After a challenging week for investors, BTC has not yet recovered as expected. The price is at $60,600. Although the Japanese stock market has recovered its losses, consolidation continues at low levels, especially due to BTC sales in most altcoins. So, what is the basis for those expecting BTC to reach $100,000 in 2025?

Cryptocurrency Goals for 2025

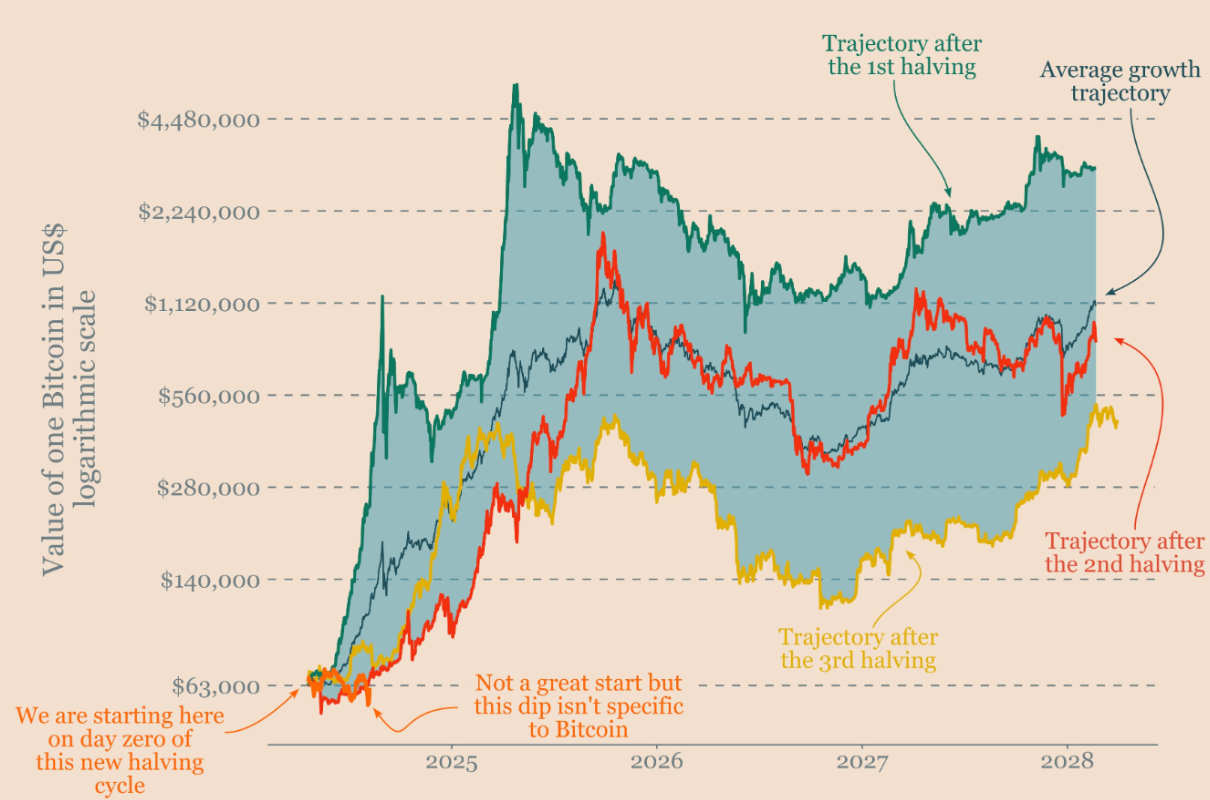

Bitcoin‘s price reaching six figures next year would mean massive gains for most altcoins as well. There is a widespread belief that the entire market will see a profitable period in 2025. According to crypto data provider Ecoinometrics, BTC fell below $50,000, deviating from its post-halving growth trajectory.

However, if the recent recovery continues, the price will need to close above $63,000 to reach higher peaks. This is essentially based on historical data.

“If it returns to this range before the end of the year, we have a high chance of reaching a six-figure value for one BTC. Assuming the same growth rate as the last three cycles, one BTC is expected to reach between $140,000 and $4,500,000 starting from $63,000.”

Of course, it should be calculated that growth weakens gradually. However, considering that the ETF channel will bring roughly double the investors through exchanges, it might not be good to lower expectations too much.

Bitcoin Technical Analysis 2025

On the technical front, Rekt Capital is considered successful in reading long-term price movements. According to him, the recent climb to $60,000 will bring a significant change in the trend.

“Bitcoin is trying to solidify this recently broken downtrend resistance (red) into a new support trend line.”

According to him, the continuation of the trend upwards has been clearly confirmed with the end of the downtrend. Moreover, strong buyer volume is also supportive.

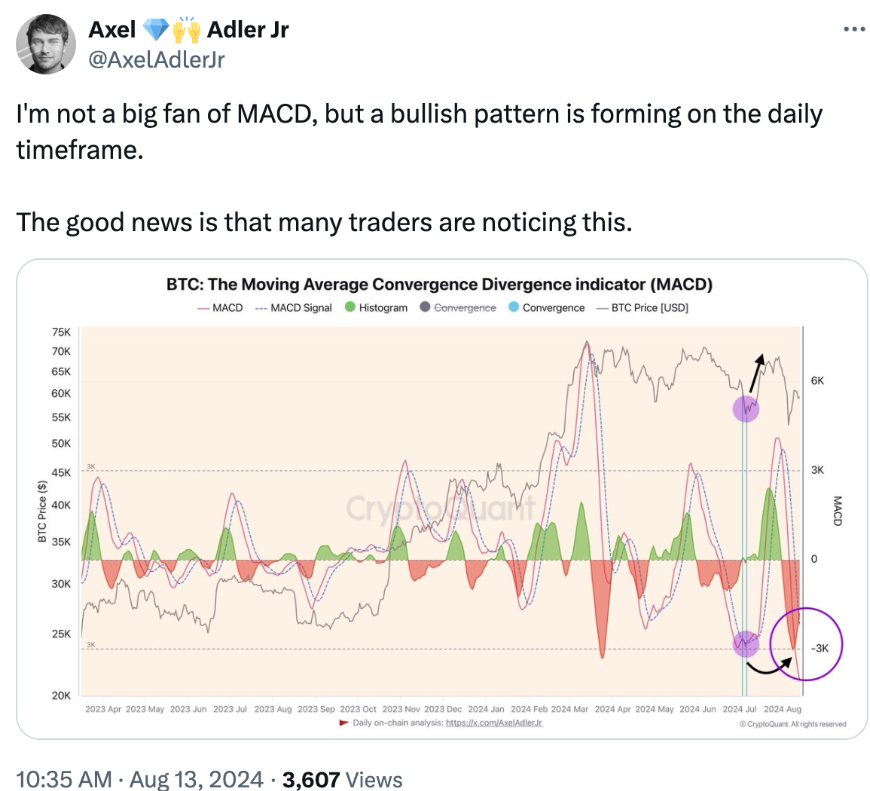

Exel Adler Jr.’s comment also supports the rise. According to him, the MACD is giving a strong bullish signal, and the current signal was last seen on July 12. At that time, BTC climbed 30% in a short period to $70,000.

Investors Buy Cryptocurrency

Glassnode analysts confirm a clear long-term upward trend and that investors are strengthening their accumulation tendency. In its latest market assessment, Glassnode, one of the companies with the largest crypto assets, wrote:

“After several months of relatively heavy distribution pressures, Bitcoin investors’ behaviors seem to be returning to HODLing and accumulation.”

Looking at the Accumulation Trend Score (ATS) metric, the company wrote that it reached the highest value of 1, indicating significant accumulation over the past 5 weeks.

“This metric also shows a shift towards behavior dominated by accumulation.”

In the last 3 months, nearly 375,000 BTC have passed into the hands of long-term investors.

Türkçe

Türkçe Español

Español