Experienced cryptocurrency analyst and trader Kevin Svenson expressed his expectation that Bitcoin‘s (BTC) rise will continue following the double-digit increase in the last 7 days. The analyst expects the largest cryptocurrency to make a significant recovery.

Prediction of $90,000 for Bitcoin

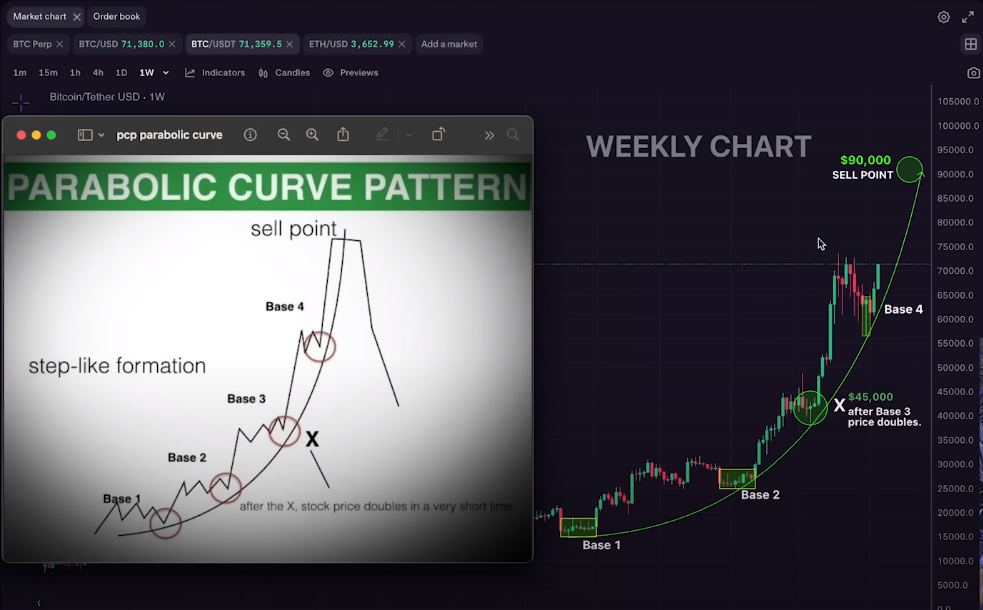

Sharing his latest observations with his YouTube subscribers, Svenson highlighted the parabolic rise trend of Bitcoin starting in the fourth quarter of 2023, suggesting that the crypto king could rise to around $90,000.

Svenson added that reaching the $90,000 level does not mean the end of Bitcoin’s current cycle. Instead, he said Bitcoin’s price would enter a cooling period and go through a correction phase where it would move sideways. According to him, consolidation, in other words, the re-accumulation phase, acts as healthy market behavior allowing new investors to enter the market and the price to find balance before the next rise.

The cryptocurrency analyst is optimistic that this consolidation period will pave the way for Bitcoin to reach six-figure levels.

Warning for $90,000 Prediction

Despite his bullish expectation, Svenson also warned that BTC might not reach $90,000, acknowledging the possibility. He said the price could drop slightly and break the parabolic trend, potentially resulting in a prolonged sideways movement before the rise resumes. This scenario reveals the inherent unpredictability of the market and the possibility of multiple outcomes.

At the time of writing, Bitcoin is trading at approximately $69,500 and has faced a 12% increase in the last seven days. While Svenson’s analysis indicates a significant bullish expectation, the market dynamics suggest that different outcomes, including shorter or longer consolidation phases, are possible.

The most important takeaway from Svenson’s scenarios is the importance of viewing the largest cryptocurrency‘s price movements in the context of broader market cycles. The expected correction and consolidation phase is part of a healthy growth process and could ultimately propel Bitcoin to new highs.