As cryptocurrency investors push BTC prices to higher levels in anticipation of ETF approval, JPMorgan has shared a new perspective. At the time of writing, US markets opened negatively due to the impact of the macro environment. However, BTC continues to hold at $34,200. Let’s take a look at what JPMorgan has to say.

Spot Bitcoin ETF and SEC

According to JPMorgan, if the United States Securities and Exchange Commission (SEC) does not approve spot Bitcoin ETFs, potential issuers could file lawsuits. Analysts at JPMorgan, led by Nikolaos Panigirtzoglou, are drawing attention to the increased risk of legal issues. They are not wrong, especially considering the strong option for issuers after the GBTC victory. Moreover, it will be challenging for the SEC to compete with BlackRock.

“Any rejection could trigger lawsuits against the SEC, creating more legal issues for the institution. We believe that SEC does not want to face another legal battle regarding the approval of Spot Bitcoin ETFs.”

Last month, the SEC lost the lawsuit filed by Grayscale Investments. The SEC did not appeal, and the decision was formalized earlier this week. This made it mandatory to reconsider the conversion of the trust into an ETF application.

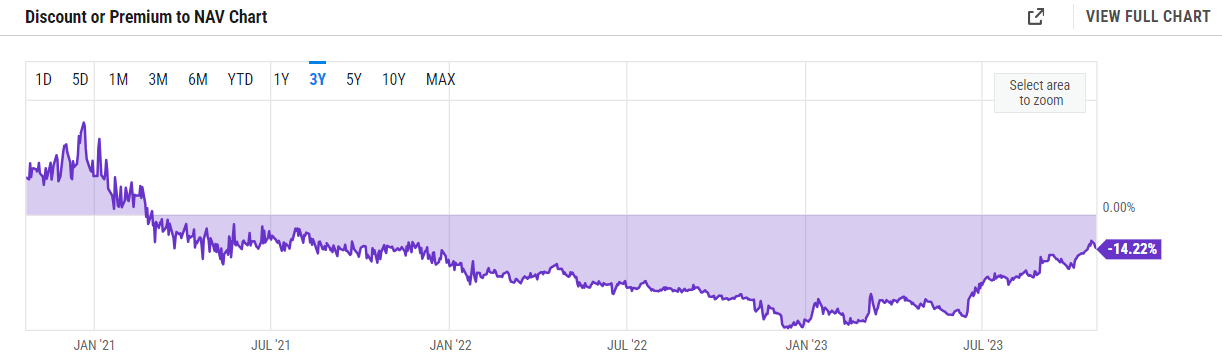

GBTC’s negative premium is approaching 0, reflecting expectations for ETF approval.

Crypto Bull Begins

Last week, JPMorgan stated that multiple ETFs could be approved within months. Today, it is said that potential issuer companies are returning to the SEC with technical preparations and modified files to clarify issues such as market manipulation and commingling of customer funds. In summary, the approval process for ETFs is progressing.

The recent surge in the cryptocurrency markets was driven by institutional demand. JPMorgan analysts agree with this view and say the following:

“Our futures position indicator based on CME Bitcoin futures, which tends to be used by institutional investors, not only reached the highest level of this year last week but also climbed to levels last seen in August 2022 before the FTX crash. In contrast, the equivalent futures position proxy for CME Ethereum futures continues to remain stagnant.”

For such a revival in institutional demand, more than just rumors are needed. The ongoing rally suggests that there is more than just rumors and that we may be entering the first phase of a crypto bull market.

Türkçe

Türkçe Español

Español