Investors in the US are showing increasing interest in hedging activities in the options market ahead of the launch of exchange-traded funds (ETFs) tied to the spot price of Ethereum (ETH), and this interest is growing daily. According to recent data, the imminent approval and launch of spot ETFs have driven investors to seek protection against potential price volatility, leading to an increase in Implied Volatility (IV), a metric that measures market expectations of price movements over specific periods.

Uncertainty in the Market Rises Before Spot Ethereum ETFs

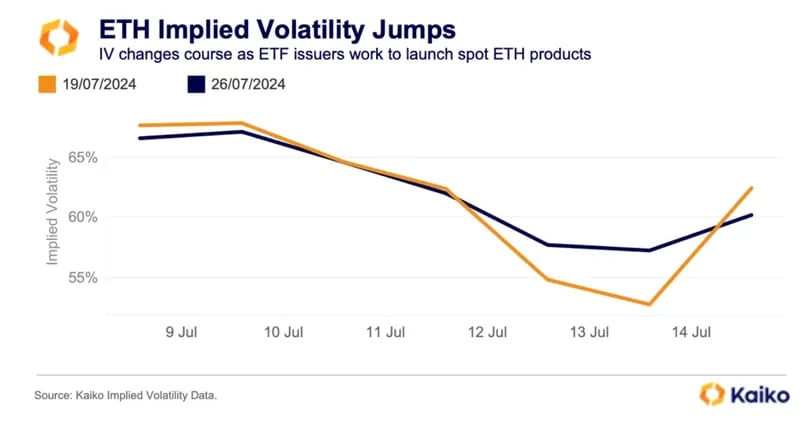

Deribit and Kaiko data reveal that IV has risen across various time frames, indicating increased demand for options that provide protection against price volatility. In the options market, call options provide protection against price increases, while put options offer insurance against price drops. The rise in hedging activities is particularly noticeable in short-term contracts. For example, the IV for options expiring on July 19 increased from 53% to 62%, surpassing the IV of options expiring on July 26.

Kaiko analysts noted that this increase in short-term IV indicates that investors are willing to pay a premium to protect their positions against sharp, short-term price movements, reflecting a sense of uncertainty in the market.

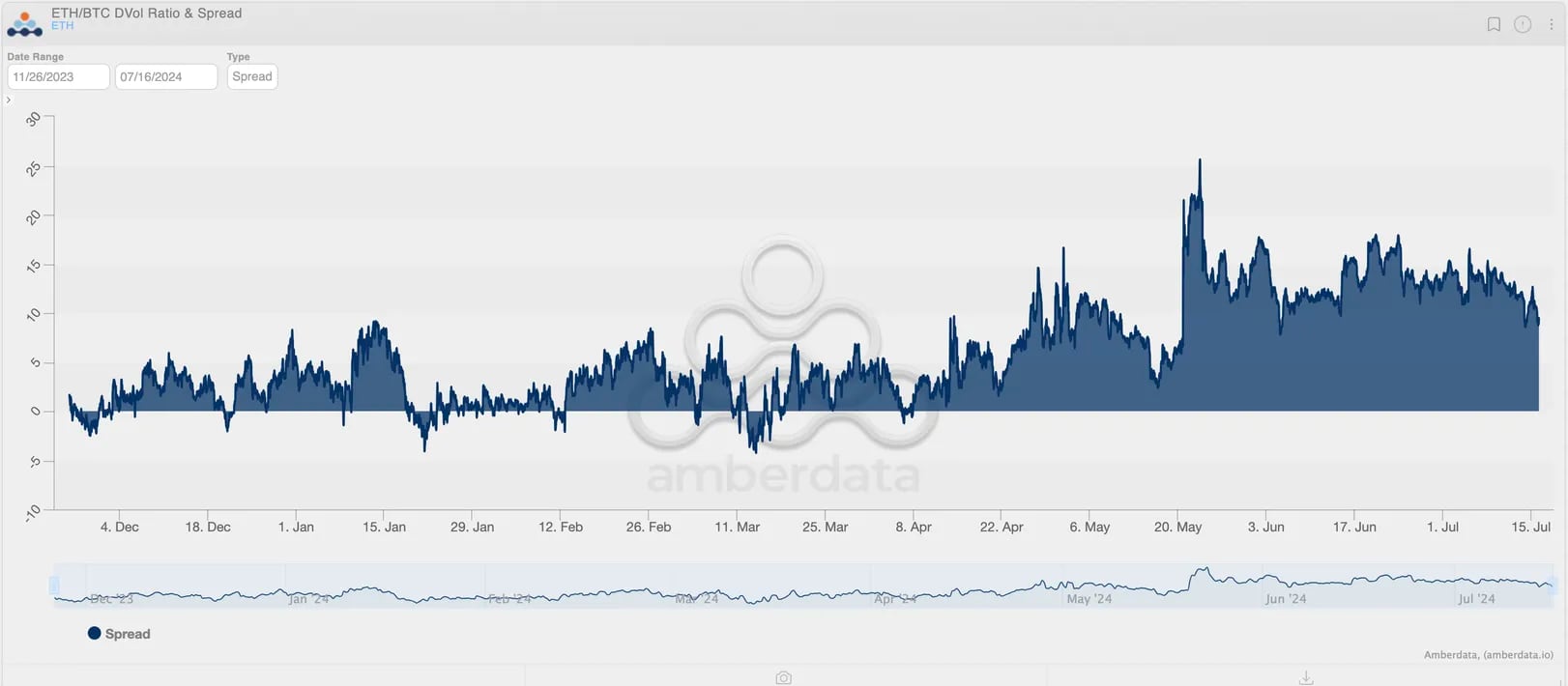

Moreover, there is a higher expectation of volatility for Ethereum compared to Bitcoin. Data from Amberdata shows that the difference between Deribit’s 30-day IV indices for ETH and BTC (BTC DVOL and ETH DVOL) has consistently averaged around 10% since the end of May, significantly higher than the 5% average in the first quarter. This indicates a persistent volatility premium for ETH, as observed by the cryptocurrency exchange Bybit and the analytics firm BlockScholes.

The optimism surrounding ETH’s volatility is partly due to the anticipated launch of the first spot Ethereum ETFs in the US. Recent reports have indicated that investors are becoming increasingly optimistic about ETH, reflecting a persistent volatility premium over BTC amid rising market activity. This optimism is expected to translate into significant fund inflows, with Gemini predicting a net inflow of $5 billion into spot Ethereum ETFs within the first six months, potentially boosting ETH’s market value more sharply compared to BTC.

“Buy the Rumor, Sell the News” May Not Occur

However, investors remain highly cautious of the “buy the rumor, sell the news” phenomenon that occurred after the launch of spot Bitcoin ETFs on January 11, which led to a post-launch price drop. Despite this cautious wait, the current market sentiment and Ethereum’s situation appear more measured compared to Bitcoin’s scenario in early January, suggesting a lower likelihood of a significant post-rally drop for the altcoin king.

Türkçe

Türkçe Español

Español