There is intense interest in Bitcoin (BTC) options among investors predicting the potential impact of the US elections on the cryptocurrency market. Options specifically offered for the US elections on Deribit are facing significant interest from investors.

High Interest in Election Futures Options

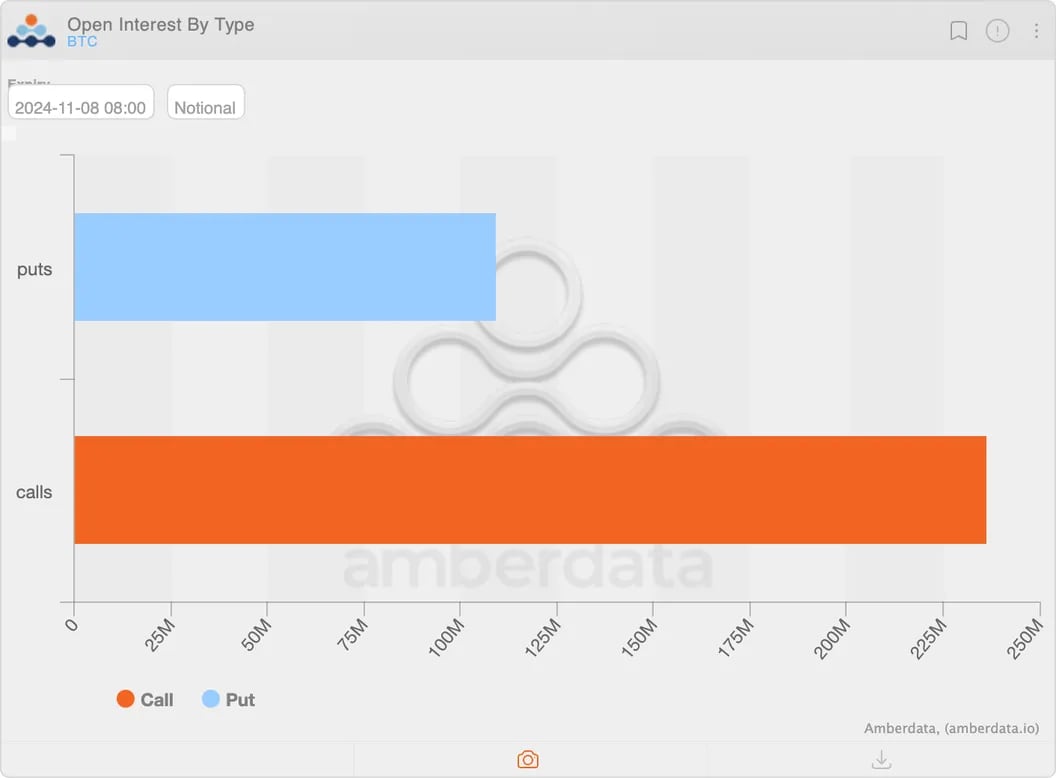

The “election futures options” that started trading on the Deribit exchange in October will be liquidated within four days after the November 4th elections. According to data provided by Amberdata, the total value of active option contracts currently stands at $345.83 million.

Call options, which make up 67% of the options, offer unlimited profit potential while facing limited loss. The remaining portion belongs to put options. The put-call ratio is below 0.50, indicating that open call options are twice as many as put options.

These election-focused contracts provide investors with the opportunity to gauge the increasing interest in the market as they predict the impact of the elections on the cryptocurrency market. The current put-call ratio of 0.50 indicates a prevailing bullish expectation in the market, as call options are traded twice as much as put options. Algorithmic trading firm Wintermute highlighted this situation in a note shared with CoinDesk.

Investors Focused on Upsurge Due to US Elections

The call option with a strike price of $80,000 is the most popular, with an open position value exceeding $39 million. Generally, open positions are concentrated in call options with high strike prices, indicating investors expecting new record prices around the election period.

On the other hand, $39 million is locked in the put option with a strike price of $45,000. Wintermute commented on this, stating, “The concentration of call options around $80,000 and $100,000 strike prices indicates that market participants are positioning for a potential upsurge in Bitcoin. The presence of put options with low strike prices suggests some hedging for protection or downside risk.”

Türkçe

Türkçe Español

Español