Crypto analyst and investor Ali Martinez points out that Dogecoin (DOGE) is displaying price movements similar to those before major rallies. On the social media platform X, Martinez told thousands of users that DOGE, the largest memecoin by market value in the first period of this year, broke out of a descending triangle formation on the weekly chart, which is considered bullish, depending on the price moving above the upper trend line.

Analyst’s Comments on Dogecoin (DOGE)

Regarded as the biggest meme coin in the market, DOGE was thoroughly reviewed by Ali Martinez. In his detailed analysis, he shared his views on potential price movements and price targets.

Currently, DOGE is undergoing a 47% price correction, very similar to previous cycles, which could ignite the next DOGE bull run!

According to Martinez’s analysis and comments, Dogecoin also displayed similar price behaviors in 2017 and 2021, which was noteworthy.

In 2017, DOGE broke out of a descending triangle. Then, DOGE entered a bull run of 982% after a 40% pullback! In 2021, DOGE again broke out of a descending triangle. Then, DOGE surged 12,197% after a 56% pullback! Over the years, Dogecoin seems to be mirroring its previous bull cycles! All you need is a bit of patience.

While Martinez’s analysis drew attention, eyes were also on the DOGE price. At the time of writing, DOGE was trading at $0.1391 after a nearly 5% increase. DOGE’s market cap had surpassed $20 billion.

Shiba Inu’s Price and Analyst’s Comments

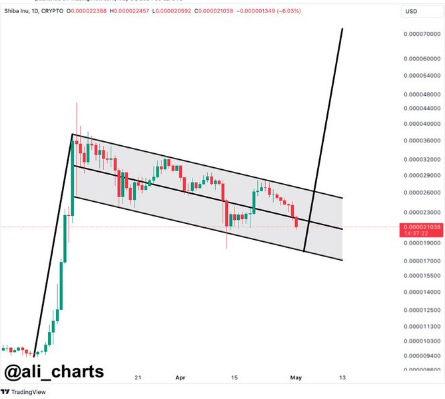

Martinez conducted his second analysis on Shiba Inu (SHIB), the second largest memecoin by market volume. Martinez noted that he had a long order 20% below the current level and anticipated nearly fourfold gains from this point.

Shiba Inu seems to be forming a bull flag on the daily chart! I am placing buy orders around $0.000018343, targeting a bullish breakout that could raise SHIB to $0.000072323.

At the time of writing, the SHIB price continued to rise. After a 3% increase in the last 24 hours, the price had risen to $0.00002377. During this period, SHIB’s market cap also rose to $14 billion. The 24-hour trading volume had decreased by 30% to $671 million.

Türkçe

Türkçe Español

Español