On November 4, 2024, spot Bitcoin  $111,074 and Ethereum

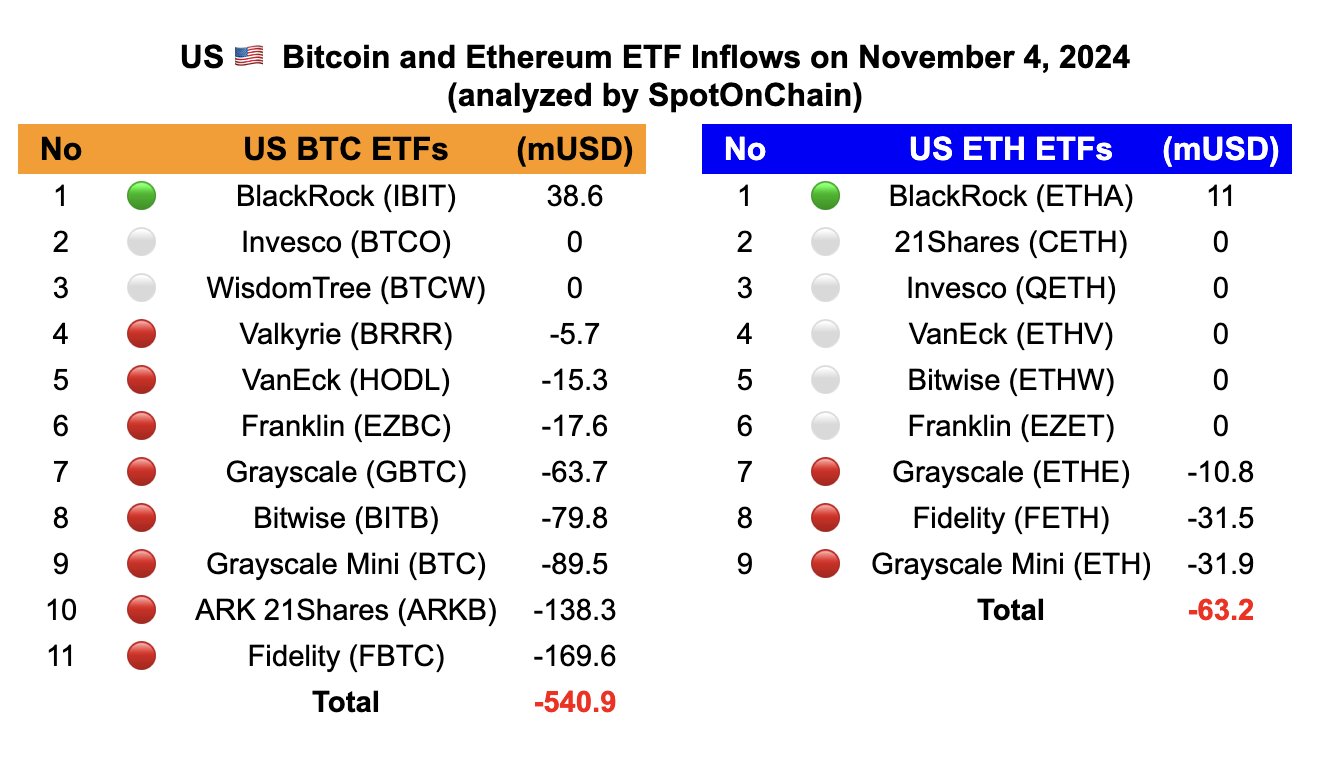

$111,074 and Ethereum  $2,651 ETFs in the United States experienced a notable decline. According to Spot On Chain’s data, there was a net outflow of $540.9 million from spot Bitcoin ETFs and $63.2 million from Ethereum ETFs.

$2,651 ETFs in the United States experienced a notable decline. According to Spot On Chain’s data, there was a net outflow of $540.9 million from spot Bitcoin ETFs and $63.2 million from Ethereum ETFs.

BlackRock’s Spot Bitcoin ETF Sees Positive Inflows

Among U.S. Bitcoin ETFs, only BlackRock’s IBIT ETF recorded a positive inflow of $38.6 million. All other spot Bitcoin ETFs faced significant losses. For instance, Fidelity’s FBTC ETF saw outflows of $169.6 million, while ARK 21Shares’ ARKB ETF experienced a $138.3 million outflow.

Prominent providers such as Grayscale, Bitwise, and VanEck also recorded negative flows. This trend is interpreted as a significant reflection of the uncertainty in the sector impacting investors ahead of the presidential elections in the U.S.

Spot Ethereum ETFs Also Experience Outflows

The scenario for spot Ethereum ETFs was not different. Only BlackRock’s ETHA ETF saw a positive inflow of $11 million, while Grayscale, Fidelity, and Grayscale Mini ETFs recorded outflows of $10.8 million, $31.5 million, and $31.9 million respectively. This indicates a decline in investor interest in spot Ethereum ETFs.

The outflows from both spot Bitcoin and Ethereum ETFs are linked to market uncertainties and the upcoming U.S. presidential election. Observers note that these outflows might reflect shifts in investor sentiment and market volatility.

Türkçe

Türkçe Español

Español