BTC price has fallen to $100,655, while altcoins continue calmly. The opening of the U.S. markets will occur as this article is prepared. Although increased movement is expected, the Fed minutes set to be released tomorrow evening could enhance volatility. What price target does VIRTUAL Coin aim for? Let’s take a comprehensive look at the current situation in cryptocurrencies.

VIRTUAL Price Target

Michael Poppe has put a spotlight on VIRTUAL Coin, a favorite altcoin over the past few months. Ripple (XRP)  $2 has been one of the biggest victims of the legal pressures that have fueled negativity around cryptocurrencies for years. Trump’s election has brought impressive gains for many cryptocurrencies, and Poppe highlights a significant opportunity for VIRTUAL Coin.

$2 has been one of the biggest victims of the legal pressures that have fueled negativity around cryptocurrencies for years. Trump’s election has brought impressive gains for many cryptocurrencies, and Poppe highlights a significant opportunity for VIRTUAL Coin.

“AI Agents perform well with VIRTUAL’s significant moves, similar to XRP. Extreme volatility leads to apparent bounce plays for HTF support levels.”

In this scenario, we are looking to $2.50-$3.00 for a strong bounce play.”

If the analyst’s scenario comes true, investors who assess the bottom could seize substantial profit opportunities, especially considering the potential for short-term negativity from the Fed minutes.

Comments on Cryptocurrencies

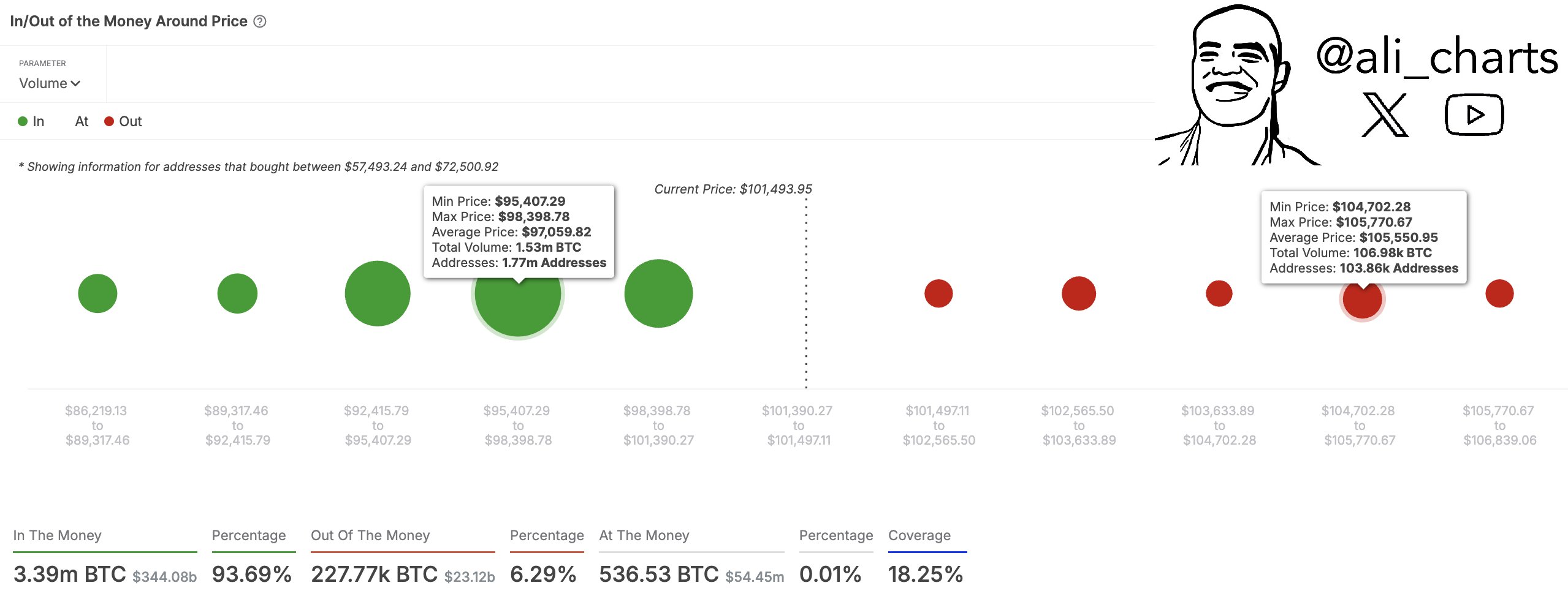

Bitcoin  $105,245 price is above a significant support level. 1.77 million addresses are holding 1.53 million BTC accumulated between $94,500 and $98,400. This indicates that this zone is a crucial support area. Additionally, there is no substantial supply wall outside the resistance range of $104,700 to $105,770. To trigger excitement for a rapid rise up to $107,000, something significant must occur.

$105,245 price is above a significant support level. 1.77 million addresses are holding 1.53 million BTC accumulated between $94,500 and $98,400. This indicates that this zone is a crucial support area. Additionally, there is no substantial supply wall outside the resistance range of $104,700 to $105,770. To trigger excitement for a rapid rise up to $107,000, something significant must occur.

Jelle shared the following chart to provide a long view of the market’s current state. He believes the chart should serve as a guide for long-term strategy.

“I still receive many questions about this chart, so I’ll summarize again:

I started dollar-cost averaging Bitcoin immediately after the FTX collapse in November 2022. Luckily, that was the bottom, but I didn’t know that then. I just thought it was a low enough price to buy BTC.

Continuing to accumulate coins up to around $30,000, I later realized Bitcoin became too expensive to buy but too cheap to sell.

This is a no-action zone until I find it sufficiently expensive to take some profits. This doesn’t mean I’ll sell all my Bitcoin instantly but rather that I aim to gradually reduce my exposure to the risks I face. I started taking profits in November after beginning in March and April of last year.

Now, I’m slowly reducing my risk by selling 2% of my Bitcoin assets weekly while ensuring I maintain significant upward risk. This strategy has multiplied my initial investment while still exposing me to substantial upside risks. The yellow box for the week remains interesting. The less I act, the less chance I have of ruining my position with foolish trades.

Anyway, I sold a bit more coin. It’s time to kick back, relax, and enjoy the show. I expect to sell a little more coin at higher prices next week.”

Türkçe

Türkçe Español

Español