Throughout 2023, the values emerging after the approval of the Bitcoin ETF on January 10, 2024, continue to attract investors‘ attention. During this process, BlackRock and Fidelity’s spot Bitcoin exchange-traded funds (ETFs) constituted a significant portion of the total ETF inflows that emerged this year among issuers.

Inflows in Bitcoin ETFs

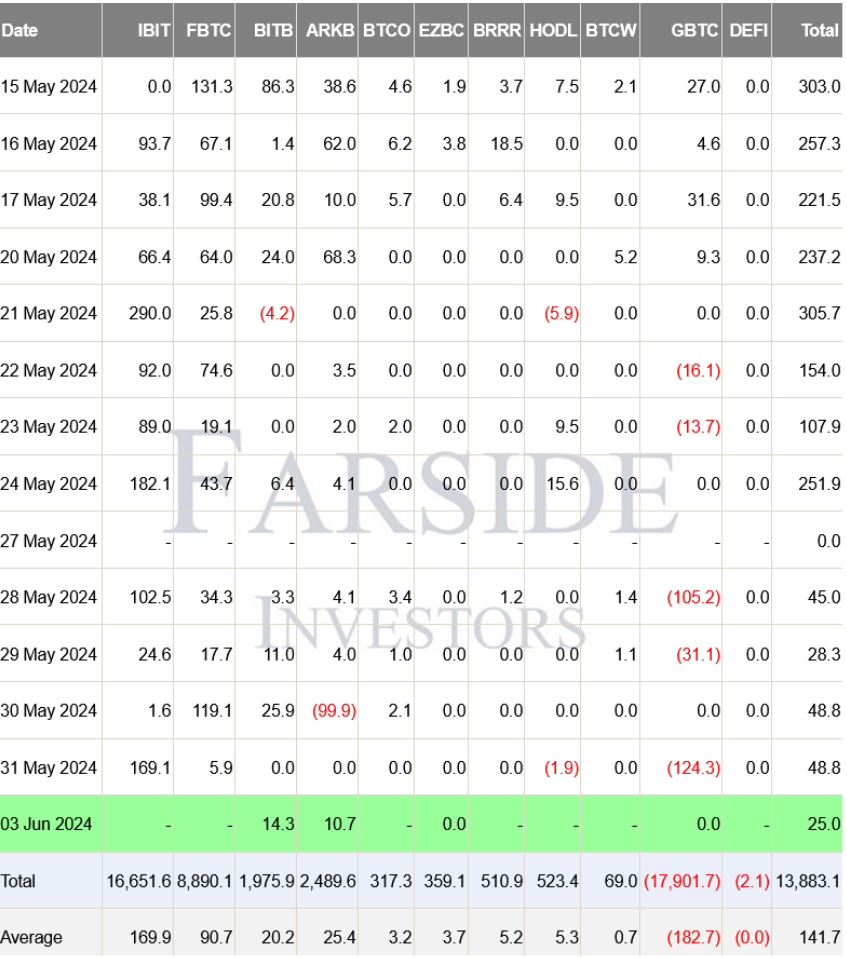

According to an analysis by Bloomberg ETF analyst Eric Balchunas, based on data provided by Bloomberg Intelligence, Bitcoin ETFs from BlackRock and Fidelity accounted for 26% and 56% of the total inflows, respectively. Data provided by Farside Investor shows that BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC) hosted inflows of $16.6 billion and $8.9 billion, respectively, since they began trading on January 10.

Meanwhile, Vanguard, which has no Bitcoin ETF issuance, reached $102.8 billion in total ETF inflows so far in 2024, surpassing BlackRock’s $65.1 billion. According to Stock Analysis, BlackRock currently manages 429 ETFs worth $2.8 trillion, while Fidelity has 70 ETFs totaling $74 billion AUM.

Another investment giant, Invesco, achieved $34.7 billion in ETF flows this year. However, only 0.9% of this came through Bitcoin ETFs, reflecting a total inflow of $317.3 million in the first five months of the year.

BlackRock’s IBIT ETF surpassed the Grayscale Bitcoin Trust (GBTC) on May 28 as the world’s largest spot Bitcoin ETF. According to data from Apollo Bitcoin Tracker, IBIT currently holds 291,567 BTC, valued at just over $20 billion based on BTC’s price.

Grayscale’s GBTC had 620,000 Bitcoin at the start of its conversion process to a spot form. However, strong outflows have occurred since then, and it now holds 285,139 BTC, valued at $19.6 billion based on BTC’s current price.

Outlook in Bitcoin ETFs

Recent inflows and outflows in Bitcoin ETFs have balanced somewhat, with many ETF providers experiencing zero inflow-outflow periods recently. For example, according to information shared by Farside Investors, there have been no inflows or outflows in the Franklin Bitcoin ETF (EZBC) since May 16.

Grayscale’s ETF continues to host average daily inflows of $141.7 million, primarily from IBIT, FBTC, and to a lesser extent, ARK 21Shares Bitcoin ETF (ARKB).

Türkçe

Türkçe Español

Español