Investors are watching the SEC’s decision on the approval of spot Ethereum ETF S-1 filings, which could act as a catalyst for a broader market rally. According to K33 Research’s latest report, Ethereum might be heading towards a supply shock with approximately 1.26 million ETH ready to exit exchanges within just five months after the ETF’s launch. This situation could lead to a significant increase in Ethereum (ETH) prices, potentially reaching an all-time high.

Report on Ethereum ETFs

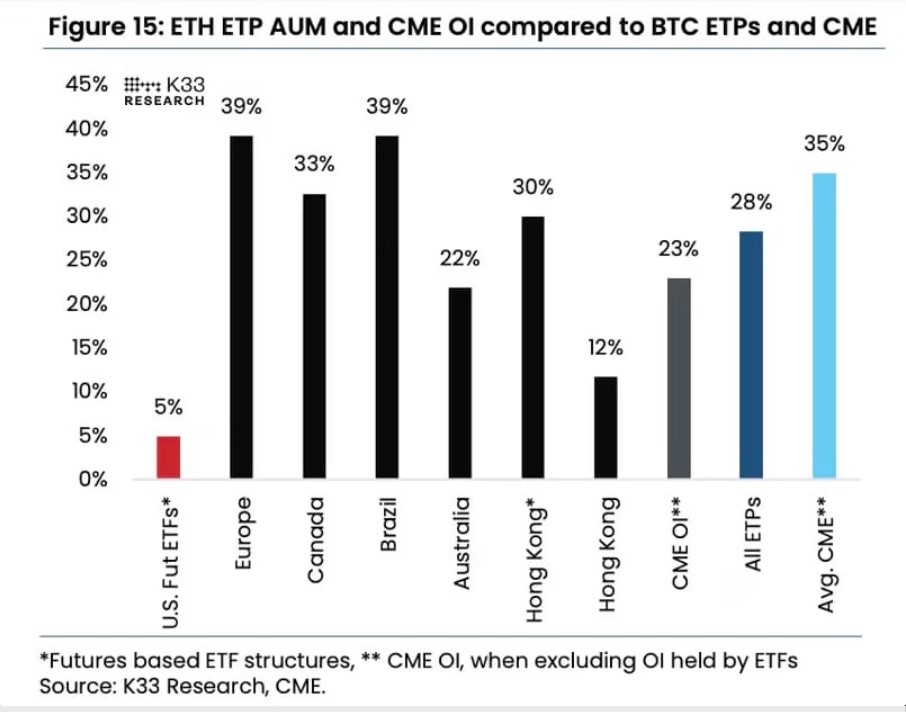

According to K33 Research, spot Ethereum ETFs could see an astonishing $4 billion in inflows within the first five months of launch. K33 Research based its estimate by comparing the assets under management (AUM) in existing Ethereum (ETH)-based exchange-traded products worldwide with similar Bitcoin (BTC) products. It also considered the open interest (OI) in futures contracts on the Chicago Mercantile Exchange (CME), a significant market for institutional investors.

Currently, Ethereum’s open interest (OI) on the CME stands at 23% of the size of Bitcoin futures. However, since ETH futures began trading on the CME in 2021, they have captured 35% of the BTC futures, indicating strong institutional demand for ETH. K33 Research, comparing these ratios with the $14 billion inflow into spot Bitcoin ETFs, forecasts that spot Ethereum ETFs could see inflows between $3 billion and $4.8 billion in the first five months of launch.

Expectations for ETH Increase

At the current ETH price of $3,800, this could mean an accumulation of 800,000 to 1.26 million ETH through these ETFs. This also represents about 0.7% to 1.05% of the total circulating ETH supply. Shortly after the approval of the spot Bitcoin ETF, BTC prices increased by 60%, reaching record levels.

According to K33 Research, if Ethereum ETFs are launched, Ethereum could start outperforming BTC after nearly two years of underperformance. More importantly, the research report noted that removing the staking feature from ETFs would not negatively affect inflows into the investment product. K33 noted that 99% of the assets under management in Canadian ETH ETFs are held in non-staking funds, while this figure is 98% for European products.

Türkçe

Türkçe Español

Español