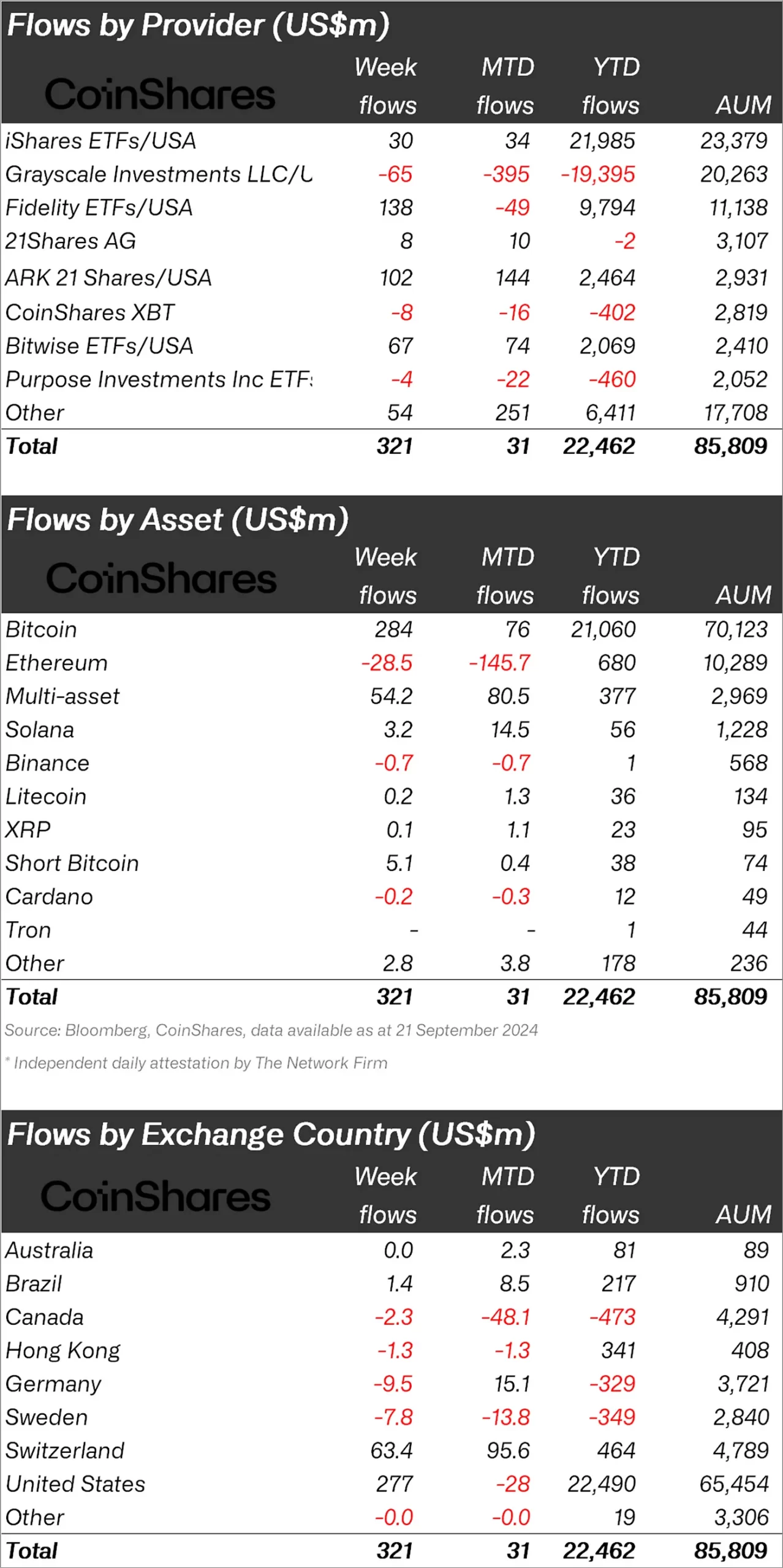

Digital asset investment products have seen a remarkable influx, reaching a total of $321 million for the second consecutive week. This surge in investments is primarily attributed to the Federal Open Market Committee’s (FOMC) recent decision to adopt a dovish stance, cutting interest rates by 50 basis points, which exceeded expectations. Following this rate cut, the total assets under management (AuM) in digital asset funds experienced a significant 9% growth.

Bitcoin Leads with Significant Inflows

Bitcoin (BTC)  $123,445 has taken the lead in digital asset fund inflows, attracting $284 million. Despite the price fluctuations post-rate cut, short Bitcoin investment products only saw a modest inflow of $5.1 million. This trend indicates that investors are focusing more on potential rises rather than declines in Bitcoin.

$123,445 has taken the lead in digital asset fund inflows, attracting $284 million. Despite the price fluctuations post-rate cut, short Bitcoin investment products only saw a modest inflow of $5.1 million. This trend indicates that investors are focusing more on potential rises rather than declines in Bitcoin.

Ethereum (ETH)  $4,761, on the other hand, has shown a contrasting trend. For the fifth consecutive week, Ethereum investment products faced outflows, totaling $29 million last week. This decline is linked to ongoing withdrawals from the existing Grayscale Trust and low interest in recently launched exchange-traded funds (ETFs).

$4,761, on the other hand, has shown a contrasting trend. For the fifth consecutive week, Ethereum investment products faced outflows, totaling $29 million last week. This decline is linked to ongoing withdrawals from the existing Grayscale Trust and low interest in recently launched exchange-traded funds (ETFs).

The popular altcoin Solana  $202 (SOL) continues to experience small but consistent weekly inflows, with $3.2 million attracted last week. This suggests that investors remain interested in alternative projects.

$202 (SOL) continues to experience small but consistent weekly inflows, with $3.2 million attracted last week. This suggests that investors remain interested in alternative projects.

Regional Distribution of Inflows: The U.S. Takes the Lead

Regionally, the highest inflow of $277 million came from the U.S., while Switzerland recorded its largest weekly inflow of the year at $63 million. Conversely, Germany, Sweden, and Canada saw outflows of $9.5 million, $7.8 million, and $2.3 million, respectively.

There is a noticeable increase in interest in digital asset investment products following the Fed’s interest rate cuts. Investors are continuing to assess market opportunities while closely monitoring central bank policies.

Türkçe

Türkçe Español

Español