Cryptocurrency Bitcoin’s price movements continue to resonate in the spot Bitcoin ETF arena. Investors pour significant money into ETFs with each BTC rise. However, Bitcoin’s price saw a slight downward movement yesterday. It’s now a fact: when Bitcoin  price rises, there are significant inflows into spot Bitcoin ETFs. Of course, the reverse is also true. If BTC price falls, outflows from spot Bitcoin ETFs can be expected. However, it’s important to note that there is no strict rule. Let’s take a look at yesterday’s numbers.

price rises, there are significant inflows into spot Bitcoin ETFs. Of course, the reverse is also true. If BTC price falls, outflows from spot Bitcoin ETFs can be expected. However, it’s important to note that there is no strict rule. Let’s take a look at yesterday’s numbers.

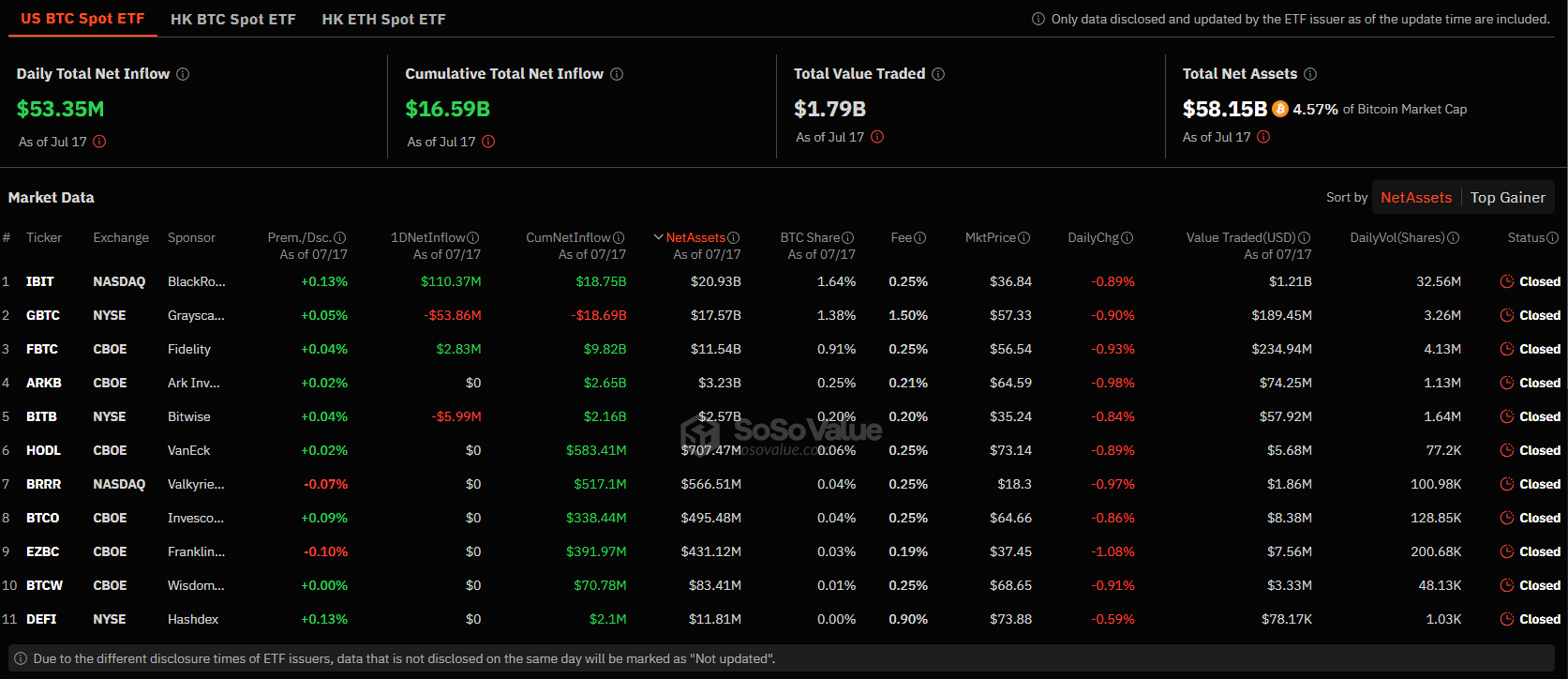

Spot Bitcoin ETFs See $53.35 Million Inflow

Bitcoin, the flagship of cryptocurrencies, is trading at $64,695. Although the price has pulled back slightly, this hasn’t prevented inflows into spot Bitcoin ETFs. The largest flow occurred into BlackRock’s spot Bitcoin ETF, IBIT. With an inflow of $110.37 million, the total assets in this ETF reached $20.93 billion.

Following BlackRock, the largest inflow was into Fidelity’s spot Bitcoin ETF. Here, the amount was $2.83 million. Fidelity’s spot Bitcoin ETF’s total assets decreased to $11.54 billion from the previous day’s $11.59 billion. These two ETFs significantly dominated the spot Bitcoin ETF arena yesterday.

How Did Other ETFs Perform?

Other spot Bitcoin ETFs did not see any inflows. Ark Invest’s ETF saw zero inflows yesterday. Similarly, VanEck’s spot Bitcoin ETF also saw zero inflows. Invesco, which had a $20.54 million inflow the previous day, also saw zero inflows.

The largest outflow occurred in Grayscale, with $53.86 million exiting. Additionally, Bitwise saw an outflow of $5.99 million.

Lastly, Franklin, Valkyrie, WisdomTree, and Hashdex’s spot Bitcoin ETFs saw no inflows and recorded zero inflows yesterday. The cryptocurrency market will focus on spot Ethereum ETFs next week. Scheduled for release on July 23, 2024, spot Ethereum ETFs are expected to create significant movement in the cryptocurrency market. Following the success of Bitcoin ETFs, similar interest is anticipated for Ethereum.