The price of Banana Gun (BANANA), a popular memecoin project from the Telegram community, has gradually stopped its decline after investors decided to sell. This process has attracted the interest of investors. The price drop has positioned BANANA as potentially profitable because accumulation could now yield gains. What do the data and chart analysis say? Let’s examine together.

Notable Data for Banana Gun

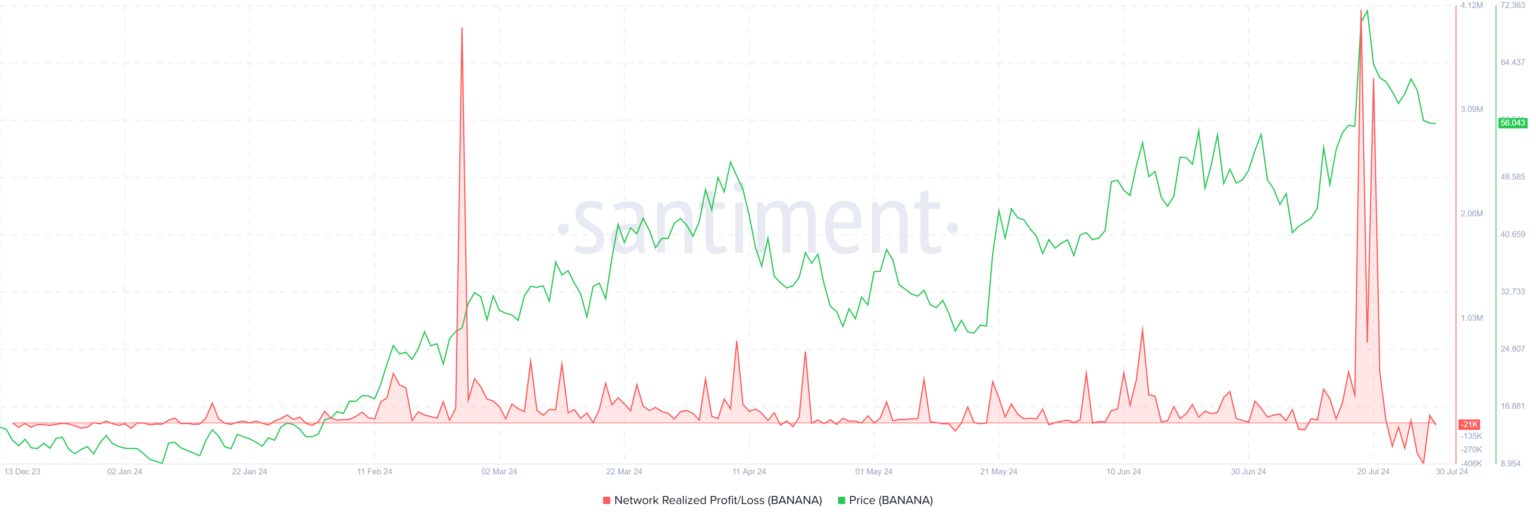

In the past two weeks, BANANA’s price has painted the daily chart red, affecting investor optimism for this popular Telegram project. As a result, investors chose to sell tokens and move their assets to exchange wallets. However, this decision did not help them much as it led to the largest loss period recorded in Banana Gun’s history. The realized losses amounted to approximately $1 million last week.

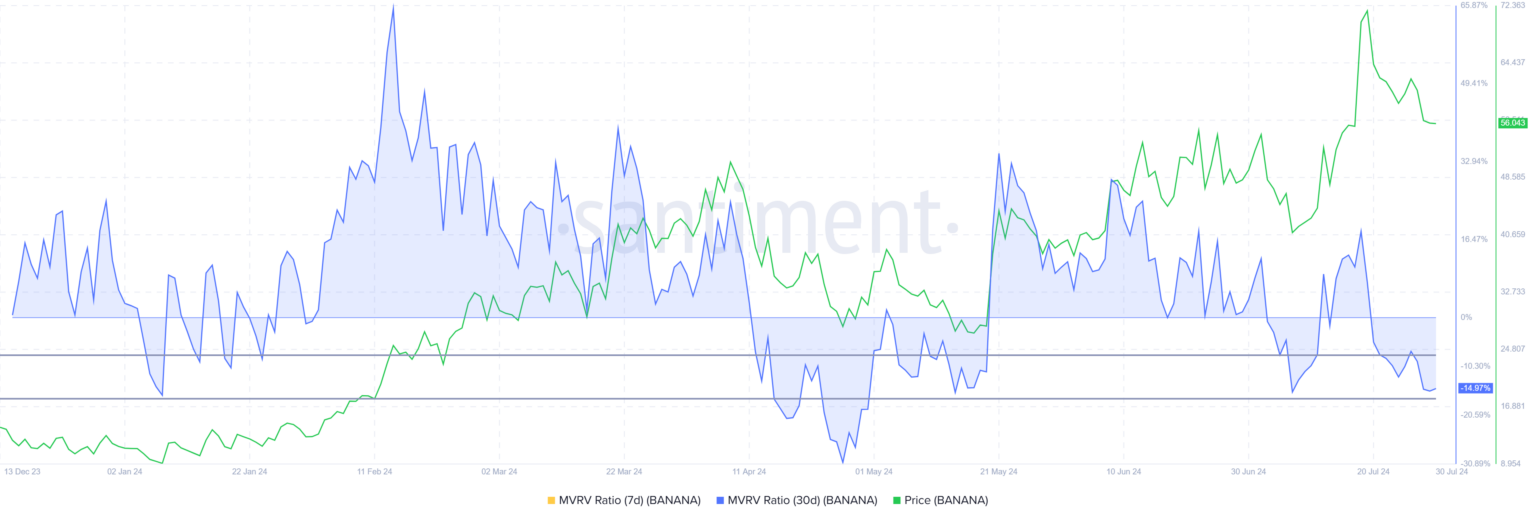

During this period, the Market Value to Realized Value (MVRV) ratio indicated that BANANA returned to the opportunity zone, suggesting the decline might not continue. The MVRV ratio assesses investor profit and loss, and currently, BANANA’s 30-day MVRV data stands at -15%, indicating losses and potential buying pressure. Historically, an MVRV between -7% and -17% often marks the start of upward trends, signaling an accumulation opportunity zone.

BANANA Chart Analysis

BANANA’s price dropped 21% from $72 to $56 in the past two weeks. Meanwhile, the token has stayed above the critical support level of $55 in the last two days. This level was tested several times as a resistance level in June and July and is now being tested as support. If investors start accumulating in the coming days, this support could lead BANANA’s price to test the psychological resistance of $65.

Consolidation below $70 is a possible outcome for the coming days. However, if the $56 support is lost, a drop to $47 is possible. This could invalidate the bullish thesis and cause BANANA’s price to struggle to recover.

Türkçe

Türkçe Español

Español