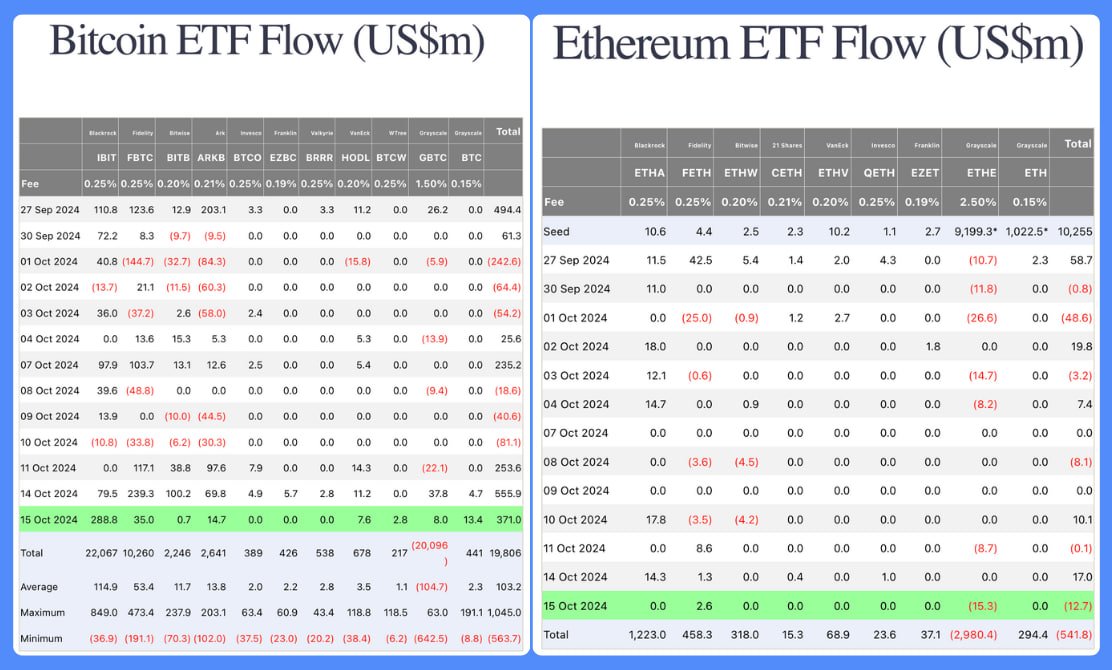

On October 15, the United States saw a notable influx into spot Bitcoin  $109,518 ETFs, recording a net entry of 371 million dollars. The most significant contribution came from BlackRock’s IBIT ETF, which alone accounted for 289 million dollars. This performance by Bitcoin, the leading cryptocurrency, indicates an increase in investor confidence. In contrast, the situation for Ethereum

$109,518 ETFs, recording a net entry of 371 million dollars. The most significant contribution came from BlackRock’s IBIT ETF, which alone accounted for 289 million dollars. This performance by Bitcoin, the leading cryptocurrency, indicates an increase in investor confidence. In contrast, the situation for Ethereum  $2,576 is quite the opposite, with spot Ethereum ETFs experiencing a net outflow of 12.7 million dollars during the same period.

$2,576 is quite the opposite, with spot Ethereum ETFs experiencing a net outflow of 12.7 million dollars during the same period.

Growing Interest in Bitcoin

The substantial interest in spot Bitcoin ETFs reflects the rising expectations of investors toward the leading cryptocurrency. Recent buzz around new spot crypto ETF applications has further fueled appetite for Bitcoin.

The entry of major players like BlackRock is particularly strengthening institutional investors’ confidence in Bitcoin. The overall influx of 371 million dollars may signal a bullish trend in the market. Some experts believe this development could indicate a potential price surge for Bitcoin.

Continued Decline in Ethereum

Conversely, the outflow from spot Ethereum ETFs suggests a more cautious approach from investors. Unlike Bitcoin, Ethereum has not managed to capture the same positive sentiment within the spot ETF space. This trend indicates a shift of investor focus from Ethereum to Bitcoin, reflecting diverging expectations in the cryptocurrency market.

As Bitcoin sees strong inflows, expectations for a price jump increase, while Ethereum’s outflows indicate a preference for caution among investors. The divergence between these two giants in the cryptocurrency market could create significant opportunities and risks in the near future.

Recent data shows BTC trading around 67,000 dollars after a 2.54% rise in the last 24 hours, while ETH is trading at 2,610 dollars with a slight 0.10% increase during the same timeframe.

Türkçe

Türkçe Español

Español