Cryptocurrency investors have faced a nightmare since mid-2022, with Terra being a significant trigger. Today marked the decision day for Terraform Labs, as Do Kwon awaits a new ruling in Montenegro regarding a prior unfavorable judgment. The pressing question remains: What will happen to LUNA Coin? Here’s a quick summary.

The Fate of LUNA Coin and Terra

Terraform Labs received court approval for bankruptcy proceedings today. The organization reached an agreement with the SEC, signing three key conditions: the establishment of a liquidation trust to orderly settle debts, the SEC’s claim fixed at $4.4 billion, and that the SEC’s demands will only be addressed after permitted unsecured claims and crypto loss reimbursements are covered. This means the SEC will not receive penalties from this bankrupt company.

Future Prospects for LUNA Coin

Todd Snyder will serve on an advisory board of five. This can be visualized by considering the FTX Bankruptcy Committee led by Ray. The Terraform Labs bankruptcy committee plan will take effect within 14 days.

What is the company’s asset value? It is reported to be between $100 million and $500 million. So, what’s next for LUNA Coin? If Do Kwon somehow manages to resurrect the Terra ecosystem with hundreds of millions, promising not to defraud again, he could employ bright minds in his new company to revitalize the Terra network, potentially regaining his former success. However, how realistic is this prospect?

LUNA Coin and even LUNC are unlikely to do anything other than speculative movements in this process. I see no reason for long-term viability, making it at best a meme coin. Alternatively, people might keep it as a memento of the nightmare from mid-2022.

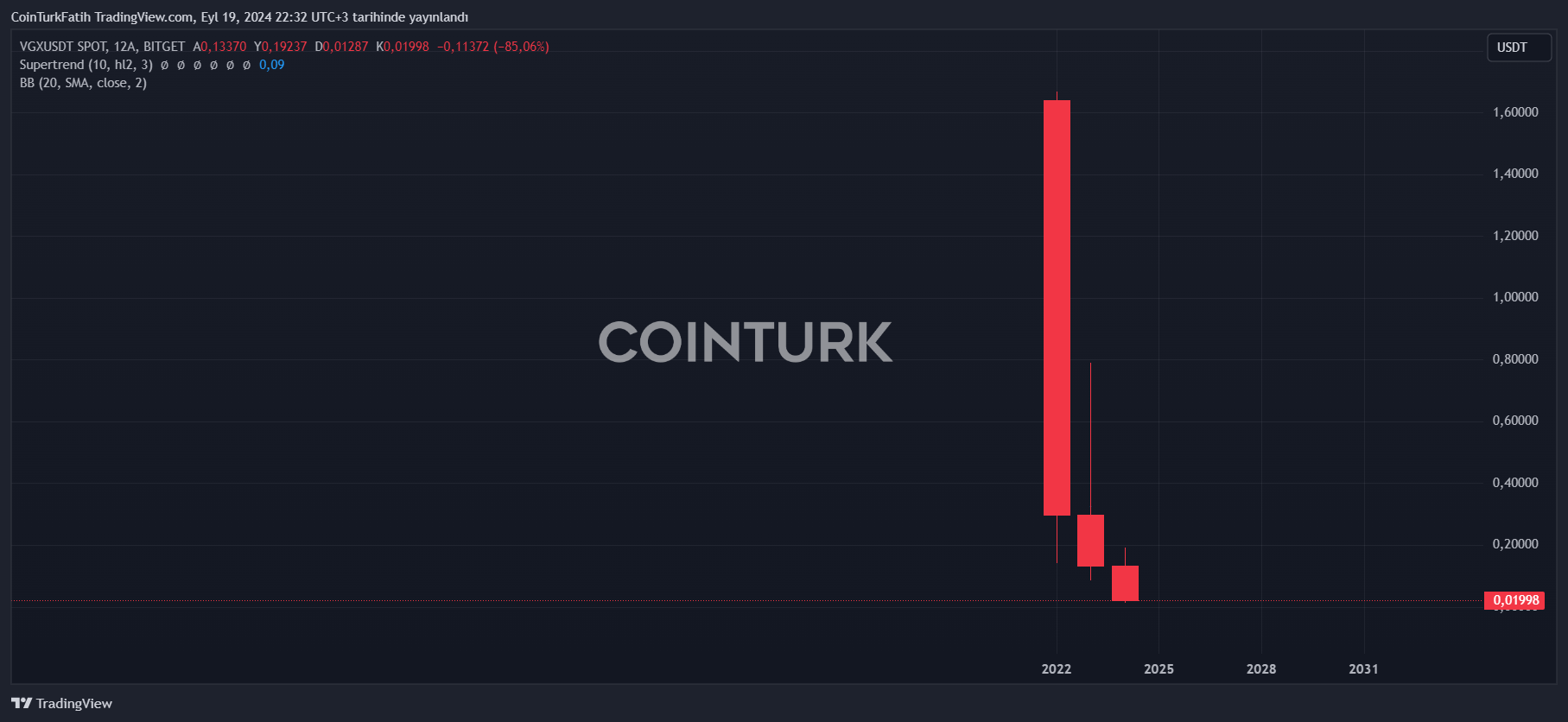

Below, you can see the graph of VGX, the token of another bankrupt company, Voyager.

Certainly, the current conditions for LUNA Coin are dire, but no one can predict the future with 100% certainty.