On April 20th, Bitcoin (BTC) completed its fourth halving. This completion led to a halving of the rewards provided to miners, which is crucial for processing transactions and securing the network. Following the event, focus has already shifted to the halving that will occur four years later and its possible impacts.

When is the Next Halving?

The first Bitcoin halving occurred on November 28, 2012, the second on July 9, 2016, the third on May 11, 2020, and the fourth on April 20, 2024.

Following these halvings, block rewards decreased sequentially from the initial 50 BTC to 25 BTC, then to 12.5 BTC, 6.25 BTC, and most recently to 3.125 BTC after the latest halving.

Looking ahead, the next halving is anticipated to occur in 2028. Each halving event for Bitcoin happens approximately every four years, bringing with it significant interactions among key factors within the Bitcoin network.

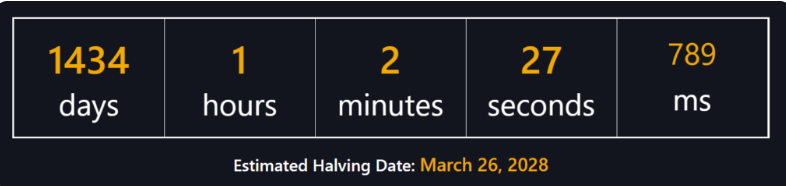

On the other hand, according to a source provided by Binance, the next halving is approximately 1,472 days away, while Coinwarz calculates this date as 1,419 days away.

Bitbo positions the date for the next halving on March 26, 2028. As of the day this article was written, it is approximately 1,434 days away.

What Will Bitcoin’s Price Be After the Halving?

The completion of the fourth Bitcoin halving in April 2024 marked another milestone on the path to Bitcoin’s maximum supply of 21 million coins. Each subsequent halving reduces the rate of supply issuance and further limits the number of Bitcoins.

The 2028 halving will once again highlight Bitcoin’s unique monetary policy characterized by its deflationary nature. With miner rewards for new blocks decreasing over time, scarcity is expected to become increasingly pronounced.

This situation is likely to strengthen Bitcoin’s potential as a store of value akin to digital gold.

Ultimately, it will be intriguing to observe how miners respond to the 2024 halving and the upcoming 2028 halving. A lingering question is whether the reduction in miner rewards will make Bitcoin mining unprofitable in the long term.

While all this was happening, eyes were on the BTC price. At the time of writing, Bitcoin’s price stood at $66,800, indicating a rise following the day of the halving.

Türkçe

Türkçe Español

Español