As the year draws to a close, it is observed that cryptocurrency investors are turning more towards altcoins rather than Bitcoin (BTC) and Ethereum (ETH). Data confirms this by showing that the total value of US dollars locked in active Bitcoin futures contracts has dropped to the lowest level in two years, while Ethereum’s has remained unchanged.

Money Flows to Altcoins Instead of Bitcoin

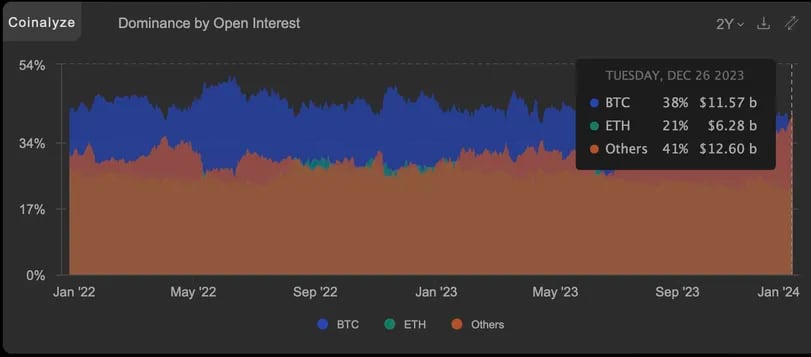

According to data provided by Coinalyze, the value of US dollars locked in active Bitcoin futures contracts constitutes 38% of the total open futures positions in the market, amounting to $30.4 billion. The data indicates that this rate is at its lowest level in the last two years.

The Coinalyze team, commenting on the subject to Coindesk, explains the decline in Bitcoin’s dominance in this area with the high interest in altcoin futures, stating, “It seems like all the money is now going into altcoins.” This suggests that investors are turning to altcoins after a notable Bitcoin rally, indicative of an increase in their risk appetite.

As is known, BTC, the largest cryptocurrency by market value, has risen over 60% since October, reaching up to $44,000. The rise was primarily triggered by a drop in Treasury yields and the expectation that the US Securities and Exchange Commission (SEC) would approve one or more spot Bitcoin ETFs between January 8-10, 2024. According to the latest data, BTC has seen an increase of over 155% since the beginning of the year, trading at $42,681.

While Ethereum’s Share Remains Stable, Other Altcoins’ Shares Increase

A closer look at the data shows that Bitcoin’s dominance in open futures positions dropped from approximately 50% to 48% at the end of October. During the same period, the dominance of the altcoin king Ethereum remained stable at around 21%, while the share of other altcoins increased from 32% to 41%.

Since then, many altcoins have seen triple-digit increases. For example, during this period, Injective’s INJ rose by 500%, Kaspa’s KAS by 300%, and THORChain’s RUNE exceeded 200%.

Türkçe

Türkçe Español

Español