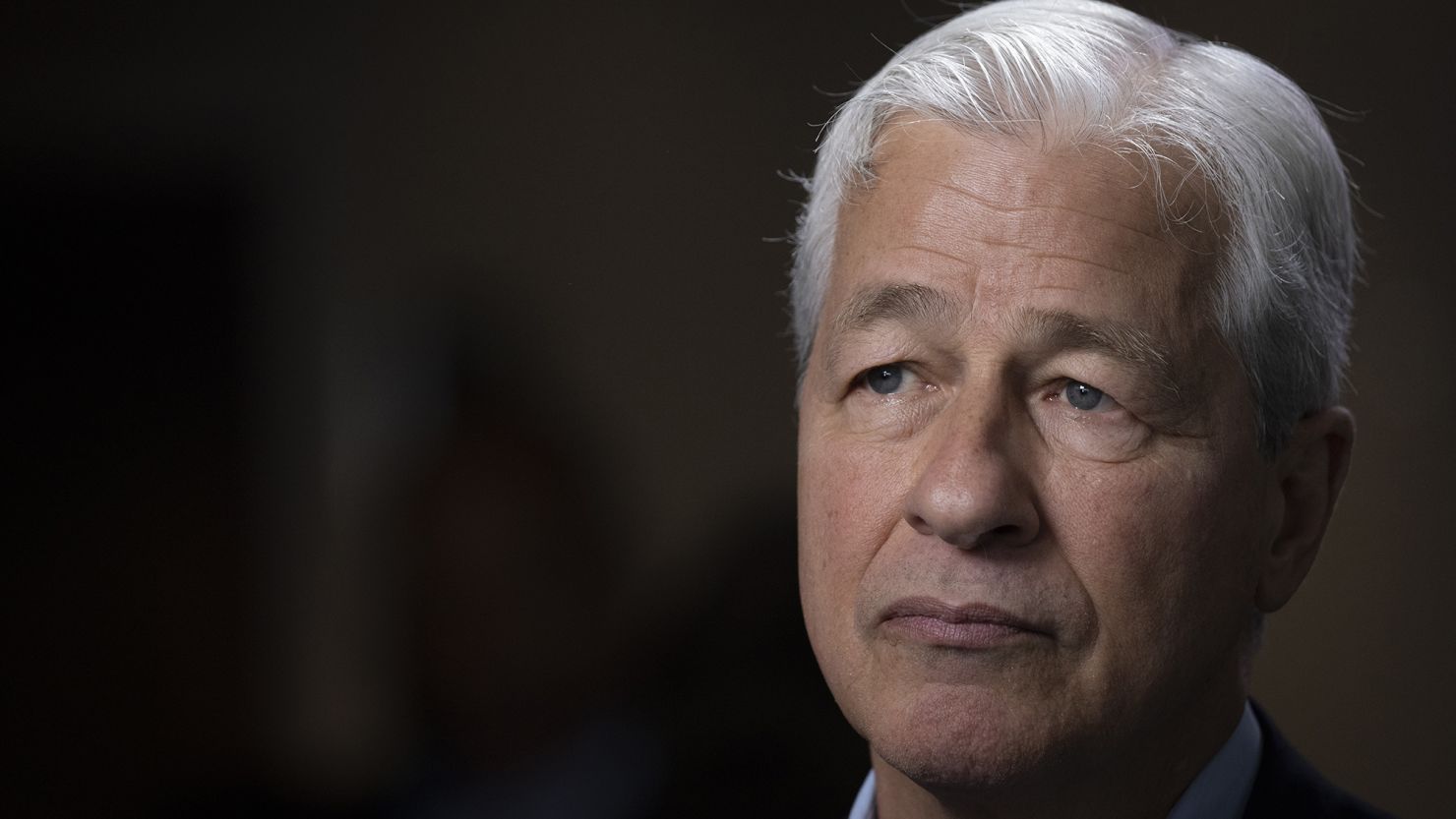

JPMorgan Chase’s CEO Jamie Dimon, who has become more widely known for his comments on Bitcoin and cryptocurrencies, indicated that the United States economy could be on the verge of significant chaos.

CEO’s Warning on the American Economy

According to Jamie Dimon’s view, the US economy may not be able to emerge solidly from the current debt quagmire in the country. It would be useful to note that the US’s national debt has surpassed its all-time high (ATH), exceeding 34.1 trillion dollars.

Speaking at a private panel, Jamie Dimon pointed out that the US economy has an interest rate of around 21.5% and an inflation rate of 12%. He also drew attention to the past, sharing what has changed in the economy since 1982.

Looking back at the period he mentioned, the unemployment rate in the US was 10% at the same time, and the National Debt was around 35% of the Gross Domestic Product (GDP).

Continuing his remarks from the mentioned period to the present day, Jamie Dimon noted that there has been a significant change in the debt-to-GDP ratio, which is now over 100% and is expected to rise to 130% by 2035.

The famous CEO used the following words to explain the situation:

When this starts, markets around the world – by the way, because foreigners own 7 trillion dollars of US government debt – there will be a rebellion, and this is the worst possible way.

On the other hand, the CEO also spoke about the impact of COVID-19 on the US economy, stating that the country’s economy has still not recovered from it. During this period, the Federal Reserve significantly increased interest rates but has slowed down in recent months and signaled a decrease.

According to the CEO, if no drastic intervention is applied, the US economy could be dragged towards the edge of a cliff over the next decade.

The Future of Bitcoin

Jamie Dimon has been a prominent critic of Bitcoin from the past to the present. The CEO, who made harsh statements before the approval of Bitcoin ETFs last month, had harsh words for Bitcoin.

Emphasizing that cryptocurrencies are useless, Jamie Dimon went as far as to talk about bans, despite the confidence in BTC by significant figures like BlackRock CEO Larry Fink, without changing his mind.

On the other hand, there are people who believe that a potential collapse in the US economy could positively affect BTC. Famous figures like Michael Saylor, Robert Kiyosaki believe that Bitcoin is vital to protect against the effects that the US economy, thought to be on the brink of collapse, could create.

While all this is happening, the long-awaited spot Bitcoin ETF in the US was approved. In this context, regulatory barriers to institutional investors investing in cryptocurrency have been removed.

Türkçe

Türkçe Español

Español