Jupiter’s (JUP) price experienced a 13% increase to $0.59 on February 7, following a general market uptrend. However, the price slightly retreated and is trading around $0.54 at the time of writing. This price level is notable as it marks the first time JUP reached $0.59 since its market debut three days prior, on February 3.

Why Is Jupiter Rising?

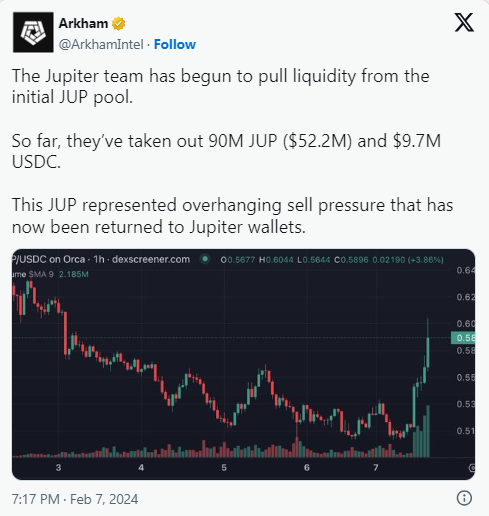

In addition to the general market conditions, an important factor contributing to Jupiter’s price increase was highlighted by Arkham Intelligence in a recent post. According to Arkham, the Jupiter exchange team had begun withdrawing existing liquidity from the first JUP pool. At the time of the post, the team had withdrawn 90 million JUP from the pool.

To clarify, a liquidity pool is a collection of cryptocurrency locked in a smart contract. This facilitates the acceleration of orders and transactions on Decentralized Exchanges (DEX).

Regarding the price movement, removing liquidity from the pool helps reduce sell pressure on the cryptocurrency, which in turn satisfies investors, and the situation with JUP was no different.

Furthermore, it was identified that Solana’s (SOL) incredible surge was another factor triggering the rise in JUP’s price. SOL had been trading below $100 for a while after its significant rise. However, as JUP’s price was increasing, SOL also climbed above $102.

It is important to remember that the Jupiter exchange is built on the Solana blockchain, and thus, they share a correlation.

Was Jupiter’s Rise Temporary?

After an airdrop, addresses that received JUP started selling, leading to a price drop in JUP, which was followed by a 6% decrease in SOL.

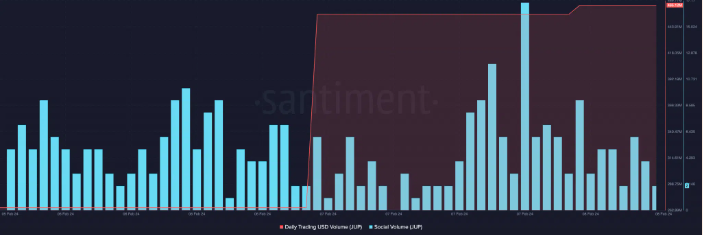

As of February 7, Jupiter’s (JUP) trading volume was at $265.95 million. However, the situation changed rapidly, and within a few hours, the volume surged to $465.12 million, indicating a high volume of trading activity for JUP.

When analyzing social volume, on-chain data reflected an increase in metrics during the price rise. At the time JUP reached $0.59, social volume also saw a significant increase to 16.95.

A closer look at the graph revealed that after the initial surge, social volume decreased. This suggests that market participants shifted their interest from JUP to other cryptocurrencies, which could be considered a buying opportunity for long-term participants.

Türkçe

Türkçe Español

Español