These days, Tether and Huobi are hot topics that continue to fuel investors’ risk appetite. Worried about a new FTX case, investors have legitimate concerns due to Justin Sun’s past mistakes. Meanwhile, there has been imbalance in stablecoin liquidity pools since mid-July.

Justin Sun and USDT: Why Did They Drop?

The two are interconnected. Today, Huobi made a statement assuring the safety of customer assets on the exchange. However, no satisfactory evidence was provided to address the allegations raised by Adam Cochran over the weekend.

The summary of the statement was as follows:

- Trust Huobi.

- Justin Sun’s personal wealth is above customer assets.

- Customer assets are secure.

However, Adam Cochran claimed that customer assets were being used by Sun (similar to what SBF, the founder of FTX, did), yet the assets were not fully backed 1:1 even with Sun’s holdings. Given the recent FTX collapse, it seems logical to reiterate the warning I issued days before. Reducing your risk on the Huobi exchange may be beneficial to avoid potential bankruptcy.

USDT Imbalance

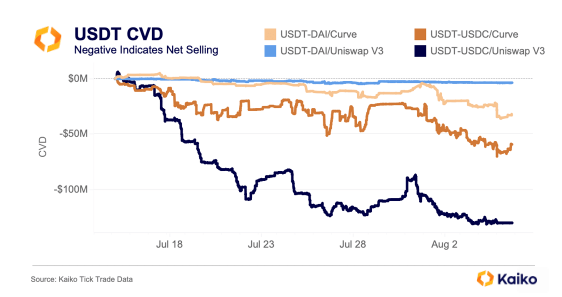

The issue of USDT shortage and stUSDT is highly controversial on Sun’s exchange. Meanwhile, last week, there was significant imbalance in the stablecoin liquidity pool due to CZ targeting the largest stablecoin. As USDT sales increased, Curve’s 3pool and Uniswap V3’s main USDT-USDC pool became imbalanced towards the end of the weekend. Uniswap experienced approximately $40 million in sales, while Curve had $35 million in sales. The Curve pool became highly imbalanced, holding 60% USDT.

However, this trend actually began in mid-July, and there was a net sale of $100 million on Uniswap from July 15th to July 22nd. While net sales decreased in the last few weeks of July, they increased again on July 31st, the day after the Curve exploit (these two events seem unrelated).

Tether’s CTO suggested that the sales could be a dirty play and coincided with Binance listing the new stablecoin FDUSD, issued by Hong Kong-based First Digital on July 26th. However, there is no evidence to suggest a connection between these two events.

After being listed on Binance, FDUSD struggled to gain momentum in terms of trading volume, even after the addition of several zero-fee trading pairs. Daily volumes exceeded $200 million before dropping to around $30 million.