Sales that began with US data accelerated further in the evening of the Fed. Subsequently, Germany stepped in, causing BTC to fall. Everything in crypto develops very quickly, and the agenda is extremely busy. The high volatility experienced by BTC prices has led to new lows for altcoins this week. So, what is the current situation for BCH, which was born as the Bitcoin killer?

Bitcoin Cash (BCH)

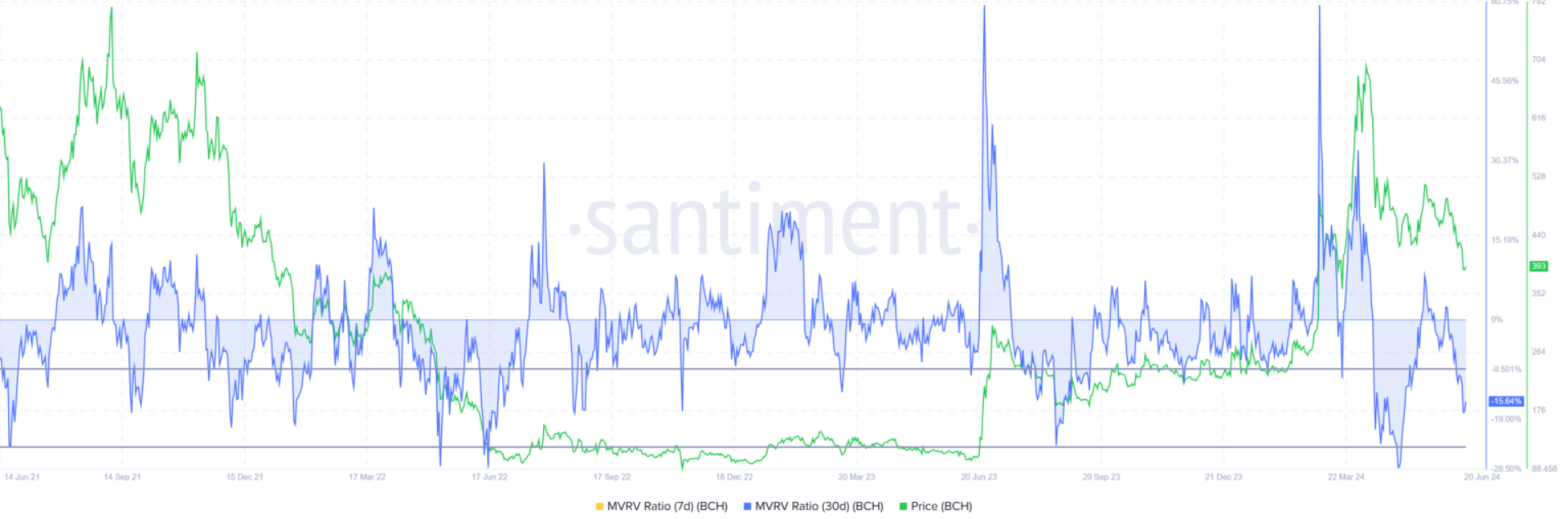

The general market condition, as well as investors’ attitudes towards altcoins, determine the price. Investor optimism that could trigger a positive divergence for BCH can be seen. Looking at the profitability of active addresses, the profitable portion of BCH investors is waiting calmly. This could pave the way for further increases.

75% of investors are waiting profitably with their BCH holdings. Only 6% of them are moving their assets. This means that those who are not in a hurry to cash in their unrealized gains represent a larger crowd.

On the other hand, another detail that boosts morale for the BCH price is the 30-day MVRV ratio. This is at -16%, and according to historical data, such a figure generally triggers a rise. In the past, price increases were triggered between -9% and -25%.

BTC Price Prediction

Bitcoin Cash’s price is currently at $392, and closures above $400 in the coming days or hours could be encouraging. If we are to see a real turnaround, this altcoin needs to accelerate the rally with closures above $420 and $430. The target is initially $440.

If the key support is not reclaimed and closures below $400 continue, it is possible for the BCH price to fall to $379 and below. For now, because the BTC price avoids closures below $64,000, there is potential for a reversal of the general market decline.

On the other hand, the details in the Fed policy report we will see on Friday could weaken the pressure on the macroeconomic front. Following the latest inflation data, the optimistic details we will see in this report could weaken the effects of the Fed members’ 3-year upward revised interest rate forecasts.

At the time of writing, BTC is at $65,000 and ETH is above $3,500. Although the US stock markets hit a new record high today, Germany’s BTC sales disrupted things in crypto.

Türkçe

Türkçe Español

Español