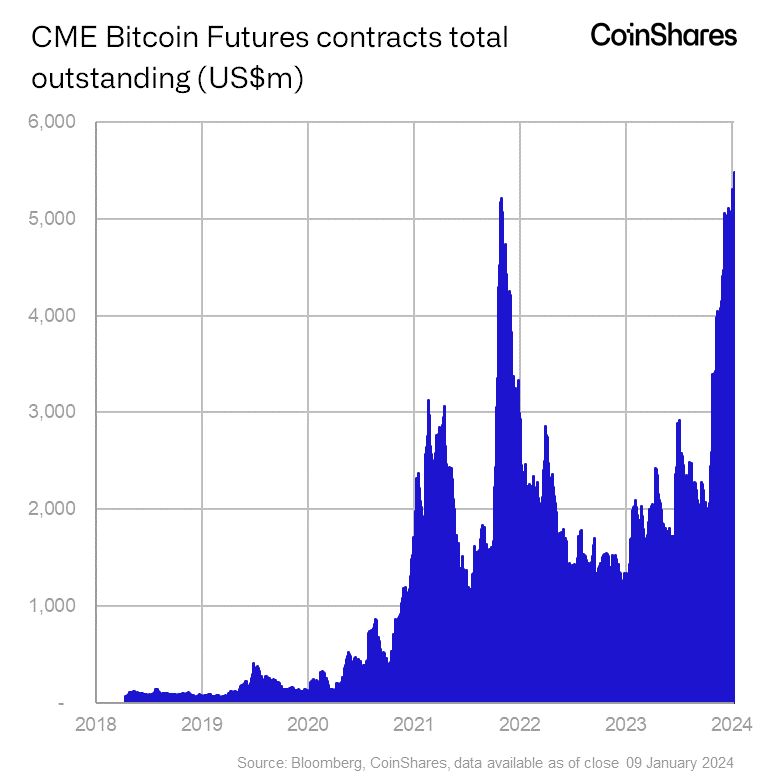

Breath is held all around the world. Investors are waiting for the SEC’s decision regarding a spot Bitcoin ETF, and its implications are already being reflected in the price. Statements from analysts and company officials are exciting investors positively and encouraging them to increase their investments. In this context, data from CoinShares has been illustrative.

Latest Status Before Bitcoin ETF

As of today, the open interest in Bitcoin futures contracts has reached its historical peak, amounting to approximately $20.443 billion, equivalent to 435,700 BTC at the ATH level.

The open positions linked to Bitcoin futures contracts have seen an increase of 11% in the last 24 hours. This reflects the rising investor expectations and appetite for the ETF, which analysts and companies in the US almost certainly expect to be approved.

This peak level is maintained by the CME Bitcoin contract, which reflects an open interest of approximately $6.225 billion, equivalent to 132,900 BTC. According to data provided by Coinglass, the open interest in the mentioned contract increased by 16.76% in the last 24 hours, highlighting the increased volatility in the market.

Following closely behind the CME contract is the Binance Bitcoin contract, which holds an open position of 96,900 BTC, or approximately $4.547 billion. This places it second among contracts and emphasizes a 10.67% increase during the same period.

Bitcoin Price Rises

As the expectation for approval of a spot Bitcoin ETF grows, this not only boosts optimism but also brings an incredible price increase.

The price of Bitcoin (BTC) experienced an increase of up to 9% by Monday evening, surpassing $47,000 for the first time since March 2022.

This surge resulted in a decisive defeat for investors who had opened short positions against the market, with over $100 million in short positions liquidated in the last 24 hours.

Considering the exchanges, OKX saw the most significant losses for traders with $84 million, positioning itself as the exchange with the highest losses. Following OKX is Binance with a $71 million short liquidation.

Despite the great excitement, tension, and liquidation of positions in the market, the 11% increase in open positions in the last 24 hours shows that investors remain hopeful, opening new positions despite the liquidations they have experienced.