Cryptocurrency markets received this week’s most important data just moments ago, which had been eagerly awaited. Inflation and PCE data tend to increase price volatility. Just like key Fed meeting decisions, these data contain signals about the interest rate path, so investors closely monitor them. So, how did the data turn out?

Cryptocurrency Latest News

The PCE data, which tracks inflation for goods and services excluding food and energy, is extremely important. The PCE, closely monitored by the Fed as an inflation indicator, was just released. Recent comments from Fed members indicated that if progress towards the 2% inflation target continues, convincing data at this point could lead to rate cuts.

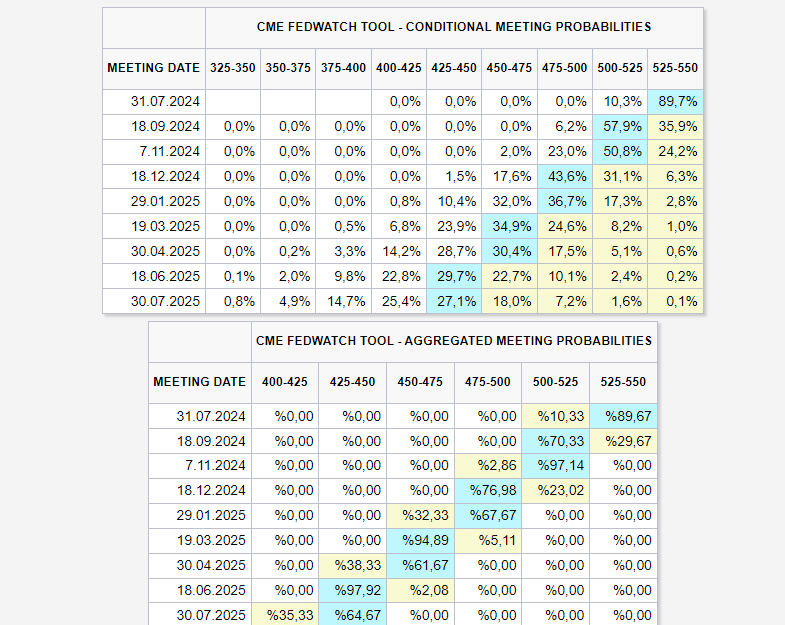

Expectations for this year have turned to a 25bp cut. The reason was the consistently poor data in the first quarter. Now, the normalization of data and continued decline in inflation could ease Fed members, allowing them to make more relaxed easing decisions. Even though data was low on the day Fed decisions were announced, members did not revise their 3-year interest rate forecasts. So, what happens now?

The annual PCE was announced in line with expectations. Since the core PCE was also in line with expectations, the situation for BTC is not so bad.