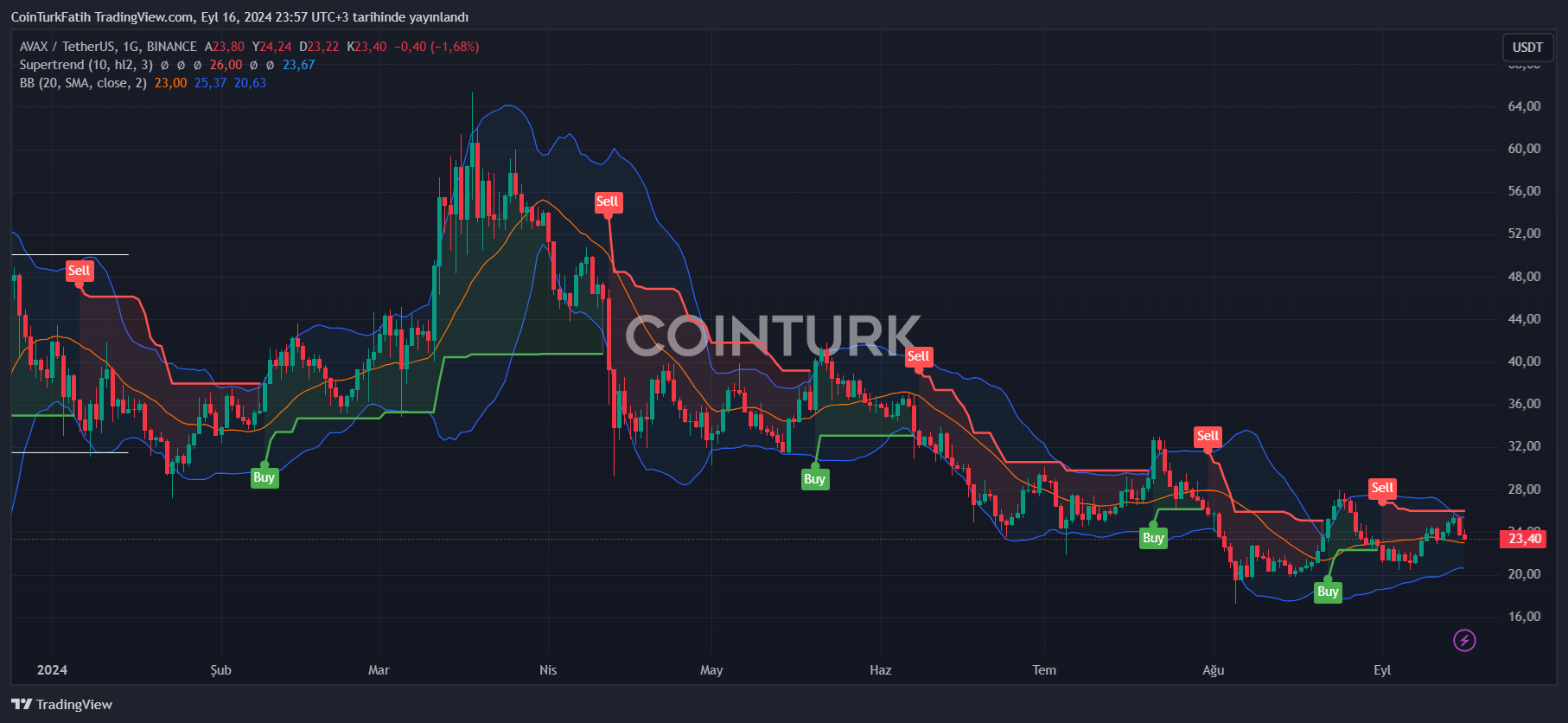

AVAX Commentary

AVAX faces challenges with annual inflation impacting support levels around $31.38. Despite two significant recent announcements, market demand has not sparked as anticipated. Although it struggles to differentiate positively, it may still factor these changes into long-term pricing.

If AVAX closes below $23.1, a test of $20.56 could occur. In short-term upward movements, upper targets may reach $25.43 and $27.8.