The United States Internal Revenue Service (IRS) announced the appointment of two new crypto tax experts from the private sector to focus on cryptocurrency assets. The official tax filing season in the US began on January 29th, following which the IRS released notifications urging citizens to report all cryptocurrency and crypto asset income, including NFTs.

IRS Takes Notable Step

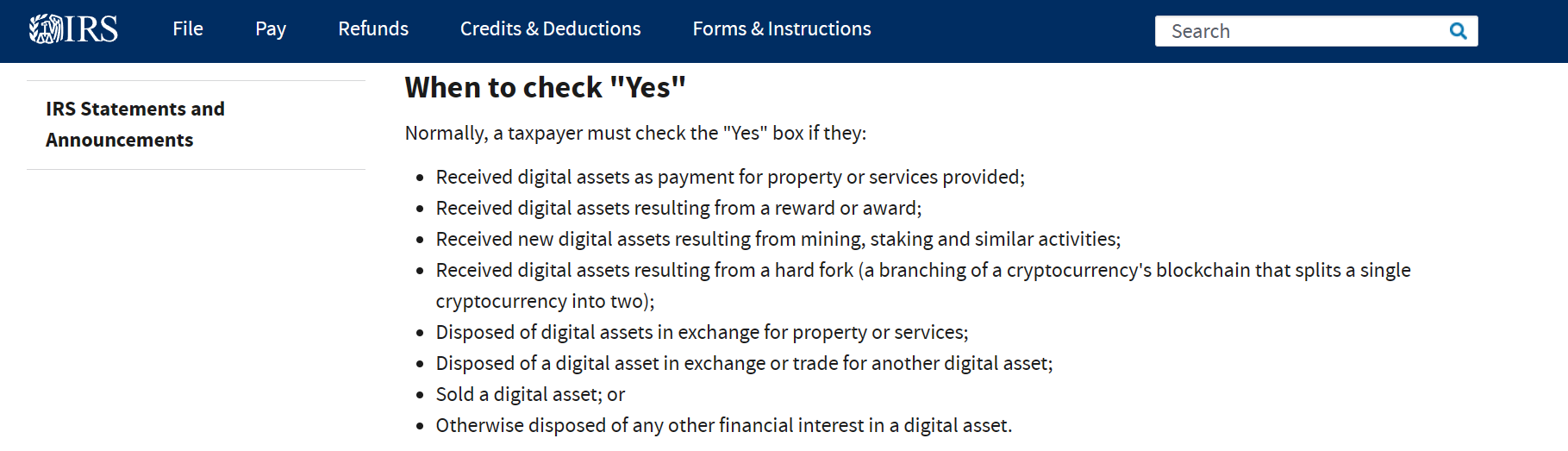

As shown below, it is necessary to report cryptocurrencies received as rewards or through staking, among other methods. According to the IRS, the two new employees, Sulolit Mukherjee and Seth Wilks, have been hired as executive advisors to the department. The agency stated the following:

“With extensive experience in tax and crypto industries, the duo will assist in leading the efforts to create service, reporting, compliance, and enforcement programs focused on crypto assets.”

IRS Commissioner Danny Werfel believes that expertise from the private sector can help the department create a successful crypto asset infrastructure that works well for everyone. The IRS will use funds from the Inflation Reduction Act (IRA), a federal law aimed at reducing inflation, to create compliance in emerging areas, including crypto assets.

Crypto Sector and Tax Process in the US

It is important to note that US taxpayers do not need to report cryptocurrency held in wallets, transferred between two wallets owned by the same person, or purchased using fiat currency. Just before the start of the tax season, on January 17th, the IRS stated that there was no need to report crypto transactions over $10,000. The department plans to implement the rule after publishing a regulatory framework.

The decision reverses a new law established on January 1st, which required all US businesses to report cryptocurrency transactions over $10,000. The IRS stated:

“Currently, crypto assets do not need to be included when determining whether the cash reporting threshold for a single transaction is met.”

The US House of Representatives Financial Services Committee also highlighted some fundamental issues with the poorly structured crypto asset reporting requirements adopted on January 1st.

Türkçe

Türkçe Español

Español