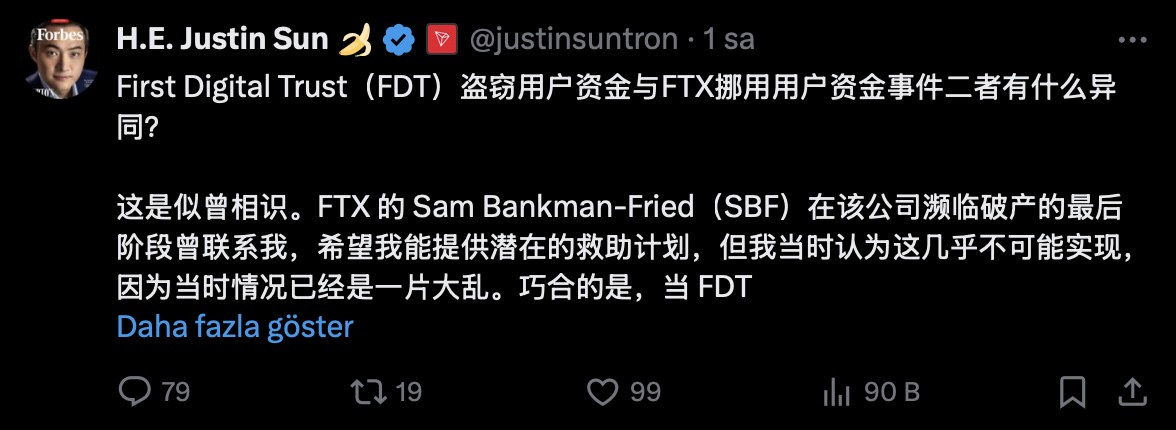

A new scandal has ignited in the world of cryptocurrencies. Justin Sun, the founder of TRON, has claimed that First Digital Trust (FDT), the issuer of First Digital USD (FDUSD), has unlawfully taken user funds, describing the situation as even more severe than the FTX collapse. According to Sun, FDT has appropriated investors’ assets without any transparency, posing a significant threat to Hong Kong’s financial reputation. Having been involved in both the FTX and FDT situations, Sun closely compared these two scandals. He highlighted that he was contacted during FTX’s crisis for rescue plans, and claimed a similar situation is occurring with FDT, where he has taken on the role of a “white knight” for TUSD as a consultant.

FTX’s Collapse and the Scale of the FDT Scandal

Sun believes that both incidents are severely damaging to user trust; however, FDT has outdone FTX with its unethical practices. At FTX, user funds were used without authorization, but these funds were masked as collateral by Alameda Research within the company. Despite users’ lack of consent, a portion of the funds was secured with assets like FTX Token (FTT), Serum (SRM), and Maps (MAPS).

Sun asserts that the circumstances at FDT are much darker than those at FTX. He claims that funds were taken directly without any collateralization process or even the knowledge of users. He emphasized that this is not mere negligence, but rather a premeditated and organized theft, condemning FDT’s manager, Vincent Chok, for maintaining silence despite the scandal’s emergence.

Furthermore, Sun pointed out that during the FTX scandal, most funds were utilized for investments in valuable companies like Robinhood and Anthropic, while at FDT, the funds were redirected to private firms for personal gain. This indicates that the FDT incident is not only a case of mismanagement but also direct corruption.

Sun: “Hong Kong’s Financial Reputation is at Risk”

Sun stressed that the FDT scandal threatens not only the users but also Hong Kong’s reputation as a global financial center. He recalled how U.S. regulatory bodies acted swiftly during the FTX incident, managing to control the damage to some extent, urging Hong Kong authorities to respond similarly.

Indeed, at the end of 2022, legal proceedings were quickly initiated in the U.S. for the FTX case, with arrests made and significant steps taken for the reimbursement of user funds. Sun warned that if similar legal actions are not undertaken in Hong Kong, users’ losses will increase, and the region’s international financial credibility will sustain serious damage.

In his call to action, Sun urged, “Hong Kong regulators must act immediately and take action against those responsible. Otherwise, such corruption will become uncontrollable, and investor trust may be irreparably shaken.”

Türkçe

Türkçe Español

Español