Litecoin (LTC) witnessed a price drop last week that caused fear among investors. Although it may not seem compatible with the advantages of investors in the past week, the coming days may look different. LTC seemed to be moving away from a tested upward momentum over time.

Price Movements in LTC

According to CoinMarketCap, the price of Litecoin has dropped more than 6.4% in the past seven days. At first glance, this may seem concerning to many, but the underlying reality was a bit different.

Crypto analyst Shan Belew recently tweeted, highlighting the fact that Litecoin is on the verge of breaking out of a six-year rising triangle.

If all the advantages align in favor of the cryptocurrency in the coming days, the price of LTC could reach new highs after the formation’s breakout. Considering how close Litecoin is to breaking above the trend line near $85, should investors expect an uptrend in LTC in December 2023?

When the daily chart of the popular cryptocurrency turns bullish, it may be likely for LTC to rise above the mentioned level. The token’s value has increased by more than 2% in the last 24 hours. As of writing, LTC is trading at $68.98 with a market cap of over $5 billion.

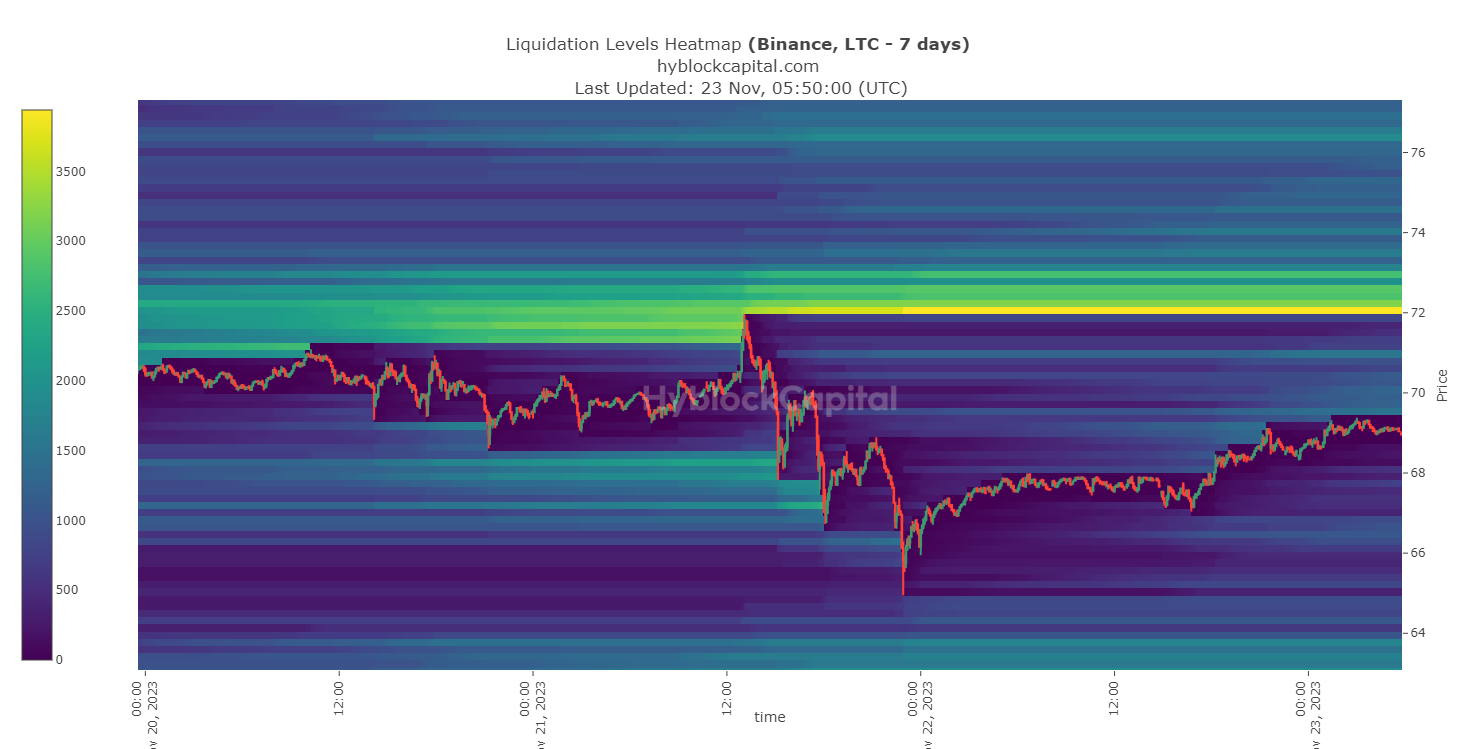

The analyst later checked the liquidation levels of LTC and found that the token needs to surpass an important resistance level before breaking above $85.

The liquidation of Litecoin recently increased by a significant margin near the $71 level, causing a price correction. Therefore, for the bull run to start, the token may need to successfully cross above this level first.

Technical Indicators in Litecoin!

However, in the short term, the situation seems to indicate a rise for the cryptocurrency. An expert examined LTC’s daily chart to find out what might be more beneficial for altcoins. The price of LTC recovered from the lower limit of the Bollinger Bands. Both the Relative Strength Index (RSI) and the Money Flow Index (MFI) recorded an uptrend, increasing the chances of price appreciation. However, the MACD indicated a clear advantage for the bearish trend in the market.

Some measurements also entered a downtrend. Despite the recent price increase, the volume of LTC decreased, indicating a decrease in investor interest in cryptocurrency transactions. The one-week price volatility also decreased, which could minimize the likelihood of a continued uptrend. Another concerning measurement could be LTC’s sharp decline in the MVRV ratio last week.