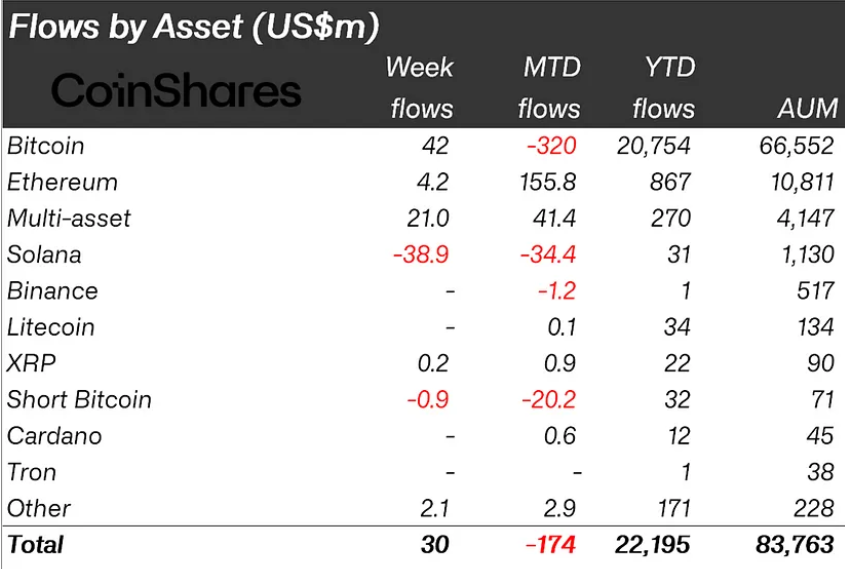

Last week, developments in the crypto investment products market caught the attention of investors and highlighted the sensitivity of the markets once again. Although there was a small inflow of $30 million overall, there were significant divergences among different crypto assets behind this figure. Notably, Solana faced the largest exits in history and saw a significant drop in memecoin trading volumes.

Fed Decisions and Market Reactions

Last week’s data from the US economy reduced the likelihood of the Fed lowering interest rates by 50 basis points in September. This development resulted in an inflow of only $30 million into crypto asset investment products.

However, this small inflow did not have the same impact across all markets. While the market share of old investment product providers decreased, activity among new providers increased. This actually shows that investors are turning to more innovative products compared to the past.

Bitcoin Gains Strength

Last week, Bitcoin showed the strongest performance with an inflow of $42 million. This reveals that Bitcoin, the leader of the crypto market, is still seen as a safe haven by investors. However, another notable point is that short-focused Bitcoin ETFs experienced an outflow of $1 million for the second consecutive week. This indicates that investors are moving away from expecting a short-term decline in Bitcoin.

On the Ethereum front, although there was only an inflow of $4.2 million last week, this figure actually masks significant activity. New providers saw an inflow of $104 million in Ethereum investment products, while established providers like Grayscale faced an outflow of $118 million. This indicates that investors prefer innovative approaches over traditional providers when it comes to Ethereum.

Sharp Decline in Solana Stands Out

Solana was one of the most talked-about crypto assets of the week. An outflow of $39 million was recorded as the largest exit in Solana’s history. The sharp decline in memecoin trading volumes particularly affected Solana, making it the most impacted asset by these exits. This once again showed the significant risks associated with Solana’s dependence on memecoin trading.

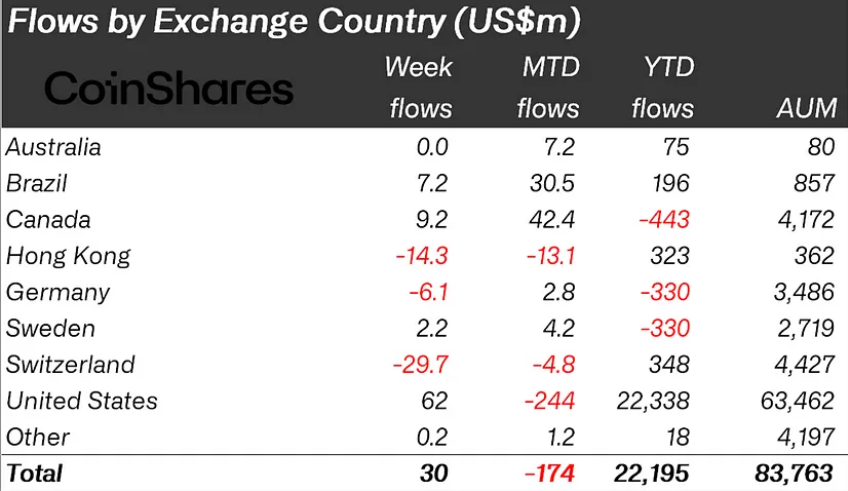

Regionally, the US, Canada, and Brazil saw inflows of $62 million, $9.2 million, and $7.2 million, respectively, in crypto investment products. However, Switzerland and Hong Kong recorded the largest outflows of the week with $30 million and $14 million, respectively. These regional differences reveal how diverse and dynamic the global crypto markets are.

Türkçe

Türkçe Español

Español