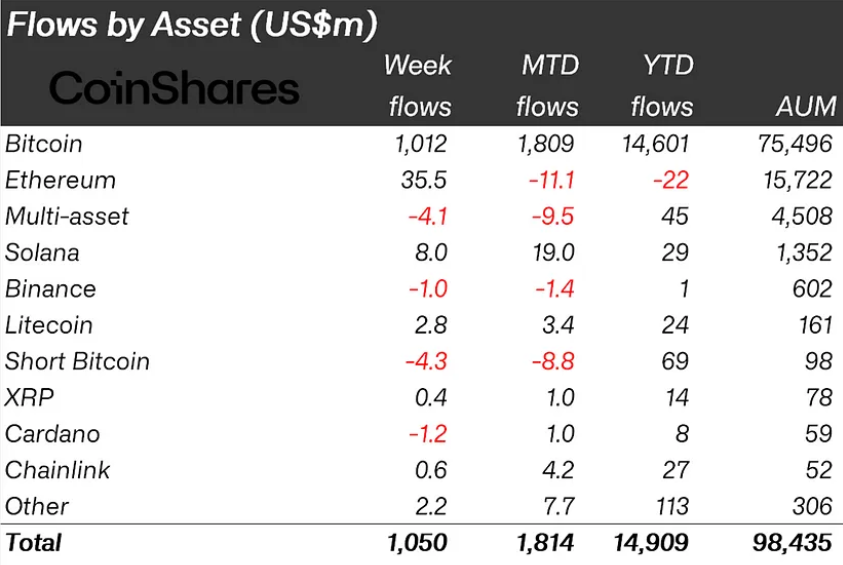

Crypto asset investment products experienced a significant increase, marking a total inflow of $1.05 billion for the third consecutive week. This flow brought cumulative inflows for the year to a record level of $14.9 billion. Such a significant increase reflected the growing interest and confidence in crypto assets among investors. The recent rise in cryptocurrency prices also contributed to this increase, raising the total value of crypto-focused Exchange-Traded Products (ETPs) to $98.5 billion. Additionally, weekly ETP trading volumes increased by 28% to $13.6 billion, indicating heightened market activity.

Regional Distribution

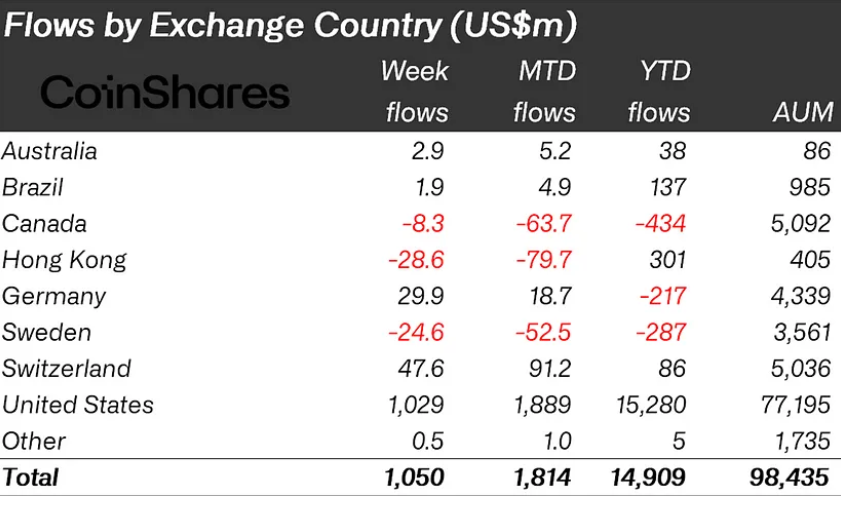

A closer look at the regional distribution of these inflows revealed that the United States was the primary beneficiary, attracting $1.03 billion. Grayscale, a leading crypto asset manager, witnessed a significant reduction in outflows, dropping to just $15 million during the week.

Europe also showed strong performance, with Germany and Switzerland recording inflows of $48 million and $30 million, respectively. However, the initial enthusiasm for spot Bitcoin ETFs in Hong Kong, which saw $300 million in the first week, waned with recent outflows of $29 million.

Ethereum Sees Inflows

Ethereum also recorded a significant increase with $36 million in inflows over the week, reaching the highest level since March. This increase likely signaled a positive market reception as an early response to the approval of Ethereum ETFs in the United States. Another leading cryptocurrency, Solana, stood out with $8 million in inflows, reflecting its growing appeal among investors.

Crypto asset investment’s overall trend highlights a shift towards a more positive market outlook. The continued inflows over the past three weeks indicated increased confidence in crypto assets as a viable investment option.