Cryptocurrency world, as always, is full of rapidly changing dynamics. Recent developments have particularly raised concerns about Ethereum’s future. The main actor in these events, which suddenly disrupted the calm course of the markets, is Jump Trading.

Jump Trading Continues Ethereum Sales

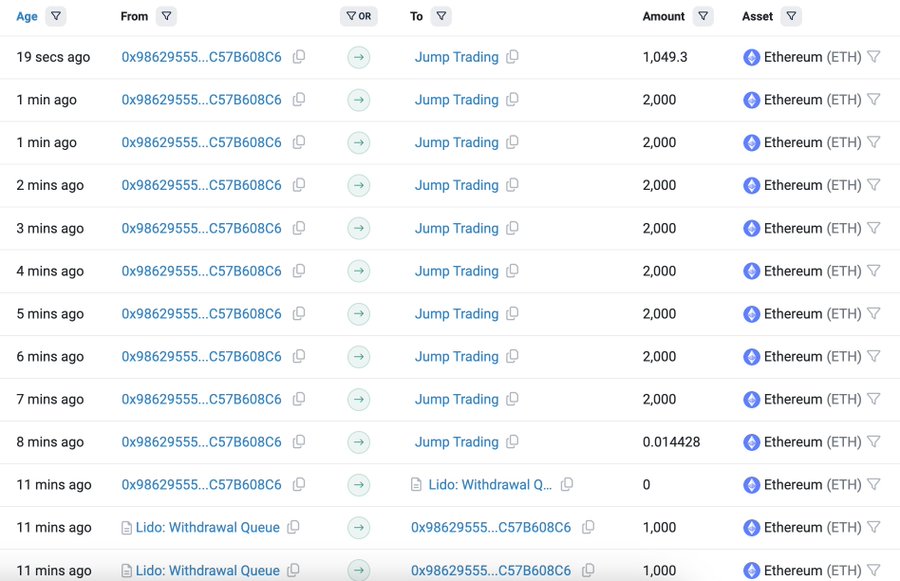

One of the leading players in the crypto market, Jump Trading, has started selling its Ethereum holdings. These sales came immediately after they requested 17,049 ETH from Lido. This amount is worth approximately 46.44 million dollars. This sales move brings to mind the events that caused a drop of over 20% in Ethereum’s price last week.

Lookonchain, which monitors on-chain data, reported today that Jump Trading is selling ETH again. The firm transferred the ETH requested from the liquid staking protocol Lido to a wallet named “0xf58”. This wallet is known to be used specifically for selling to crypto exchanges. It is also noted that Jump Trading currently holds 21,394 wstETH worth 68.58 million dollars.

Is a New Wave of ETH Price Drop Coming?

Last week, Jump Trading’s liquidation of 300 million dollars worth of ETH led to a drop of over 20% in Ethereum’s price. Now, with the firm selling larger amounts of ETH, there are growing concerns that a similar situation might recur. As of now, ETH is trading at 2,725 dollars.

ETH, which has lost over 3% in value in the last 24 hours, recorded its lowest and highest prices in the past 24 hours as 2,613 dollars and 2,750 dollars, respectively. Additionally, the trading volume in the last 24 hours has decreased by 28%. This situation indicates a decline in investor interest.

The movement in Ethereum in the crypto derivatives market is also noteworthy. According to Coinglass data, the total open interest in ETH futures has dropped by over 1% on some exchanges in the last 4 hours. These data create uncertainty about how the market will react to this wave of sales.

Jump Trading’s Future Remains Uncertain

The resignation of Jump Trading’s president Kanav Kariya and the investigation initiated by the CFTC in June have increased the pressure on the firm. Following these developments, the firm’s continued aggressive sales could create new volatility in the cryptocurrency market.

Currently, Jump Trading holds approximately 148 million dollars worth of Ethereum. Some of these assets are 24,993 ETH in the “0xf58” wallet, while the other part is 29,093 stETH staked in Lido Finance.