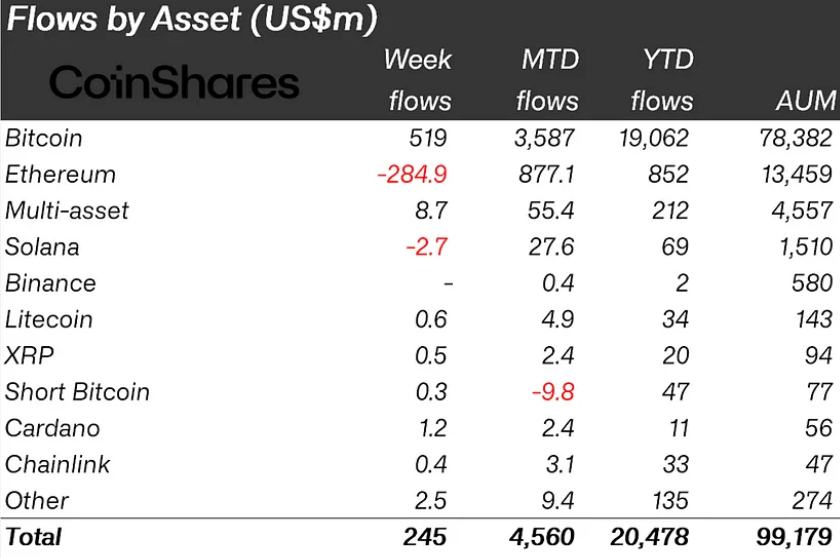

Crypto-based investment products present a complex landscape filled with intertwined dynamics and ever-changing trends. The performances of Bitcoin and Ethereum serve as significant indicators capturing investors’ attention, while the impact of current market conditions on cryptocurrencies is also revealed. Last week, crypto asset investment products drew attention with an inflow of $245 million. Bitcoin and Ethereum emerged as two standout assets attracting investor interest despite the overall stagnation.

Bitcoin Attracts $519 Million Inflows

Bitcoin showcased a remarkable performance with $519 million in inflows. These strong inflows brought Bitcoin’s total inflows this month to $3.6 billion, and year-to-date inflows to $19 billion.

This increase in Bitcoin emerged due to a series of factors. Notably, the perception of Bitcoin as a potential strategic reserve asset and speculations about a possible interest rate cut by the Federal Reserve in September 2024 boosted investors’ confidence in Bitcoin. This situation reinforced Bitcoin’s reliability and appeal.

Ethereum Sees Inflows and Outflows with ETFs

Ethereum is experiencing a period of significant interest with the launch of spot-based ETFs. An investment of $2.2 billion, one of the highest inflow figures since December 2020, highlighted the impact of Ethereum ETFs. However, this positive development was overshadowed by simultaneous outflows from existing Ethereum products.

Grayscale’s Ethereum Trust, as a significant player, witnessed an outflow of $1.5 billion, leading to a net outflow of $285 million across all Ethereum investment products. These outflows reflect a similar situation observed following the ETF launches in January 2024.

Trading Volumes for Crypto Assets

Trading volumes for cryptocurrencies reached their highest levels since May, totaling $14.8 billion throughout the week. This increase, supported by the Ethereum ETF launches, contributed to the rise in total assets under management (AuM) to $99.1 billion.

Year-to-date inflows into cryptocurrencies reached a record $20.5 billion. This figure demonstrates the continued strong interest and commitment to the crypto space despite mixed signals from different asset classes.