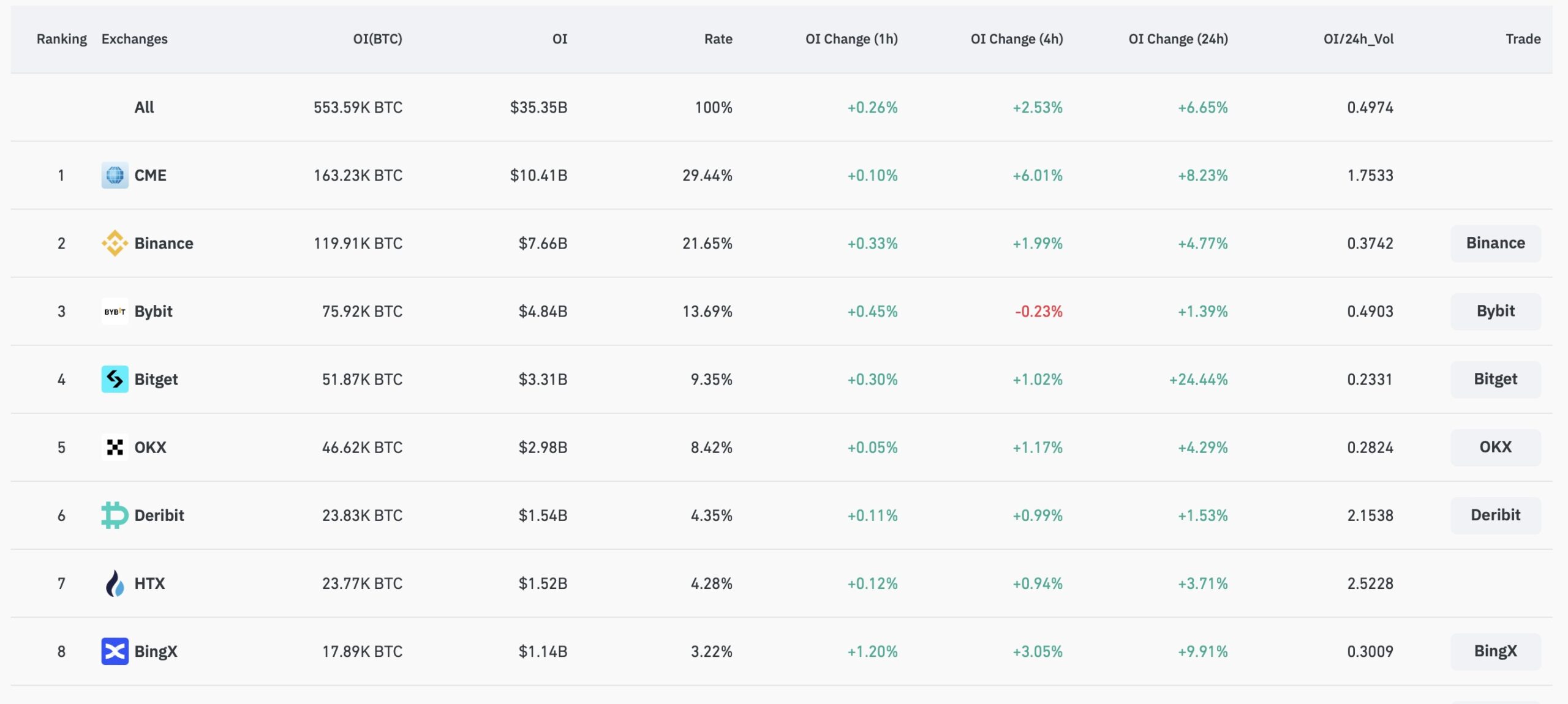

According to data from Coinglass, the total open interest for all Bitcoin  $103,435 futures contracts has risen to 55,300 BTC (approximately $35.3 billion). This increase indicates a growing volatility in the cryptocurrency market and heightened investor interest.

$103,435 futures contracts has risen to 55,300 BTC (approximately $35.3 billion). This increase indicates a growing volatility in the cryptocurrency market and heightened investor interest.

CME Takes the Lead

The Chicago Mercantile Exchange (CME) holds the top position in terms of open interest, with Bitcoin futures open interest reaching 163,023 BTC (about $10.4 billion). This accounts for 29.44% of the total market open interest.

Following CME, Binance ranks second with an open interest of 119,091 BTC (approximately $7.66 billion), representing 21.65% of the total market share.

Bybit, Bitget, and OKX Join the Rankings

Bybit stands third with an open interest of 75,092 BTC (around $4.84 billion), capturing 13.69% of the market share. Bitget comes fourth with 51,087 BTC (about $3.31 billion) in open interest, holding 9.35% of the market. OKX places fifth with 46,062 BTC (approximately $2.98 billion) of open interest, accounting for 8.42% of the market.

These figures show that CME and Binance control more than half of the total futures market. Furthermore, the significant interest in the cryptocurrency market indicates that investors are turning to futures contracts to profit from Bitcoin’s price movements.

The increase in open interest in futures contracts reflects investors’ high expectations regarding future price movements. The growth in open interest on exchanges, especially those attracting institutional investors like CME, may lead to increased market liquidity and volatility. The current growth patterns in Bitcoin futures are seen as crucial indicators of how dynamics within the cryptocurrency market are evolving and how investors are adjusting their strategies.

At the time of this report, Bitcoin is trading at $63,744, having risen by 2.88% in the last 24 hours.

Türkçe

Türkçe Español

Español