Avalanche (AVAX) recent price movements have erased losses seen in May and June. Less than a week ago, AVAX price surpassed $30, exciting investors with bullish expectations. However, things might not go as expected, as longer time frame analyses show AVAX’s price movement might fall short of investor expectations. Fibonacci levels indicate potential future price movements and what might follow.

AVAX Comments

As of the time of writing, the general market outlook shows a positive daily view, while the weekly view reflects a bearish trend. This suggests the possibility of the price rising towards $40 before a potential downward movement.

A series of Fibonacci retracement levels, including the May and June price drops, were noteworthy. The 50% level at $32.66 is currently one of the biggest resistances for AVAX.

The daily RSI value was 51, and after last week’s pullback, today’s positive outlook was noticeable. AVAX’s OBV in June showed a calm appearance, indicating that bulls on the Avalanche side are still not ready for a rally.

AVAX’s Future

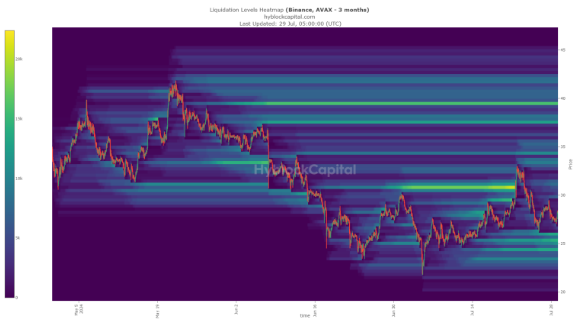

In the early days of this month, the liquidity pool at $30.8 facilitated an upward price movement. AVAX rose to $33 before experiencing a decline. For further upward price movements, the regions of $34.3, $37.5, and $39.5 remain noteworthy.

AVAX price could form a range above $30, potentially starting a downward price movement by capturing existing liquidity in these areas, which would result in the liquidation of short positions.

The Fibonacci retracement levels mentioned in the article also play a significant role in this process. Therefore, leverage investors might expect the weekly market structure to maintain continuity until AVAX price surpasses the $38 level.

Meanwhile, a decrease in market volume was observed alongside AVAX’s price, dropping to $10.842 billion, maintaining its 12th position. The trading volume, after a 47% decrease, stands at $340.6 million.