Altcoin unlocking events can have significant consequences on their prices. We have seen many examples confirming this. Unlocking events worth hundreds of millions of dollars could lead to significant losses for some altcoins in April. So, which altcoin will have how much worth of unlocking, and when will it happen in April?

Altcoin Unlocking Events

Cryptocurrencies enter the market with two different supply definitions: maximum and circulating supply. When an altcoin starts trading on exchanges, it can release 1% of its 1 billion supply into circulation, which can lead to massive price increases.

This situation is facilitated by investors ignoring the locked 99% supply and turning artificial scarcity into a rally due to massive interest. Over time, as the circulating supply approaches the maximum supply, the amplitude of price fluctuations decreases. Many altcoins that entered the market with a low supply have all-time high prices that are very unlikely to be reached again.

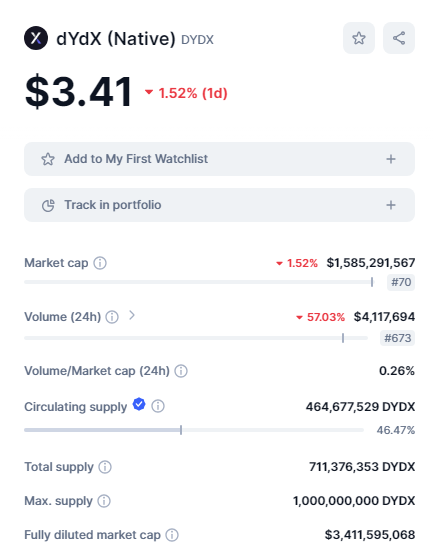

For example, DYDX released only a small portion of its supply during the last bull market and saw prices over $20. But the supply has now exceeded 460 million. Therefore, to surpass $20 again, it would need to reach a market value of $9.2 billion. Considering its current market value is $1.58 billion, this is not so easy.

April Unlocking Schedule

For these reasons, it is important to examine the token economy of the relevant cryptocurrency when determining long-term investment strategies. If you make long-term purchases because of hype, your losses may increase as the supply balances. Of course, projects that can significantly increase the utility of their tokens and create demand above inflation can offer their investors the opposite scenario.

The details of the unlocking events scheduled for April are as follows;

The most notable among these are DYDX, STRK, AXS, and PIXEL. These altcoins, which will unlock a significant amount compared to their circulating supply, may face sales from investors expecting a downturn. The postponement of DYDX’s unlocking event had disappointed many investors waiting to short-sell in futures markets. If we see such an unlocking schedule update (for any of them), prices could move in the opposite direction of expectations.

Türkçe

Türkçe Español

Español