As with every Sunday, today we address significant developments that directly concern cryptocurrency investors. Investors should always be on the lookout for important developments that could trigger volatility and prepare in advance. Often, the signs of volatility are apparent days beforehand, and all you need to do is briefly check what will happen this week. COINTURK makes this easier for you. Here is the list of expected developments.

Crypto Key Developments

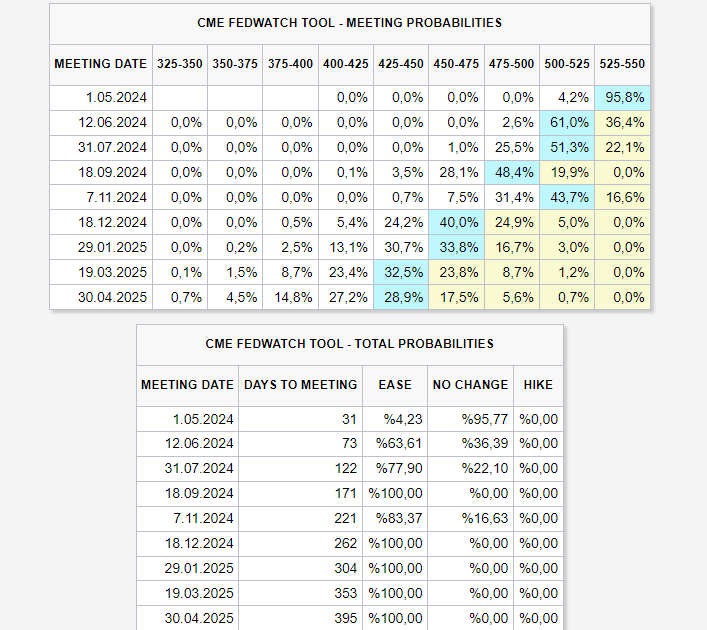

Following the Fed meeting, risk markets have started to feel a bit more pressure as the data isn’t coming in as great. The SEC should now start cutting interest rates, with the first quarter already at its end. For the Fed to start cutting rates, US data must favor risk markets.

So, what significant developments will occur over the next 7 days in the crypto world or on the macroeconomic front?

April 1, Monday

- 16:45 US Manufacturing PMI (Expectation: 52.8 Previous: 52.2)

- XVS Announcement

- DYDX Unlocking ($113.33 Million)

- ZETA ($11.17 Million)

- ACA ($5.07 Million)

- Coinbase‘s application to the CFTC for LTC, DOGE, and BCH will be concluded

April 2, Tuesday

- 01:50 Fed/Cook

- 17:00 US JOLTS (Expectation: 8.790M Previous: 8.863M)

- 17:10 Fed/Bowman

- 19:05 Fed/Mester

- 20:30 Fed/Daly

- Aptos DeFi Days Event

April 3, Wednesday

- 12:00 EU CPI (Expectation: 2.5% Previous: 2.6%)

- 15:15 US ADP Nonfarm Employment Change (Expectation: 149K Previous: 140K)

- 16:45 Fed/Bowman

- 16:45-17:00 US Services and ISM PMI Data

- 19:00 Powell will speak

- 20:10 Fed/Barr

- SUI ($65.77 Million)

April 4, Thursday

- 14:30 ECB Minutes

- 15:30 US Unemployment Claims (Expectation: 214K Previous: 210K)

- 21:00 Fed/Mester

- Bitcoin Cash (BCH) Halving

April 5, Friday

- 15:30 US Average Hourly Earnings (Expectation: 0.3% Previous: 0.1%)

- 15:30 US Nonfarm Employment (Expectation: 205K Previous: 275K)

- 15:30 US Unemployment Rate (Previous/Expectation: 3.9%)

- 16:15 Fed/Barkin will speak

- 19:15 Fed/Bowman

- GAL Unlocking ($14.6 Million)

April 6, Saturday

- Hong Kong Web3 Event

What Investors Can Expect

Current employment data will be released on Friday. The Fed said that any acceleration in interest rate cuts could be possible with a relaxation in employment. However, a significant pullback in employment is not expected. For cryptocurrencies to rise, hourly earnings data should come in low, and unemployment should increase.

Many cryptocurrencies will undergo unlocking, but the most significant event for altcoins will be the BCH halving. Coinbase has applied for derivative products for 3 altcoins; if the CFTC is going to object, it should do so by Monday. Investors have bought into the expectation, so there could be profit-taking in BCH, LTC, and DOGE tomorrow.

Türkçe

Türkçe Español

Español