The significant exits in crypto-based investment products highlight investors‘ reactions to market uncertainties. Bitcoin and Ethereum have seen substantial losses. Economic and geopolitical concerns in the US are seen as the main reasons for these fluctuations. Let’s look at institutional investors’ behavior last week.

Significant Exits in US Crypto Markets

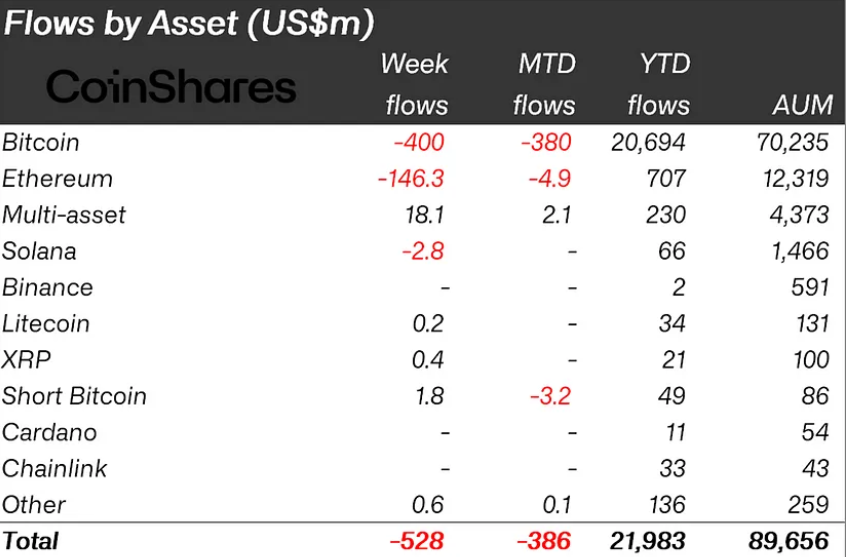

Digital asset investment products saw a total exit of $528 million last week. These exits reached their highest level in four weeks. Economic recession fears, geopolitical concerns, and general market liquidations in the US are the main reasons for these exits. During this period, major cryptocurrencies like Bitcoin and Ethereum also experienced significant losses.

Bitcoin saw an exit of $400 million after five weeks of inflows. Ethereum experienced an exit of $146 million, bringing net exits to $430 million since the ETF launch in the US. These exits in both major crypto assets are seen as a reflection of the overall market fluctuations.

Regional Crypto Movements

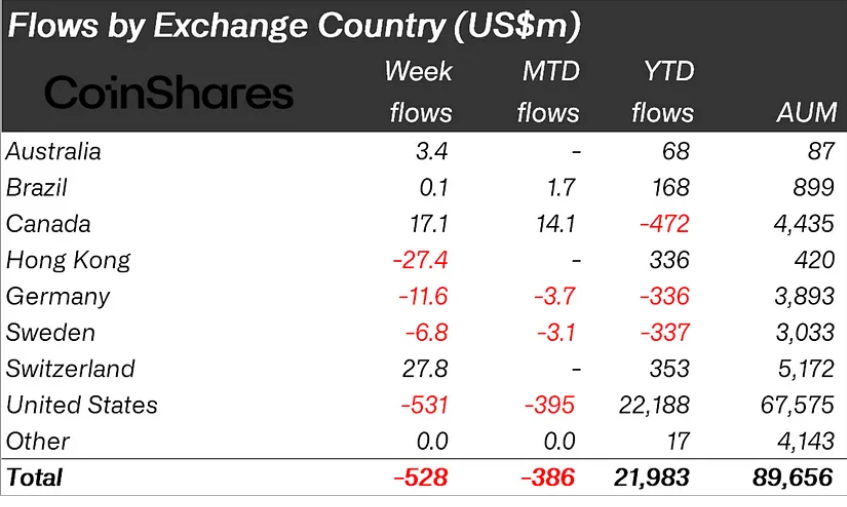

Exits were mostly US-based, amounting to $531 million. Germany and Hong Kong also saw exits of $12 million and $27 million, respectively. Canada and Switzerland viewed the price weakness as an opportunity, recording inflows of $17 million and $28 million, respectively. These regional differences indicate varying risk perceptions and strategies among investors.

Last week, ETP trading volume was $14.8 billion, representing only 25% of the total market. The price correction since Friday’s close resulted in a $10 billion loss in the value of total ETP assets under management (AuM). This reflects the overall volatility of ETP markets and the cautious approach of investors.

Short Positions and Blockchain Stocks

Short-focused Bitcoin saw its first measurable inflow of $1.8 million since June. Alongside exits from technology-related ETFs, blockchain stocks also saw an exit of $18 million. These exits are seen as indicators of general uncertainties in technology and crypto asset markets.

Although Ethereum’s newly launched ETFs in the US saw an inflow of $430 million, these were balanced by a $603 million exit from Grayscale Trust. Small-scale exits were also observed in European ETPs, but this did not change the overall picture. These developments show how quickly market dynamics can change and how investors adopt different strategies.

Türkçe

Türkçe Español

Español