The world’s largest cryptocurrency, Bitcoin, faced significant selling pressure last week after Tesla liquidated its $373 million worth of BTC assets. As of the time of writing, Bitcoin is trading at $26,060 with a market capitalization of $507 billion.

Will Bitcoin Price Fall?

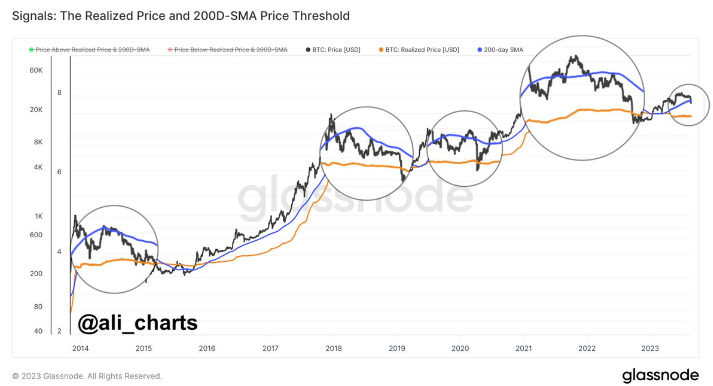

On-chain and technical indicators suggest that BTC price could further drop as it has fallen below the 200-day moving average. Popular crypto market analyst Ali Martinez explains:

Whenever BTC has dropped below the $200 daily SMA in the past 10 years, it has usually fallen enough to touch the Realized Price. Currently, the Realized Price is around $20,350.

Although the TD Sequential daily chart presents a buy signal, confirmation will not come unless there is a continuous close above the 200-day MA. Investors need to closely monitor the $25,200 – $24,800 range, as breaking this crucial support could bring the Bitcoin price down to $20,000.

Bitcoin Analysts Predict a Downtrend

Amidst the current price movement, many market analysts have drawn attention to the future of Bitcoin price. Renowned crypto market analyst Peter Brandt stated that closing below $24,800 would be detrimental to the daily and weekly charts.

Rekt Capital, a well-known market analyst, observed a strong bearish technical signal in Bitcoin’s performance. BTC, reaching a Double Top formation, may encounter $26,000 as a resistance instead of its previous support role, indicating a downtrend.

Leading crypto analysts such as CrediBULL Crypto, Crypto Tony, and Crypto Birb predict the most favorable buying opportunity around $25,000. CrediBULL Crypto predicts that Bitcoin price will likely maintain a bottom level above $25,000, drawing parallels with a previous market correction that occurred before BTC reached its all-time high.

However, some analysts remain hopeful for a recovery in Bitcoin prices as September begins. It is reported that the U.S. Securities and Exchange Commission (SEC) will provide an update on Wisdomtree and BlackRock’s spot Bitcoin ETF applications in the first week of September.