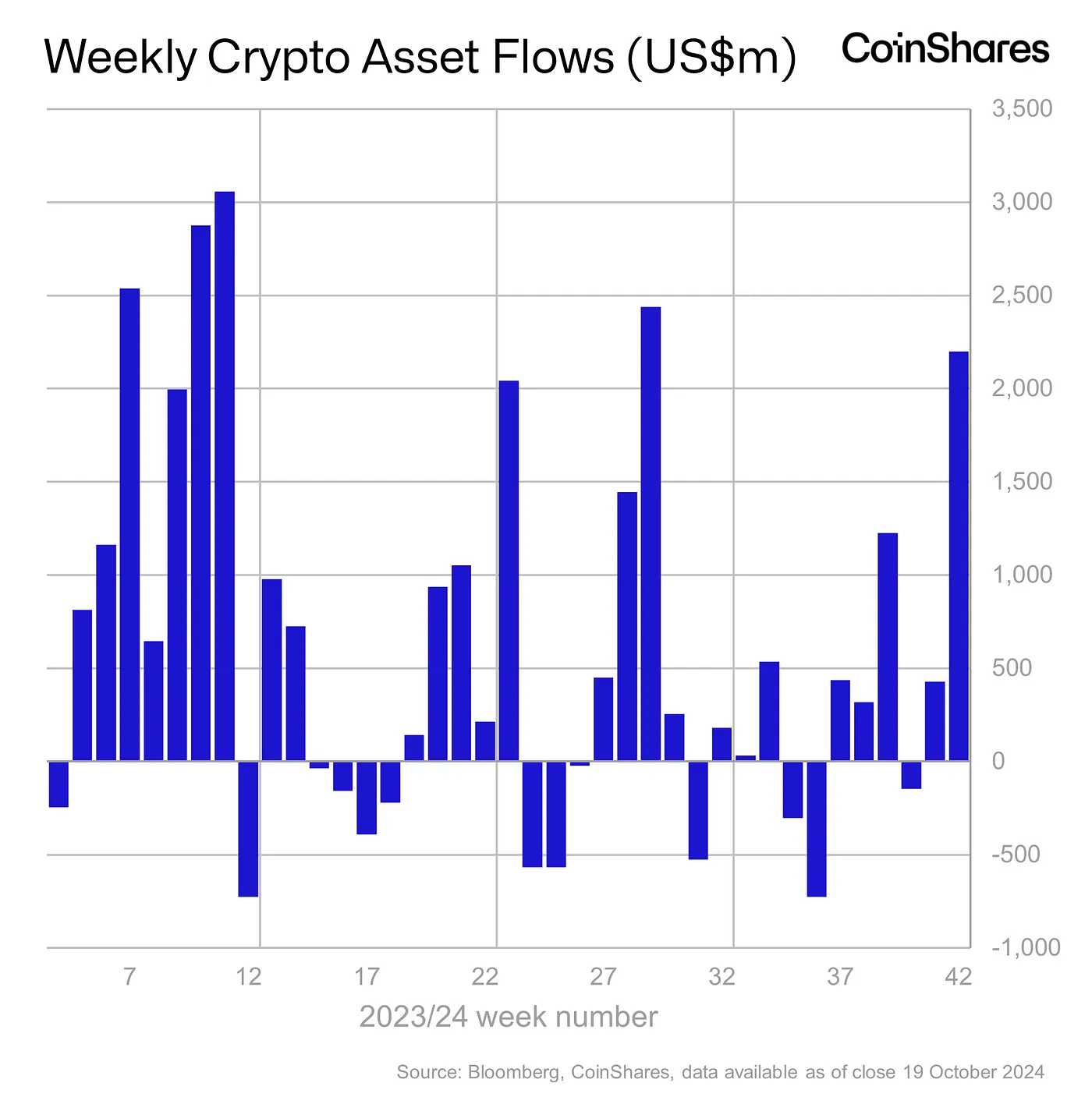

Crypto investment products recorded an influx of $2.2 billion, driven by growing optimism ahead of the US elections. This influx marked the largest weekly increase since July. In the United States, expectations for a Republican victory have heightened optimism among investors regarding cryptocurrencies. Consequently, trading volume surged by 30%, bringing total assets under management close to $100 billion.

US Sees Inflows While Other Regions Experience Profit Taking

The United States emerged as the focal point for inflows into crypto investment products, attracting $2.3 billion. However, countries like Canada, Sweden, and Switzerland experienced minor outflows. Canada saw a $20 million outflow, Sweden $18 million, and Switzerland $15 million.

It is believed that outflows in crypto investment products likely stem from investors outside the US realizing their profits.

Bitcoin (BTC)  $121,870 emerged as the week’s biggest winner with an influx of $2.13 billion. Additionally, Bitcoin investment products featuring short positions saw $12 million in inflows, recording the highest weekly influx for such products since March.

$121,870 emerged as the week’s biggest winner with an influx of $2.13 billion. Additionally, Bitcoin investment products featuring short positions saw $12 million in inflows, recording the highest weekly influx for such products since March.

Ethereum and Other Altcoins Attract Attention

Ethereum (ETH)  $4,733 joined the rally this week, garnering $58 million in inflows. Altcoins like Solana

$4,733 joined the rally this week, garnering $58 million in inflows. Altcoins like Solana  $199 (SOL), Litecoin (LTC), and XRP attracted investments of $2.4 million, $1.7 million, and $700,000, respectively. However, a different trend occurred in multi-asset products, which ended a 17-week streak of inflows with a $5.3 million outflow.

$199 (SOL), Litecoin (LTC), and XRP attracted investments of $2.4 million, $1.7 million, and $700,000, respectively. However, a different trend occurred in multi-asset products, which ended a 17-week streak of inflows with a $5.3 million outflow.

The fluctuations in crypto investment products echo the increasing interest and expectations surrounding the US presidential elections. The anticipation that Republicans will support cryptocurrencies has created a positive atmosphere in the markets.

Türkçe

Türkçe Español

Español