On November 25, spot Bitcoin  $91,967 and Ethereum

$91,967 and Ethereum  $3,139 ETFs experienced record outflows in the United States. Total outflows from spot Bitcoin ETFs reached $489.16 million. Despite these outflows, institutional interest remained concentrated in various ETFs, with BlackRock’s iShares Bitcoin Trust attracting notable inflows of $267.79 million. The total assets in BlackRock’s spot Bitcoin ETF rose to 492,623 BTC, equivalent to approximately $47 billion in market value.

$3,139 ETFs experienced record outflows in the United States. Total outflows from spot Bitcoin ETFs reached $489.16 million. Despite these outflows, institutional interest remained concentrated in various ETFs, with BlackRock’s iShares Bitcoin Trust attracting notable inflows of $267.79 million. The total assets in BlackRock’s spot Bitcoin ETF rose to 492,623 BTC, equivalent to approximately $47 billion in market value.

Interest Grows for Spot Ethereum ETFs

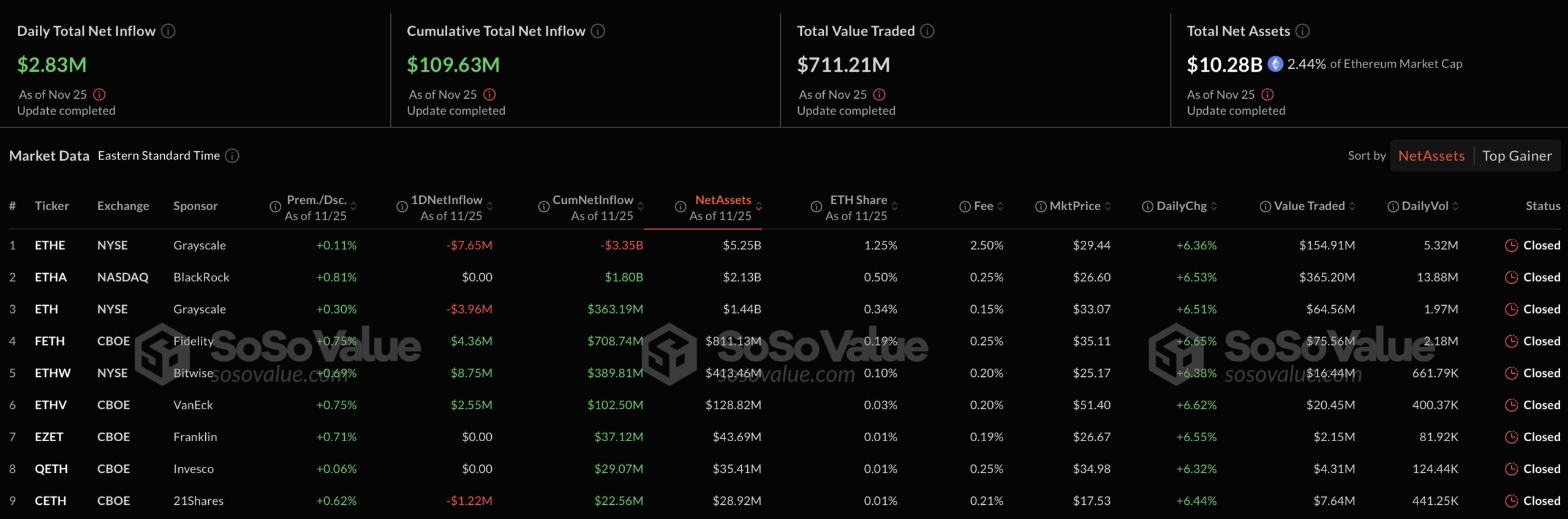

In contrast to the outflows from Bitcoin ETFs, there were inflows into spot Ethereum ETFs. On the same day, these investment products saw a total inflow of $2.83 million. This indicates that institutional support is not limited to Bitcoin alone, with Bitwise’s Ethereum ETF leading with an inflow of $8.75 million, bringing the company’s spot Ethereum ETF assets close to $413 million.

Despite recent price declines in Bitcoin and Ethereum, investors have maintained their confidence in ETFs. Analysts emphasize that the outflows on November 25 were likely profit-taking and did not undermine the long-term positive trend. Particularly, BlackRock’s leadership in the cryptocurrency ETF market clearly reflects major players’ appetite for cryptocurrencies.

Strong Institutional Support Despite Price Declines

The prices of BTC and ETH fell in the last 24 hours, yet this did not negatively impact demand for ETFs. Experts noted that price fluctuations did not deter institutional investors, who see current prices as attractive buying opportunities. Interest in ETFs suggests that the cryptocurrency market may witness further institutional adoption in the future.

Investments led by BlackRock indicate the market’s maturation. Both Bitcoin and Ethereum’s ETF performances reveal a strategic approach by institutional investors. Overall, the strong interest in Bitcoin and Ethereum ETFs highlights ongoing institutional support in the cryptocurrency market, increasing confidence in its long-term growth potential.