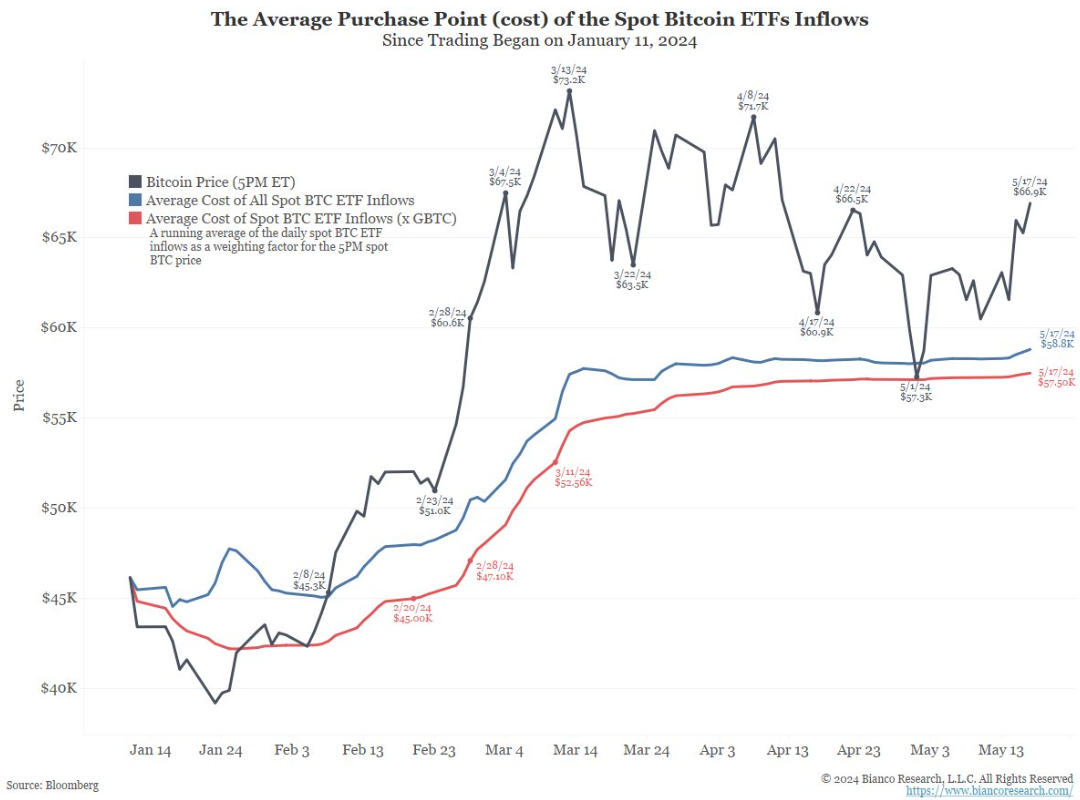

Boring days for investors are over, and we see relatively active hours in altcoins. BTC is at $67,000. The king of cryptocurrency is closer to $70,000 compared to the same day last week, gaining strength from the revival of inflows on the ETF front. So, what does the latest market research published by Bianco tell us?

The Future of Cryptocurrencies

Since May 13, we have seen net inflows in ETFs. GBTC has paused sales and is experiencing net inflows in recent days. All these are positive, and the total value of Spot Bitcoin ETFs is approaching $13 billion. Promising inflows started after the 13F filings, and we saw which ETFs the billion-dollar investing companies bought.

So, what does Bianco Research’s latest study say? Jim Bianco, the founder of Bianco Research, said;

“Pulling money into the off-chain Tradfi world in the form of an orange FOMO poker chip will not take digital assets to the promised lands of a new decentralized financial system. On the contrary, it will hinder this goal.”

This warning highlights the long-term risk that increasing liquidity outside the blockchain could pose for BTC and the rest of crypto.

Will Bitcoin Increase?

Markus Thielen, research director at 10x Research, says the king cryptocurrency could break all-time records with closes above $67,500. However, BTC has not yet been able to do this or enter this trend. At the time of writing, the price is at $66,970 and reached a peak of $67,349 in the last 24 hours.

So, if we return to the first section, how realistic is the increasing dominance of traditional finance over crypto? Coinbase’s first-quarter financial results may provide some insight. Institutional trading volume rose from $215 billion in the first quarter of 2021 to $256 billion this quarter. Although this seems like weak growth, when we look at the same thing for individual investors, there is a 50% decrease compared to 2021.

Bianco wrote;

“If the goal is to develop a new financial system, an ETF that drags money back into the Tradfi world does not reach these promised lands. Throughout the quarter, we were sure that boomers called their asset managers and told them to get into BTC. This is not the case for more than 95% of Spot BTC ETF assets.”

So, at the same time, ETFs have not been very successful in attracting the interest of baby boomers. While 85% of BTC supply is with individuals, 10% is with hedge funds.

Türkçe

Türkçe Español

Español