Bitcoin (BTC) is experiencing a downturn as bears push the price below the critical $60,000 threshold, increasing anxiety among investors. Falling below this level could have negative consequences not only for Bitcoin but also for the broader altcoin market, especially Ethereum (ETH).

Bitcoin Faces Critical Levels

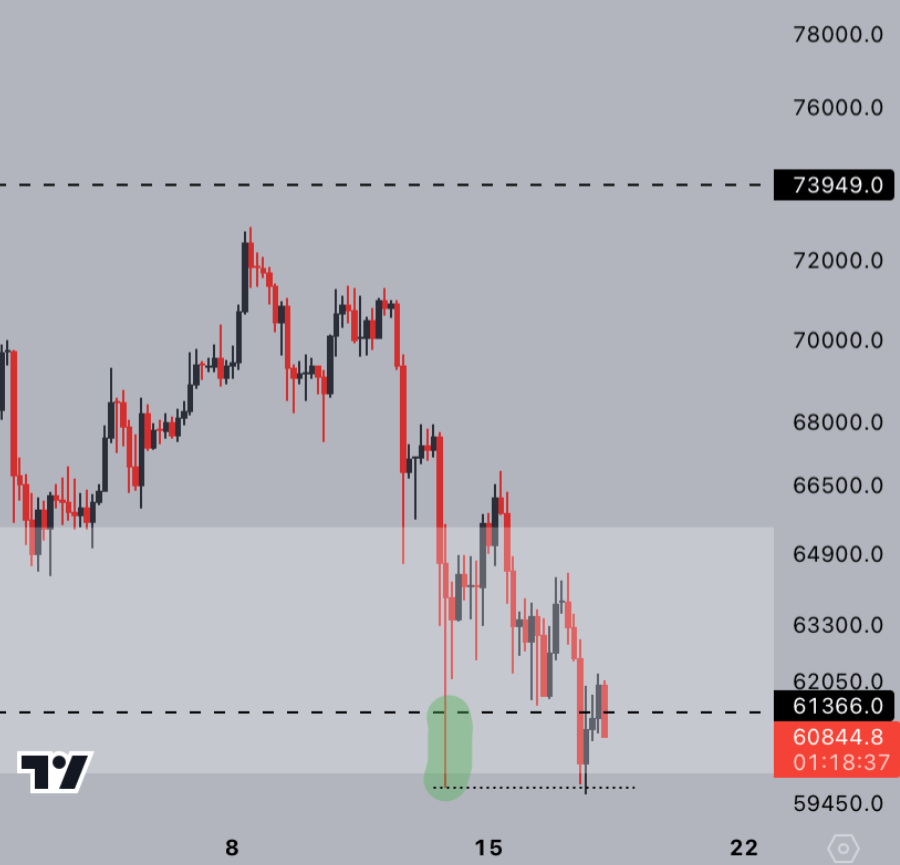

Cryptocurrency expert CryptoJelleNL pointed out today on his personal X account that the latest chart pattern indicates an ongoing battle between bulls and bears. The analyst noted that Bitcoin recently retested the bottom of its current range, highlighting the continuing dominance struggle.

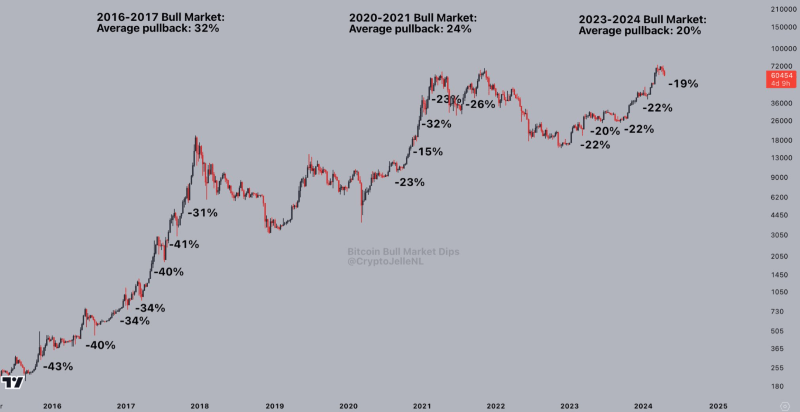

In the face of current market volatility, analysts like CryptoJelleNL stress the importance of patience. Amidst market dynamics, the analyst advised a cautious approach, suggesting waiting without taking profits until Bitcoin surpasses $70,000. Despite the grim outlook, the analyst remained optimistic, referencing the proverb that the darkest period is often just before dawn in a bull market.

Famous cryptocurrency analyst Michael van de Poppe echoed this cautious optimism, stating that Bitcoin is currently playing a wait-and-see game as momentum decreases. He expects continued pullbacks and consolidation in the short term, while also noting that periods of capitulation often precede reversals.

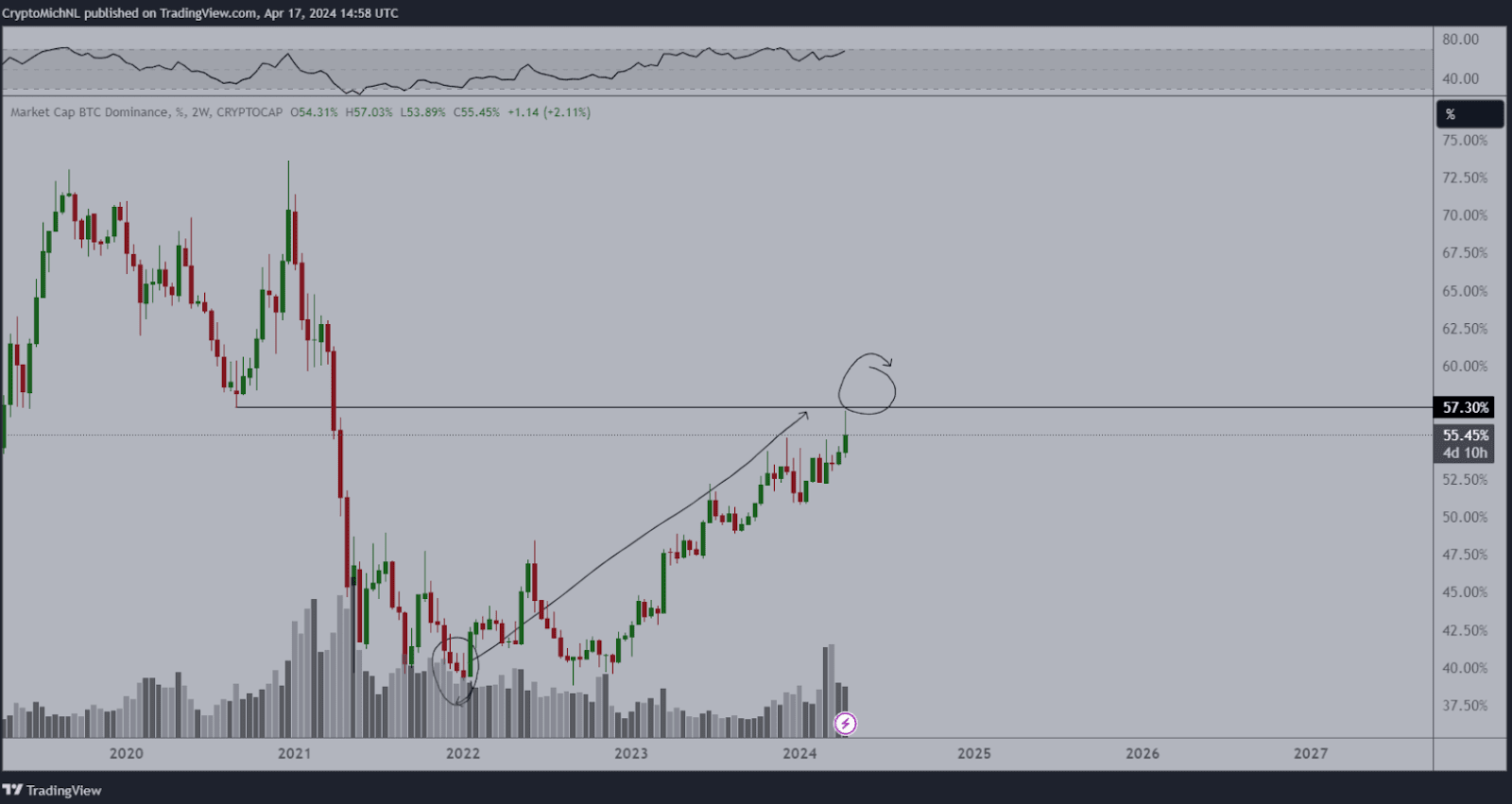

Van de Poppe suggested that Bitcoin’s market dominance might have peaked after consolidation and could potentially signal a downtrend, as supported by chart analysis.

Meanwhile, closely followed cryptocurrency analyst Ali Martinez highlighted that Bitcoin has entered a consolidation phase within a well-known trading channel, with $61,000 acting as a critical support level. Martinez noted that breaking this support could lead to a drop to $56,200, while maintaining it could see a rise to $66,500.

Eyes on Bitcoin’s Fourth Block Reward Halving

Despite differing opinions among analysts, the crypto world is focused on the expected Bitcoin’s fourth block reward halving on either April 19 or April 20. Historically, halvings have been a significant price influencer by reducing new supply by 50%, potentially leading to upward movements if demand remains stable or increases, with market observers anticipating this trend to continue post-halving.

Türkçe

Türkçe Español

Español