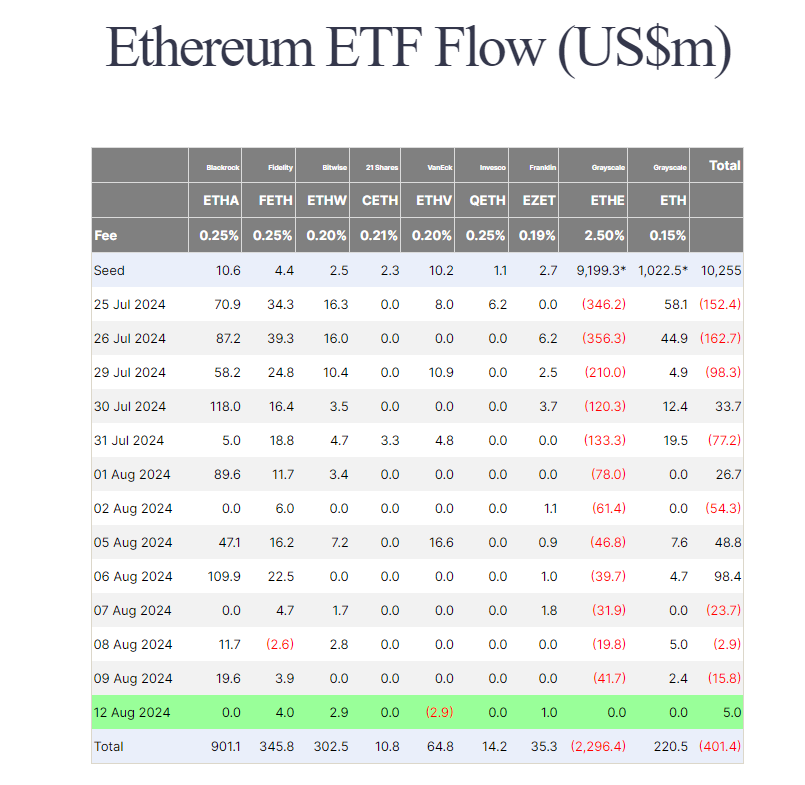

Ethereum and Bitcoin investment funds’ latest developments revealed the ever-changing dynamics of the cryptocurrency market. On August 12, 2024, spot Ethereum exchange-traded funds (ETFs) in the US saw a net inflow of $4.9 million. This marked a recovery following the past three days. Grayscale’s Ethereum Trust (ETHE) fund recorded net zero inflows on Monday for the first time in 14 days since its conversion to an ETF. This indicates that investors are reassessing their interest in cryptocurrencies.

Current Status of Spot Ethereum ETFs

While Grayscale’s ETHE recorded zero inflows, VanEck’s ETHV fund experienced an outflow of $2.92 million. This was the first outflow since July 23. In contrast, Fidelity’s FETH fund saw an inflow of $3.98 million, and Bitwise’s ETHW fund had an inflow of $2.86 million.

Franklin’s EZET fund also drew attention with an inflow of approximately $1.01 million. These movements in the funds show that investors are adopting different strategies and must adapt to the market’s constantly fluctuating nature.

On Monday, the total daily trading volume of spot Ethereum ETFs reached $286 million. This figure represents a significant increase compared to Friday’s $166.9 million. This rise indicates that investors’ interest in cryptocurrencies is resurging and they are shaping this interest according to market movements.

Movements Observed in Spot Bitcoin ETFs

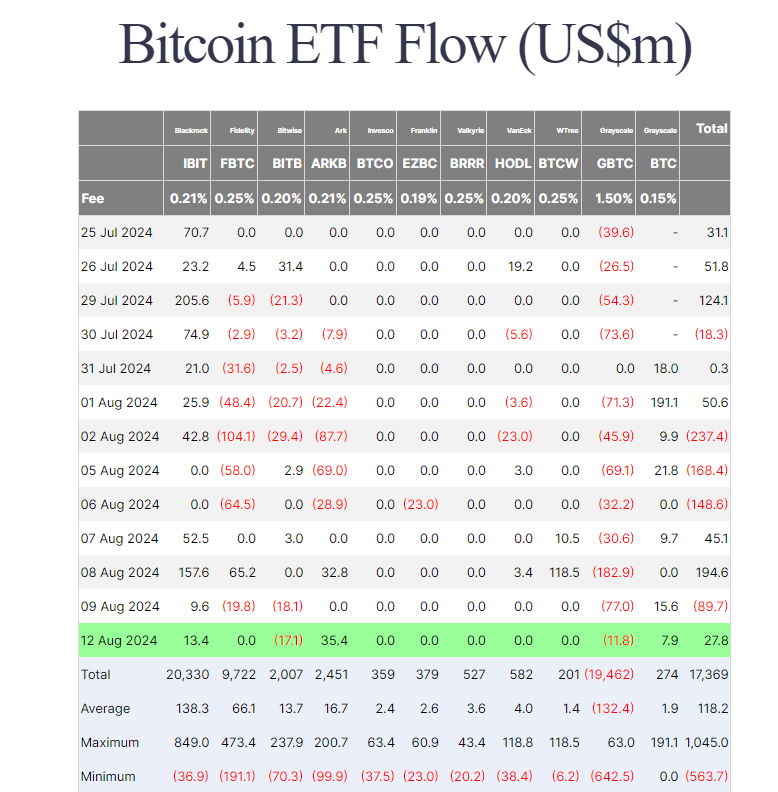

A larger movement was observed on the Bitcoin front. The 12 spot Bitcoin ETFs in the US recorded a net inflow of $27.87 million on Monday. Ark and 21Shares’ ARKB fund had the largest net inflow with $35.4 million. BlackRock’s IBIT fund followed with a net inflow of $13.45 million. These developments indicate that large institutional investors’ interest in Bitcoin continues to grow.

However, Bitwise’s BITB and Grayscale’s GBTC funds experienced outflows of $17.06 million and $11.77 million, respectively. These outflows suggest that while large funds maintain their interest in Bitcoin, some investors are realizing profits or rebalancing their portfolios.