Bitcoin price is currently at $63,600. As expected, trading volumes have dropped over the weekend. Investors are cautious as April comes to an end. What are the price predictions for Solana and Avalanche in May? What can investors expect if volatility increases?

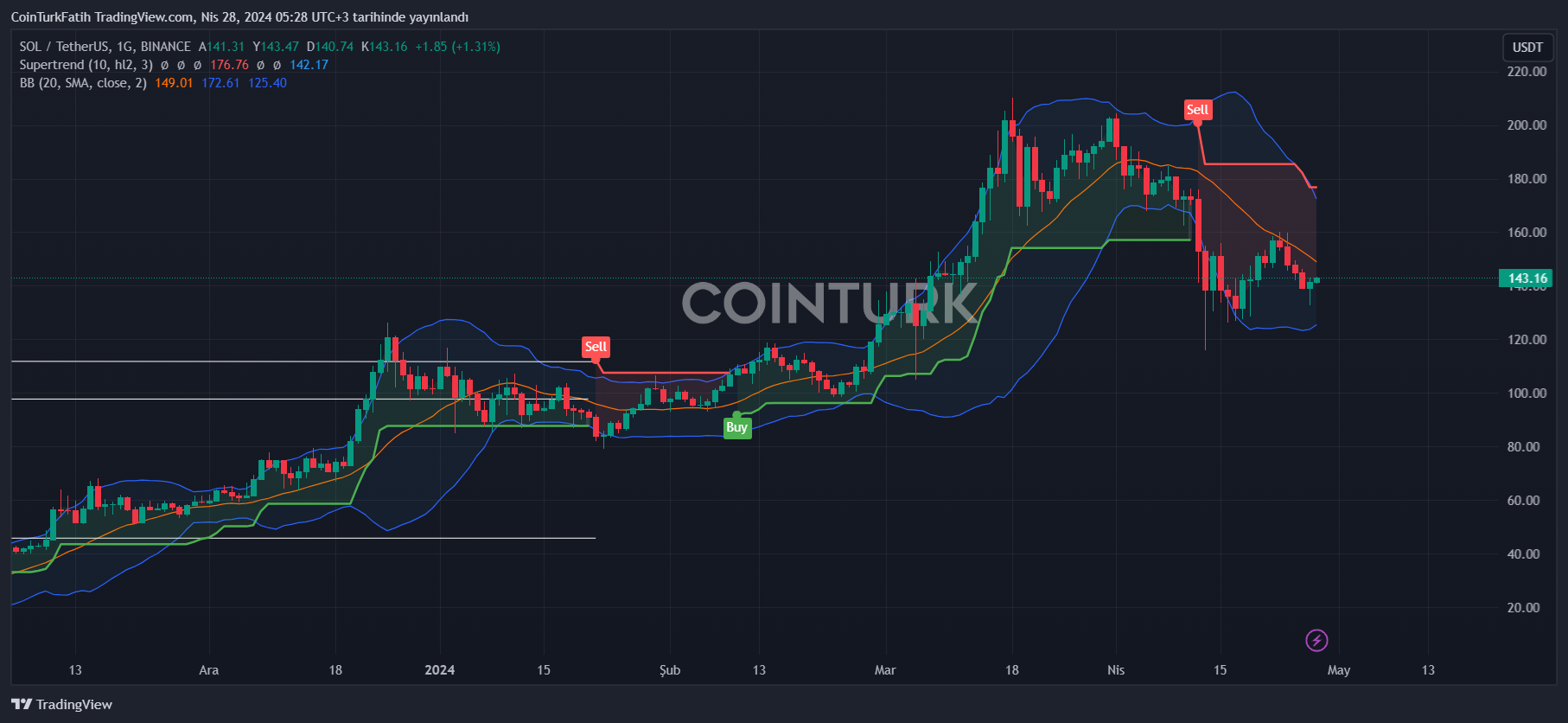

How Much Will Solana (SOL) Be Worth?

Many significant events are expected in May, generally anticipated to increase volatility in cryptocurrencies. We will see important developments from the interest decision on the day to comments by Powell about the current outlook and April inflation data.

Spot Bitcoin ETF weakness, macroeconomic uncertainties, and other risks are dampening optimism for May. If Solana (SOL) is to see a good May, prices need to close above $145 to return to an upward trend.

If the $160 threshold is also reclaimed, SOL Coin’s main targets will be the $183 and $205 resistance levels. However, if things turn sour and the $127 support is lost, sales could accelerate. Typically, the markets tend to be quite dull between May and July. Dubbed the “sell and go on vacation” period, investors might see levels of $117, $98, and $80. The rally’s accelerated level being the $116 region, closures below this area could lead to double-digit prices.

Avalanche (AVAX)

SOL Coin saw impressive demand and started 2024 strongly. The situation was not the same for AVAX. As of this writing, the price stands at $34.8, which has not seen significant gains compared to alternatives this year.

The resistance level of the parallel channel we have been discussing for months is at $50, and the $50, $52 area is the main breakout point for a triple-digit target. Currently, the price is testing the $31.6 base support after losing this resistance. Long tails seen in test candles suggest bulls are active at the support level, but closures below the base could lead to continued sales down to $21.

In a positive scenario, closures above the $50, $52 area could be seen, and the $65 resistance might be retested.

Türkçe

Türkçe Español

Español