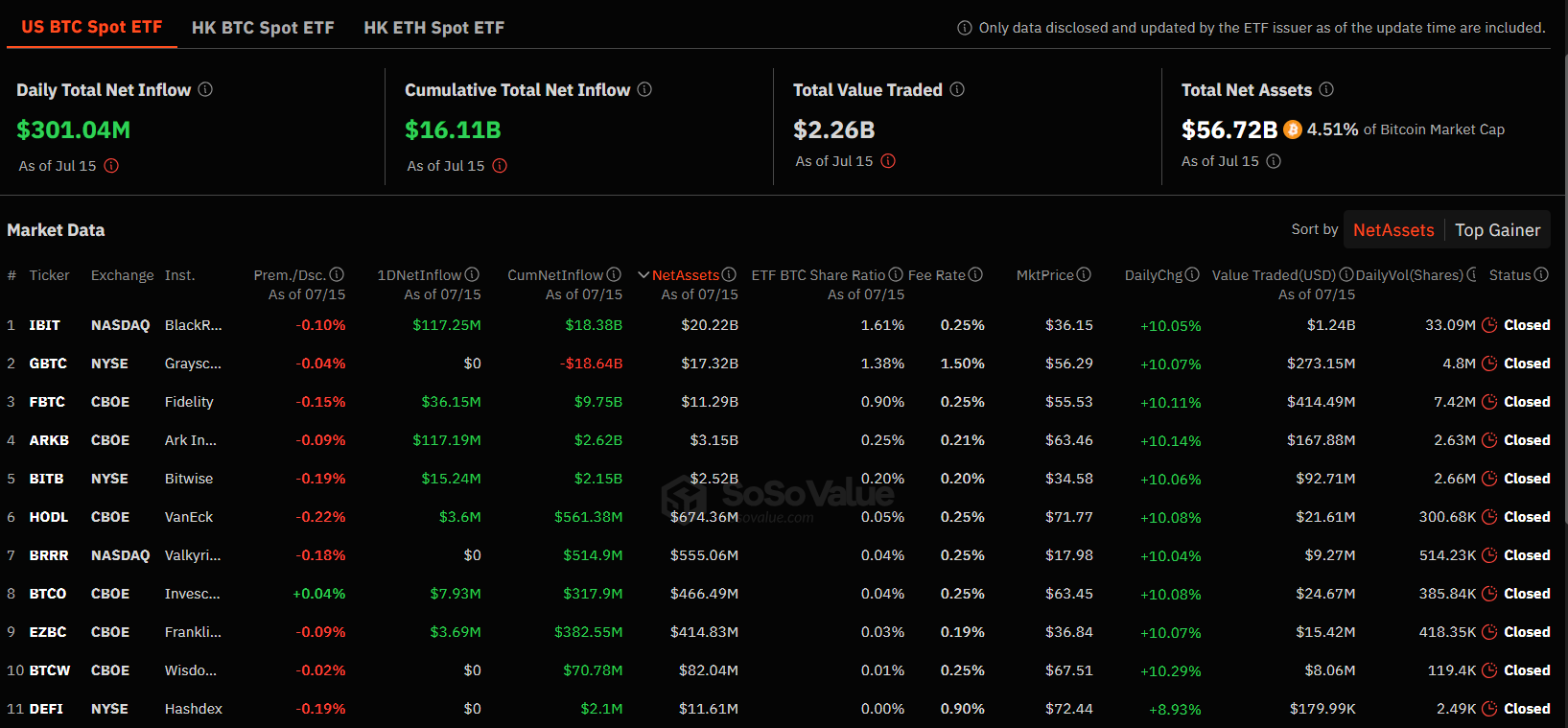

The latest update on the Spot Bitcoin ETF flow dated July 15, 2024, shows a significant net inflow of $301.04 million, indicating strong interest in Bitcoin-related financial products. This influx demonstrates growing confidence in Bitcoin ETFs as a valid investment tool among institutional and individual investors. Additionally, the figures reflect the impact of Bitcoin’s price rising towards $65,000.

Highlights of the Day in Spot Bitcoin ETFs

BlackRock and Ark Invest, the group’s leaders, each achieved a net inflow of $117 million. This substantial investment underscores strong belief in these firms’ management capabilities and their strategic approaches to Bitcoin investment. Both companies are at the forefront of financial innovation, and the significant inflows reflect investors’ confidence in their ability to navigate the volatile cryptocurrency market.

Fidelity also saw a notable investment with a net inflow of $36.15 million. Fidelity’s longstanding reputation in the financial sector, combined with its focus on cryptocurrencies, has made it a preferred choice for investors looking to diversify their portfolios with Bitcoin ETFs.

Investment Amounts in Other ETFs

Bitwise received an investment of $15 million, highlighting its growing importance in the ETF market. Bitwise is known for its comprehensive approach to cryptocurrency investments, offering products that appeal to a wide range of investors.

Another significant player in the ETF market, VanEck, achieved an inflow of $3.6 million. VanEck is actively involved in the cryptocurrency space, and this investment reflects continued confidence in its offerings. Despite being relatively smaller compared to others, it represents steady interest in Bitcoin ETF products.

Invesco and Franklin Templeton also saw positive inflows of $7.93 million and $3.69 million, respectively. These investments highlight the variety of options available to investors looking to invest in Bitcoin through ETFs. At the time of writing, Bitcoin is trading at $63,522.