At the end of 2023, markets expecting a 150bp rate cut were shocked by first-quarter inflation data. Fed’s estimated rate cut was 75bp, but a worse figure was announced. Fed members revised their 3-year rate forecasts upward, indicating no cuts this year. What does JPMorgan think about this?

JPMorgan Interest Rate Analysis

JPMorgan, the largest bank in the US, is closely watched for its market predictions. Interest rate cuts are crucial for cryptocurrency investors, and if the Fed starts cutting rates soon, monetary expansion will benefit all risk markets, including crypto.

However, speaking at an event in Washington, JPMorgan Chase & Co. President Daniel Pinto said the Fed might not cut rates this year due to ongoing inflation. Pinto also mentioned that we might see a decline in inflation soon, emphasizing that there might not be a new rate hike.

According to him, the Fed is in no rush, and an early rate cut could have “painful” consequences. The highlighted risk here was a recession. Pinto’s latest statements confirmed the comments of JPMorgan CEO Jamie Dimon. Dimon had stated in a letter to shareholders this month that sticky inflationary pressures could challenge the market more than expected.

This week, New York Fed President John Williams said rate hikes are still on the table, pushing up two-year Treasury yields. Pinto also mentioned the acquisition of the failed First Republic Bank, calling it a positive move for JPMorgan but clarified that they would not acquire more small banks.

Will Rates Decrease?

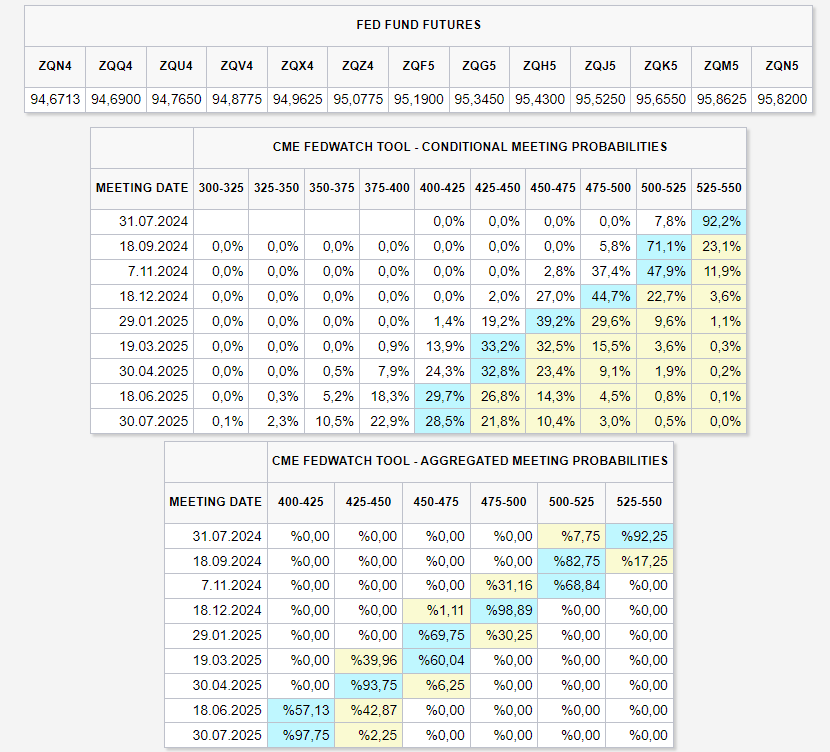

After Friday’s employment and wage growth data, expectations for two rate cuts this year strengthened. Additionally, Non-Farm Payroll data for the past few months were revised downward. Considering the high figures triggered sales in crypto, these revisions have started to become discouraging.

On the other hand, with data revisions favoring risk markets, we saw confirmation of the employment easing the Fed wanted. The Fed might find the courage to ease at this point.

Türkçe

Türkçe Español

Español