Cryptocurrency units Bitcoin (BTC) lost their short-term gains leading up to the halving event. After the completion of the halving event, the markets did not respond positively, and analysts attribute this to a post-halving pullback. Despite a predominantly red market, we have identified three cryptocurrencies worth watching next week in this context and prevailing market sentiment.

Cryptocurrency Bitcoin (BTC)

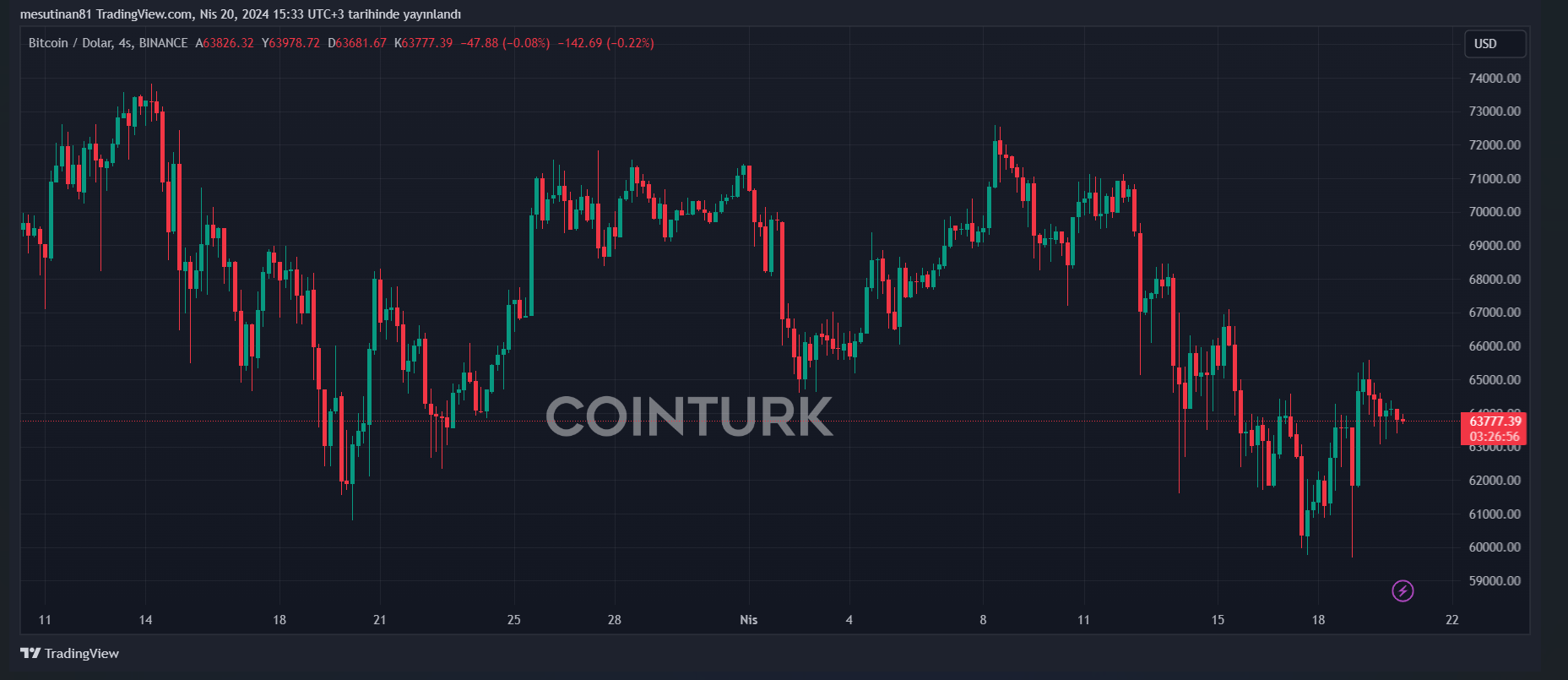

One of the main reasons for the interest in Bitcoin is the recent halving event and how the price will develop. Since the event, Bitcoin has undergone a correction and fell below the $65,000 level. The initial optimism revolved around Bitcoin’s potential to gain above $65,000. However, the correction following the halving reduced these expectations and raised questions about the cryptocurrency’s short-term outlook.

It is important to note that Bitcoin initially fell below the $70,000 region following increased geopolitical tensions. Indeed, investors will be interested in how Bitcoin prices adapt to the tensions developing in the Middle East next week.

Most importantly, Bitcoin’s ability to sustain gains above the $60,000 support zone. Analysts emphasize the importance of this price level, suggesting that falling below $60,000 could create problems for the cryptocurrency and potentially indicate further declines. Bitcoin was trading at $63,777.

Solana (SOL) Maintains Resilience But Network Issues Persist

Solana (SOL), a significant player among decentralized finance (DeFi) projects, is closely monitored especially for its Blockchain activities. Despite significant price increases in recent months, general market sell-offs have pushed SOL below $130.

SOL has shown resistance against market turbulence, regaining the $141 level. Despite this resistance, various issues continue in the Solana network. Despite the latest major network update, high transaction failure rates still persist, resulting in 71% of transactions failing as of April 19.

The latest v1.18.11 update to the devnet initially failed but was successfully restarted on a second attempt. This effort aims to alleviate network congestion and address technical challenges, indicating ongoing efforts. As of this writing, SOL was trading at $141, having corrected over 7% in the last seven days.

Celestia (TIA) Maintains Positive Trajectory With Modular Network

Celestia (TIA) cryptocurrency, representing a modular network, facilitates the direct deployment of individual Blockchains with minimal additional burden. TIA has shown notable performance in the current market rally, maintaining a positive trajectory amidst general downtrends.

TIA’s upward momentum began in late 2023 with the launch of Celestia’s mainnet beta, marking the beginning of the modular Blockchain era. Another factor influencing the value increase could be related to its listing on Binance.

As we enter the new week, it remains to be seen whether TIA can maintain its resistance and trajectory in the green zone. At the time of writing, the token was trading at $11.56, achieving nearly a 3% gain on a daily basis and over 15% increase in the last seven days.

Türkçe

Türkçe Español

Español