As with every Sunday, today we are examining the important developments that will occur over the next 7 days. Looking back, we saw how these significant developments, macroeconomic data, and key events had serious consequences on prices. So, what kind of developments are we expecting to see in the coming days that are anticipated to affect prices?

Cryptocurrencies and Significant Developments

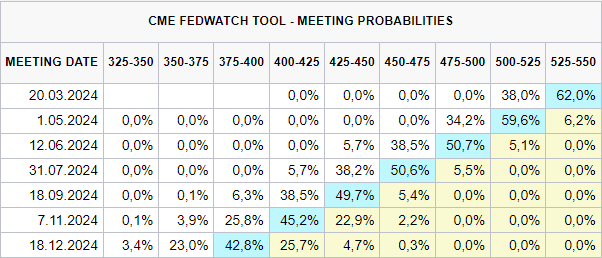

Powell left his mark on the week we are about to leave behind. Shattering the dreams of the overly optimistic, the Fed Chairman said that if employment data came back positive, they would start to consider rate cuts. Days later, employment and wage increase data arrived that was so strong that expectations for a rate cut in March fell to 17%. If we remember that this expectation was over 80% a few weeks ago, we can better understand the market negativity of the last 3-4 weeks.

Monday, February 5

- 03:00 Powell Will Speak

- 10:00 Turkey Inflation Data (Expectation: 64.5%, Previous: 64.77%)

- 22:00 Fed/Bostic

- GAL Unlocking Event ($9.47 Million)

Tuesday, February 6

- 20:00 Fed/Mester

- Polygon Etrog Upgrade

- Astar DApp Staking V3

Wednesday, February 7

- 20:30 Fed/Barkin

- HFT Unlocking Event ($4.15 Million)

Thursday, February 8

- 16:30 Unemployment Insurance Claims (Expectation: 219K, Previous: 224K)

- 20:05 Fed/Barkin

Will Cryptocurrencies Fall?

It’s a relatively calm period in terms of macroeconomic data. Statements by Fed members will be important for investors. Especially after such strong employment data, it will be crucial for Fed members to share their current views on the economy. If there is an intention to return to the narrative of a possible final 25 basis point rate hike, this could trigger sellers in the crypto market.

On the other hand, while a rate cut in March is no longer expected, optimism for a cut in May continues. Clear statements from members that there will be no cut in the third meeting of next year will be frustrating for the markets.

On the other hand, Polygon and Astar may positively diverge with ongoing developments in their networks. In the coming days, entries for spot Bitcoin ETFs will continue to be one of the most important issues to watch. Additionally, the slowing down of GBTC outflows is also significant.