Investors familiar with traditional markets can invest through various channels outside of cryptocurrency exchanges. Most of these mean indirect investment in crypto. MSTR is the most popular among them, and Michael Saylor deliberately turned his company into an unofficial BTC ETF product. So, which is better?

MSTR Shares and Crypto

Stock market investors who want to profit when Bitcoin rises can buy MSTR shares from the end of 2020, before ETF approvals. Since MicroStrategy holds a massive amount of BTC in its reserves, the value of the reserves and thus the BTC price increases, which also raises the MSTR share prices.

Until ETF approval, this was a good strategy. For many years, we talked about the massive MSTR shares held by BlackRock on behalf of its clients. It was a good strategy; MSTR shares even performed 50% better than the BTC spot price. Since adopting this strategy, the company’s share price has increased nearly tenfold.

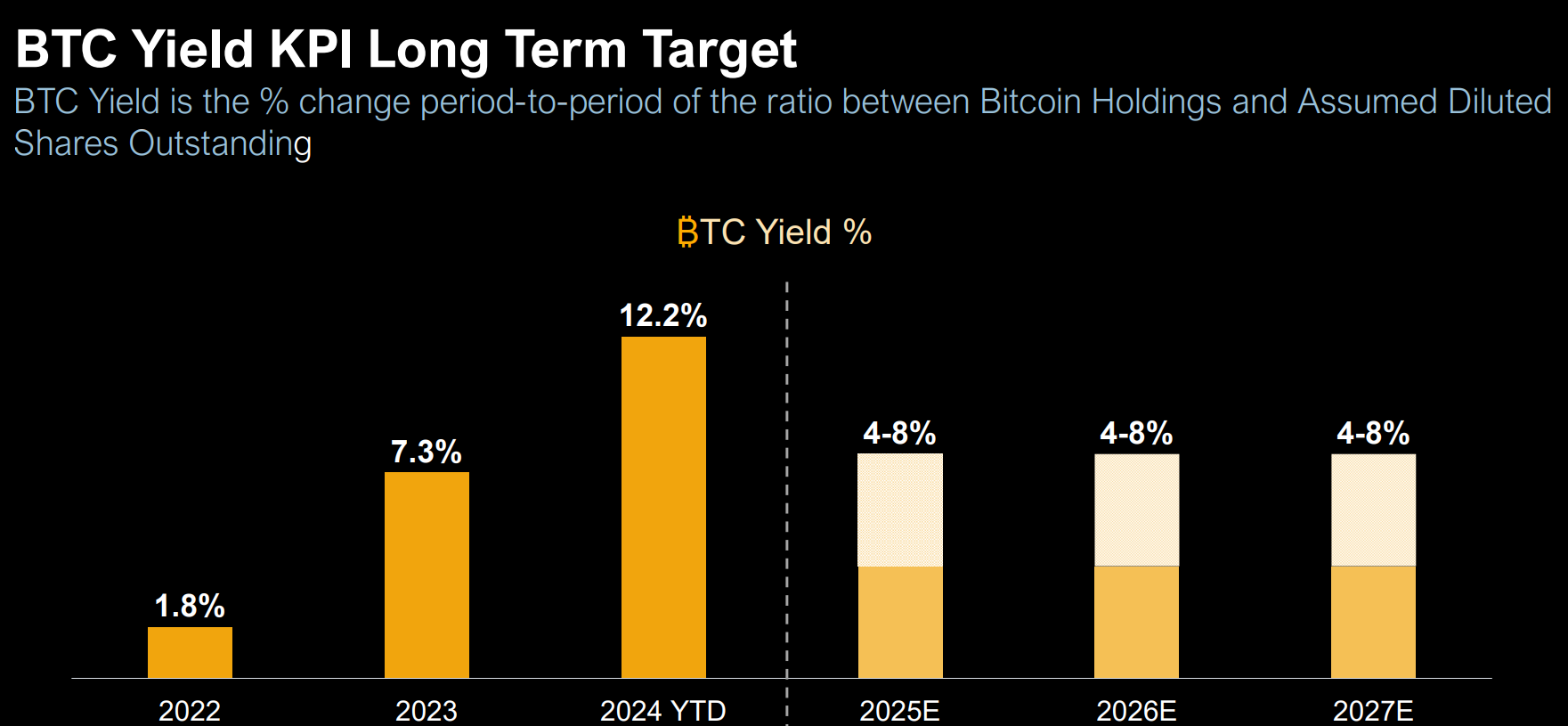

On August 1, the company announced in its earnings call that it would adopt “Bitcoin Yield,” a measure of BTC per share, as a corporate performance metric. This means MicroStrategy will gradually increase the BTC ratio per share and promises to benefit investors. It will do this by taking on more debt and issuing shares. However, the already high share price undermines the sustainability of MSTR’s story of outperforming BTC.

MSTR’s Future and Alternatives

Benchmark fintech analyst Mark Palmer says that if BTC reaches $150,000 by the end of 2025, MSTR shares will reach $2,150 (or $215 due to a 10-to-1 split). MSTR is trading at $132, and according to Palmer’s estimate, even if BTC increases by 300%, the price will roughly rise by 60%.

The company has $3.7 billion in debt, and if there is a rapid decline in BTC prices, MSTR may face a negative premium in its unofficial BTC ETF story if it lacks sufficient cash. So, what does MicroStrategy do? It is actually a business intelligence company, and in the second quarter, its corporate software business earnings decreased by 7%. This means the company is entirely dependent on a process where BTC prices continuously rise and it continuously borrows.

Moreover, leveraged products launched for MSTR can make things even more challenging. In summary, MSTR involves significant risks. Therefore, investors are likely to shift from the MSTR channel to real BTC ETF products like those from BlackRock and Fidelity. What would happen in such a scenario? The massive billion-dollar MicroStrategy BTC reserve would need to be offloaded onto the exchanges.

The collapse story of the previous bull run was the crypto credit frenzy, and in the future, Saylor could deliver a significant blow to the markets.

Türkçe

Türkçe Español

Español