Although enduring such tedious periods is challenging, the outcome is exciting. For now, no one is interested in the end. The intense evaluation of short-term profit areas shows that most investors do not care about boring days. However, such periods bring significant fluctuations, and we may see extremely painful rises for investors who remain outside.

Cryptocurrencies and Gold

BTC shows shallow volatility, sets a tough resistance, and cannot surpass it. As long as it fluctuates in this range, investors try to turn the process in their favor by determining short-term trading ranges. However, at some point, the level they wait for to buy again does not come, and the price increases steadily. This situation of being left out causes pain similar to being stuck in a rapid collapse during bear markets.

We have not yet seen the painful face of the bull, but the Gold price exceeded $2,500 for the first time in history. Bitcoin price lingered in the $1,500 range while successfully defending the $56,000 support. Popular crypto analyst Filbfilb wrote;

“The fact that BTC will not rise with good news probably tells more than people want to accept.”

Since the beginning of the year, gold has increased by 21% alone, while BTC has risen by 38%. Although gold lags behind, it represents something much larger in terms of market value, so BTC is not in a very good position proportionally.

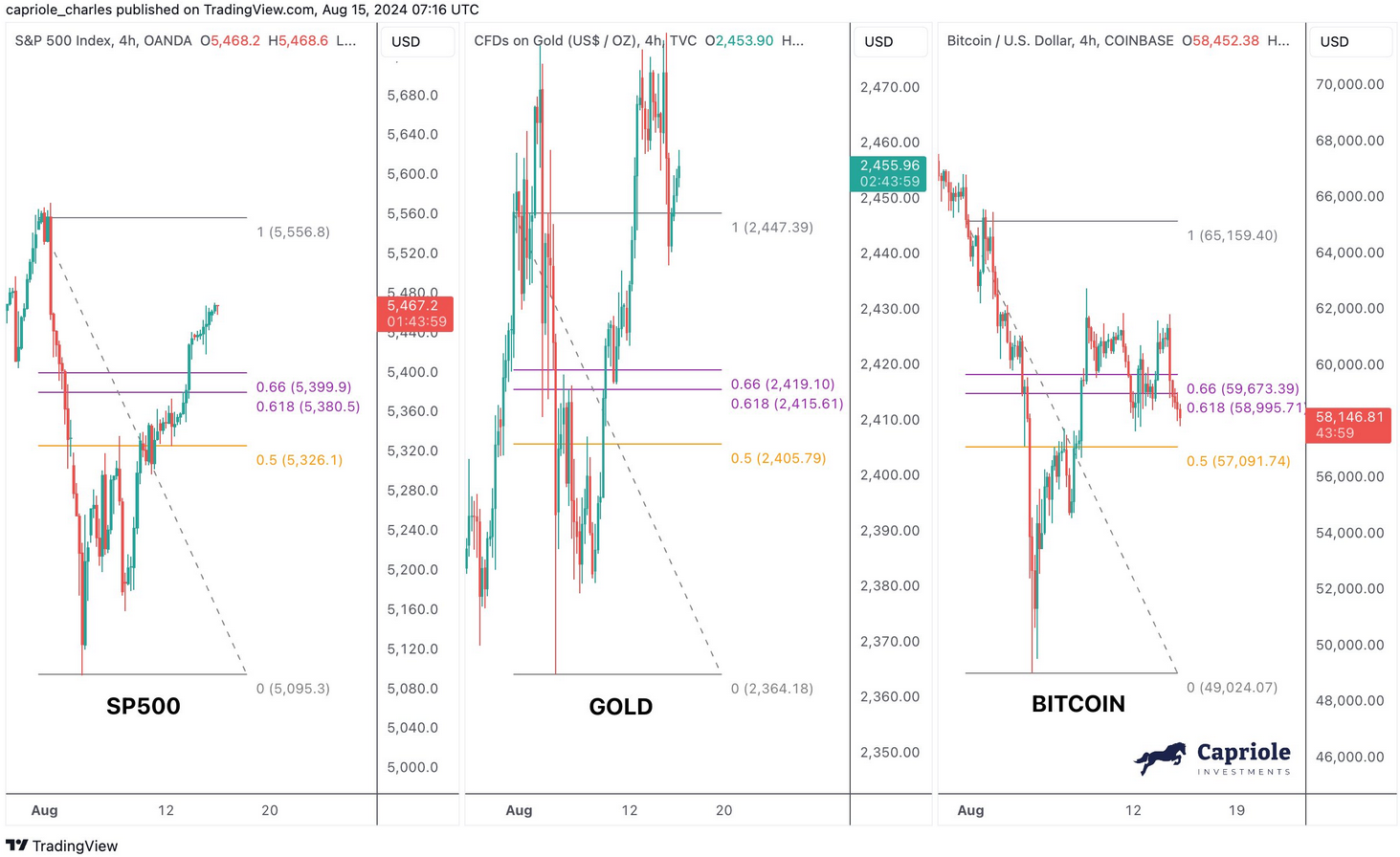

Charles Edwards, another popular expert, advised investors to be patient even though BTC did not deliver as expected this month (and previous months). According to him, BTC should historically follow the Gold chart and may follow it with a delay of up to three months. So, there is still time.

Cryptocurrencies Will Rise

But when? Cryptoverse CEO and founder Benjamin Cowen became another popular expert writing that investors should be patient by comparing previous cycles with the current situation. According to him, what happened in previous cycles will repeat, albeit with a delay.

“As a reminder, in 2019 when the Fed lowered interest rates, BTC also diverged from SPX. Many people continue to act as if such things are unprecedented and hard to believe, but *exactly* the same thing happened in the last cycle.”

Tuur Demeester, however, is not so optimistic.

“To be clear: the blood loss is probably not over! For example, if we see a major sell-off in the stock markets, a pullback to $45,000 is not unthinkable. Make sure your seat belts are fastened.”