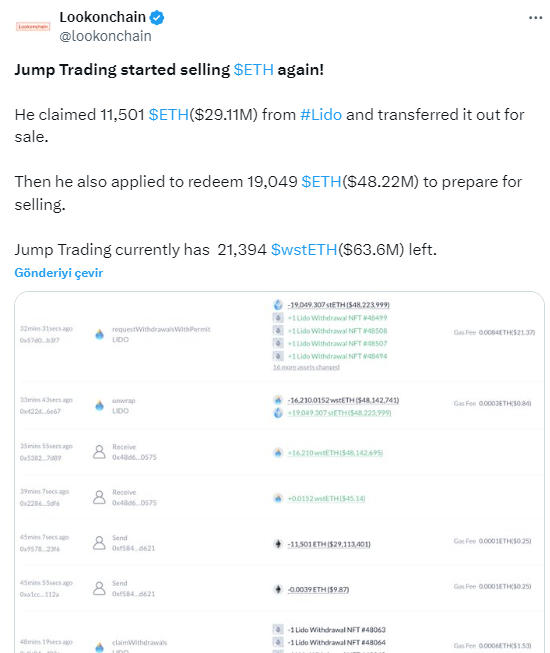

There is a noticeable movement in the cryptocurrency market. Jump Trading has decided to sell Ethereum again. In the past few days, they have withdrawn 11,501 ETH from the Lido platform, preparing these assets for sale. This transaction represents a total value of $29.11 million. Additionally, they have filed for another 19,049 ETH, preparing for a sale worth approximately $48.22 million.

Assets Withdrawn from Lido

The large amount of Ethereum withdrawn from the Lido platform has the potential to create significant market fluctuations. Jump Trading has once again demonstrated its importance in the cryptocurrency markets with this move. The sale of these withdrawn assets could affect the supply-demand balance in the market and cause price fluctuations.

Jump Trading also holds 21,394 wstETH (worth $63.6 million). These assets are being considered as preparation for potential future sales. This situation will carry both an opportunity and a risk factor for investors. Because one of the reasons for the previous crash was the sales made by Jump Trading.

Potential Deep Impact on Markets

The sale of this large amount of Ethereum could lead to fluctuations in the cryptocurrency markets. Investors are closely monitoring how such large sales will affect prices. Jump Trading’s move could emerge as one of the important factors determining the course of the markets.

Looking at the Ethereum price after the move, we see that ETH is trading at $2,526. It should be noted that the Ethereum price has remained unresponsive to this move. However, we cannot predict what the upcoming hours will bring. Because, due to an effective drop on Monday, the market has now shifted to a dip-buying strategy.

With the dip-buying strategy, it is likely that the sales to be made by Jump Trading will be absorbed by the cryptocurrency market. Such absorption will prevent the ETH price from falling and may even contribute to its increase.

Türkçe

Türkçe Español

Español